Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The stock price of Tesla (TSLA) is trading at $290 per share in the beginning of Jan 2023. You heard that TSLA intend to

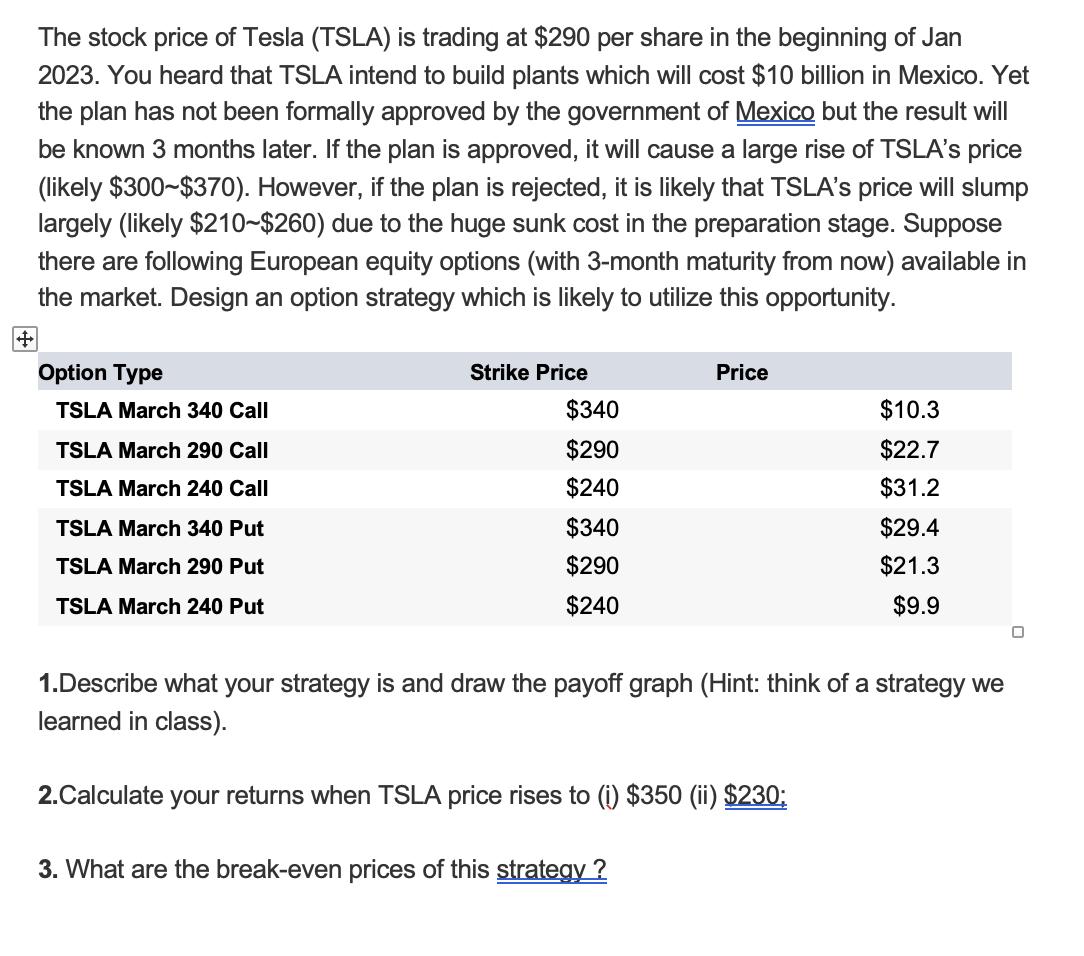

The stock price of Tesla (TSLA) is trading at $290 per share in the beginning of Jan 2023. You heard that TSLA intend to build plants which will cost $10 billion in Mexico. Yet the plan has not been formally approved by the government of Mexico but the result will be known 3 months later. If the plan is approved, it will cause a large rise of TSLA's price (likely $300-$370). However, if the plan is rejected, it is likely that TSLA's price will slump largely (likely $210-$260) due to the huge sunk cost in the preparation stage. Suppose there are following European equity options (with 3-month maturity from now) available in the market. Design an option strategy which is likely to utilize this opportunity. + Option Type TSLA March 340 Call TSLA March 290 Call TSLA March 240 Call TSLA March 340 Put TSLA March 290 Put TSLA March 240 Put Strike Price $340 $290 $240 $340 $290 $240 Price 1.Describe what your strategy is and draw the payoff graph (Hint: think of a strategy we learned in class). 2.Calculate your returns when TSLA price rises to (i) $350 (ii) $230; 3. What are the break-even prices of this strategy? $10.3 $22.7 $31.2 $29.4 $21.3 $9.9 0

Step by Step Solution

★★★★★

3.35 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

To take advantage of the potential price movement in Tesla TSLA stock based on the outcome of the plant approval in Mexico you can implement a strateg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started