Answered step by step

Verified Expert Solution

Question

1 Approved Answer

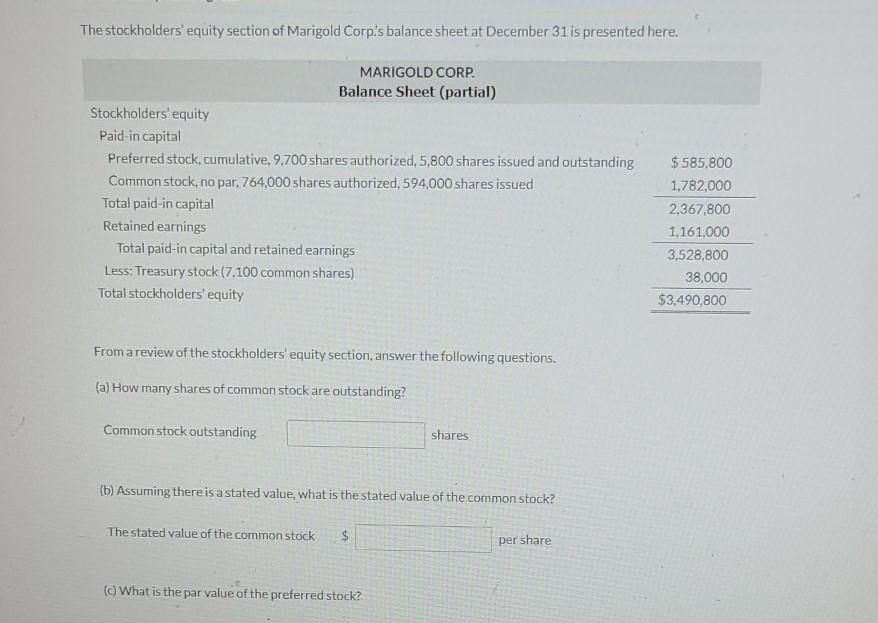

The stockholders' equity section of Marigold Corp's balance sheet at December 31 is presented here. MARIGOLD CORP. Balance Sheet (partial) Stockholders' equity Paid-in capital Preferred

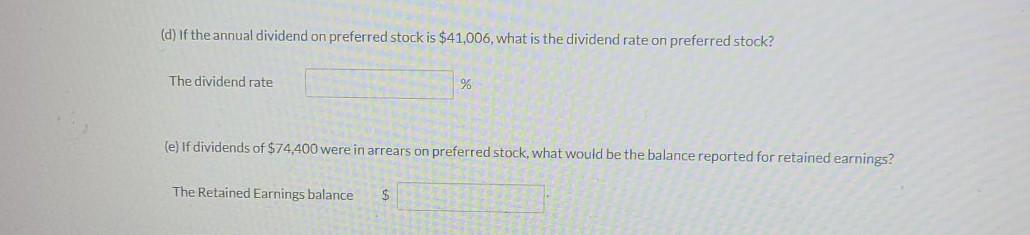

The stockholders' equity section of Marigold Corp's balance sheet at December 31 is presented here. MARIGOLD CORP. Balance Sheet (partial) Stockholders' equity Paid-in capital Preferred stock, cumulative, 9.700 shares authorized, 5,800 shares issued and outstanding Common stock, no par. 764,000 shares authorized, 594,000 shares issued Total paid-in capital Retained earnings Total paid-in capital and retained earnings Less: Treasury stock (7.100 common shares) Total stockholders' equity $585.800 1,782,000 2.367,800 1,161,000 3.528,800 38,000 $3,490,800 From a review of the stockholders' equity section, answer the following questions. (a) How many shares of common stock are outstanding? Common stock outstanding shares (b) Assuming there is a stated value, what is the stated value of the common stock? The stated value of the common stock $ per share (C) What is the par value of the preferred stock? (d) If the annual dividend on preferred stock is $41,006, what is the dividend rate on preferred stock? The dividend rate % (e) If dividends of $74,400 were in arrears on preferred stock, what would be the balance reported for retained earnings? The Retained Earnings balance $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started