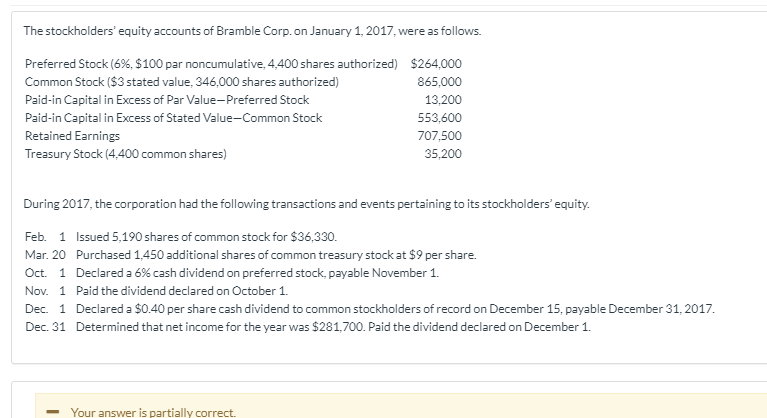

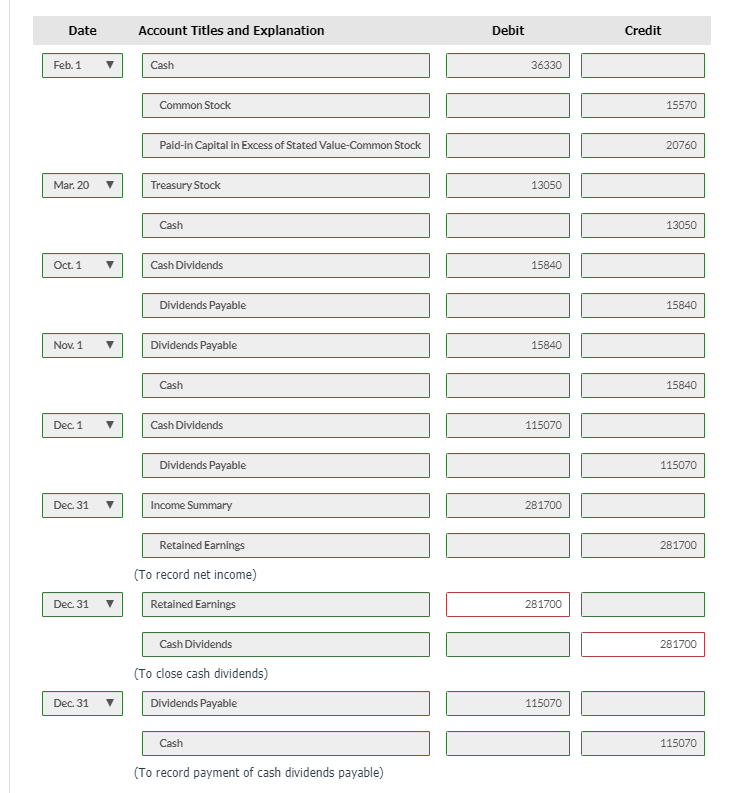

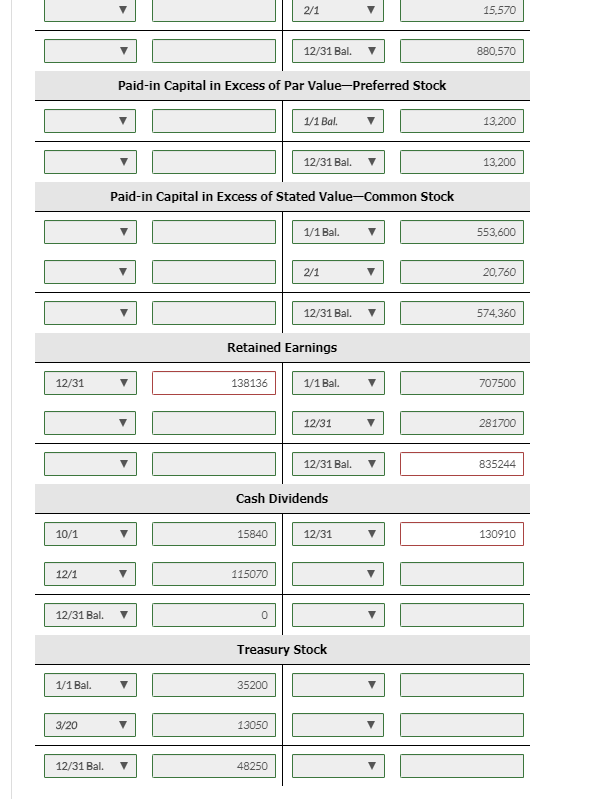

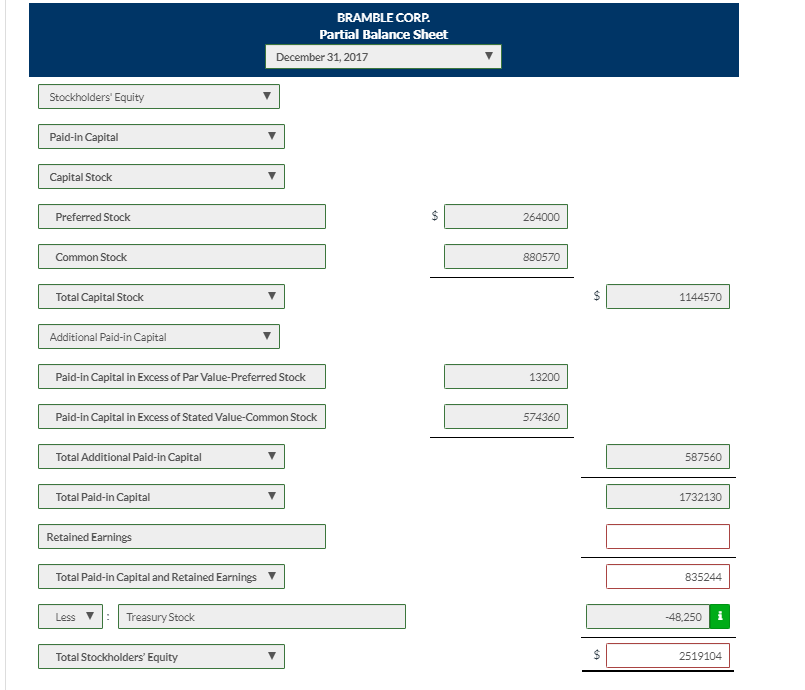

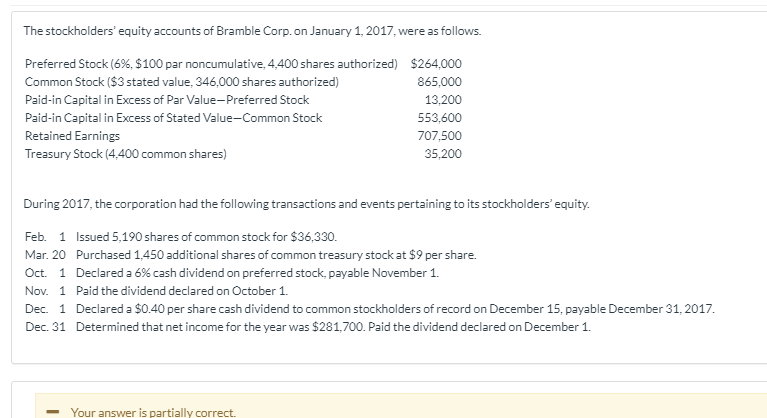

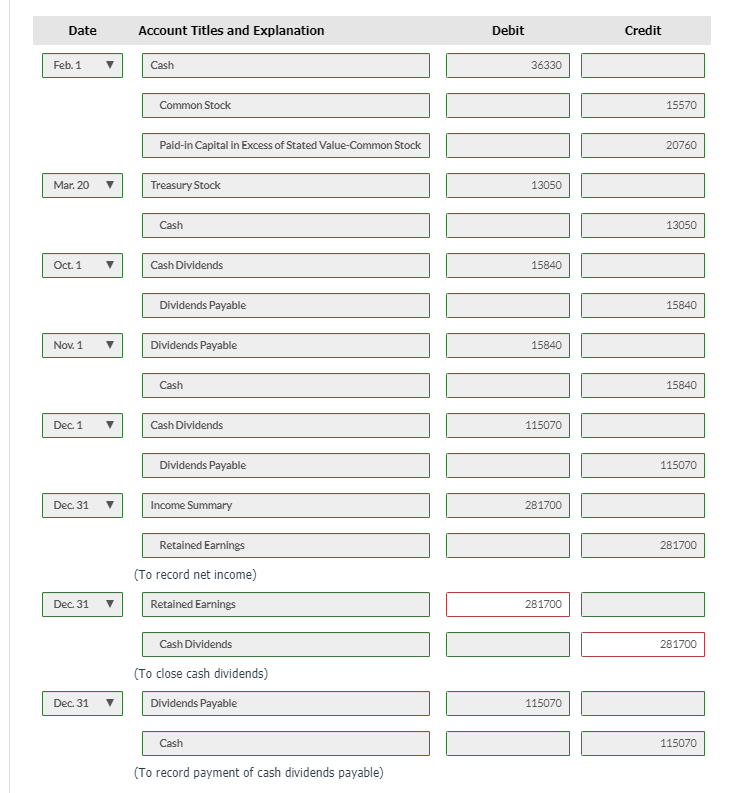

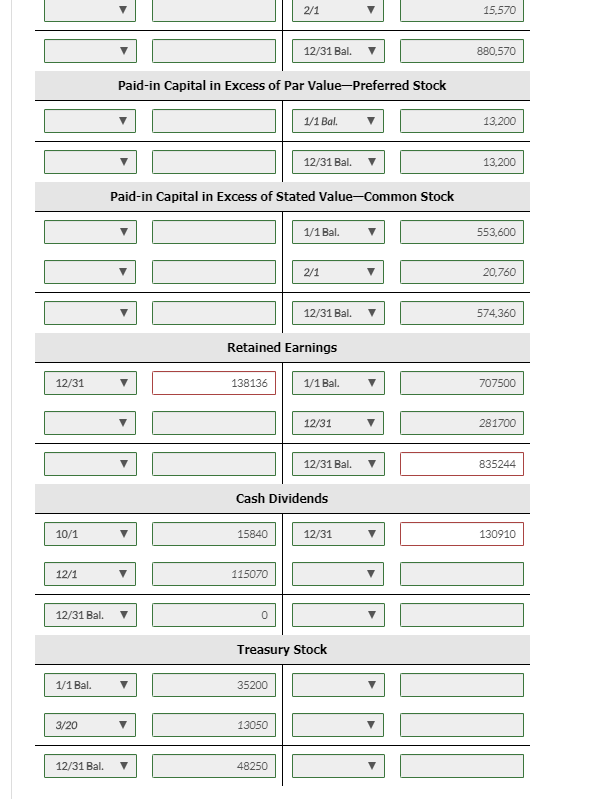

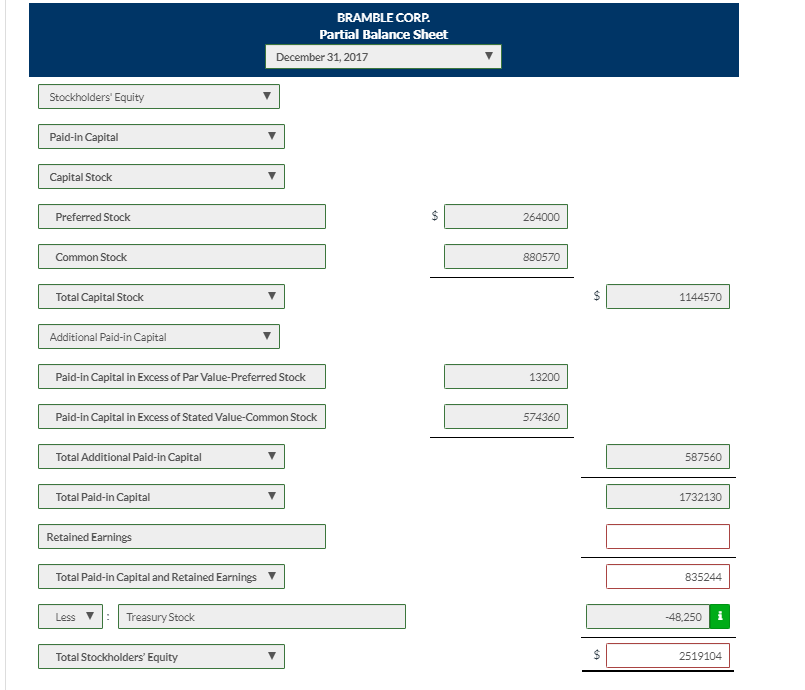

The stockholders' equity accounts of Bramble Corp.on January 1, 2017, were as follows. Preferred Stock (6%, $100 par noncumulative, 4,400 shares authorized) $264.000 Common Stock ($3 stated value, 346,000 shares authorized) 865,000 Paid-in Capital in Excess of Par Value-Preferred Stock 13,200 Paid-in Capital in Excess of Stated Value-Common Stock 553,600 Retained Earnings 707,500 Treasury Stock (4.400 common shares) 35,200 During 2017, the corporation had the following transactions and events pertaining to its stockholders' equity. Feb. 1 Issued 5,190 shares of common stock for $36,330. Mar. 20 Purchased 1,450 additional shares of common treasury stock at $9 per share. Oct. 1 Declared a 6% cash dividend on preferred stock, payable November 1. Nov. 1 Paid the dividend declared on October 1. Dec. 1 Declared a $0.40 per share cash dividend to common stockholders of record on December 15, payable December 31, 2017. Dec. 31 Determined that net income for the year was $281,700. Paid the dividend declared on December 1. - Your answer is partially correct. Date Account Titles and Explanation Debit Credit Feb. 1 Cash 1 36330 Common Stock L 15570 Pald-in Capital in Excess of Stated Value-Common Stock 20760 Mar. 20 Treasury Stock 13050| Cash 13050 Oct. 1 Cash Dividends 15840 Dividends Payable 15840 Nov. 1 Dividends Payable 15840 Cash 15840 Dec 1 Cash Dividends 115070 Dividends Payable 115070 Dec 31 Income Summary 281700 Retained Earnings 281700 (To record net income) Dec 31 1 Retained Earnings 281700 Cash Dividends 281700 (To close cash dividends) Dec 31 | Dividends Payable 115070 Cash 115070 (To record payment of cash dividends payable) 2/1 15.570 8 80.570 880.570 31 Bal. C Paid-in Capital in Excess of Par Value-Preferred Stock 1/1 Bal. 13,200 12/31 Bal. 13,200 Paid-in Capital in Excess of Stated Value-Common Stock 553.600 2/1 20,760 12/31 Bal. 574.360 Retained Earnings 138136 1/1 Bal. 707500 12/31 281700 12/31 Bal. 835244 Cash Dividends 2011 15840 12/31 130910 115070 12/31 Bal. Treasury Stock 1/1 Bal. 35200 3/20 13050 12/31 Bal. 48250 BRAMBLE CORP. Partial Balance Sheet December 31, 2017 Stockholders' Equity Paid-in Capital Capital Stock Preferred Stock 264000 Common Stock 880570 Total Capital Stock 1144570 Additional Paid-in Capital Paid-in Capital in Excess of Par Value-Preferred Stock 13200 | Pald-in Capital in Excess of Stated Value-Common Stock 574360 Total Additional Paid-in Capital 587560 Total Paid-in Capital 1732130 Retained Earnings Total Paid-in Capital and Retained Earnings | 835244 Less : Treasury Stock -48.250 Total Stockholders' Equity $ 2519104