Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The stocks of three companies are traded in a financial market. Company E (Energy sector) issues NE=10 shares, company H (Health-care sector) issues NH=40 shares,

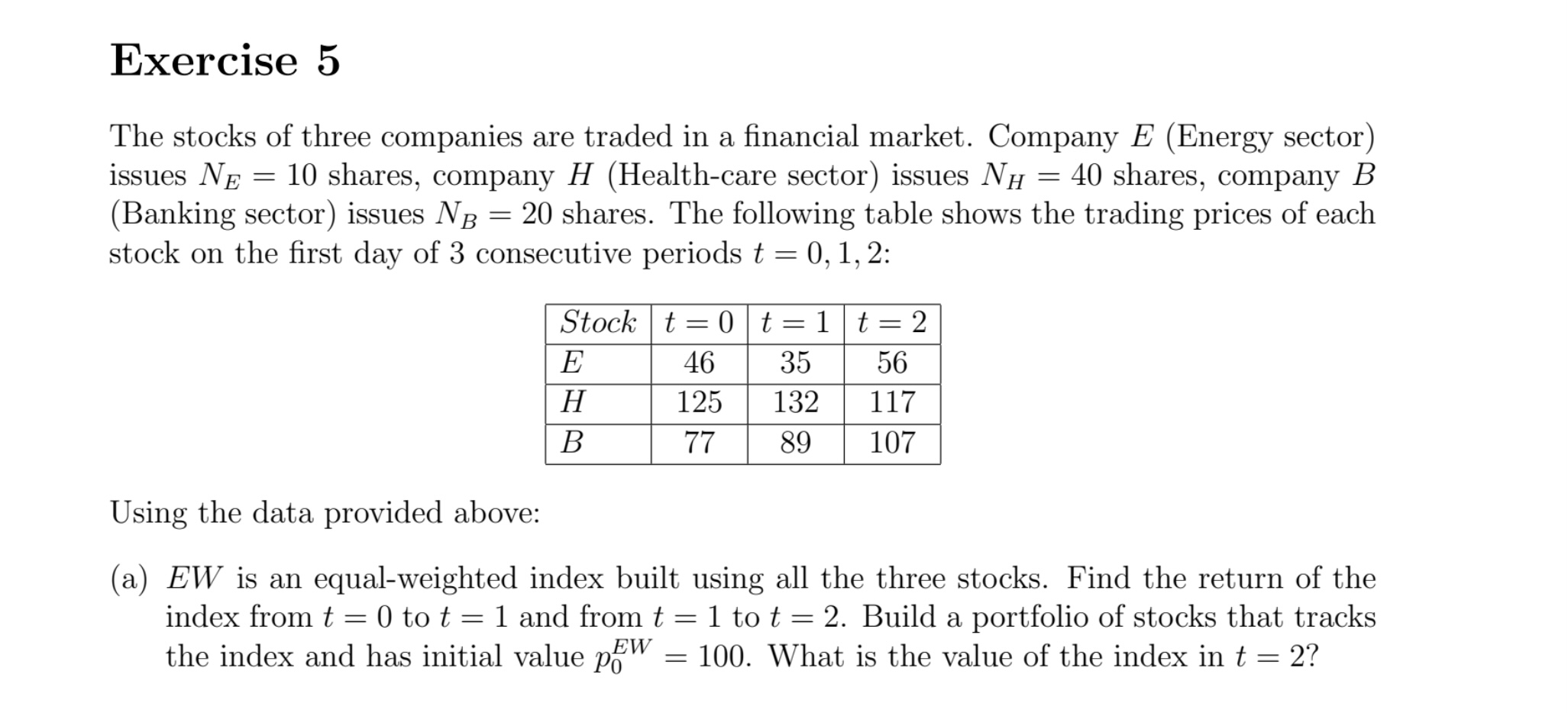

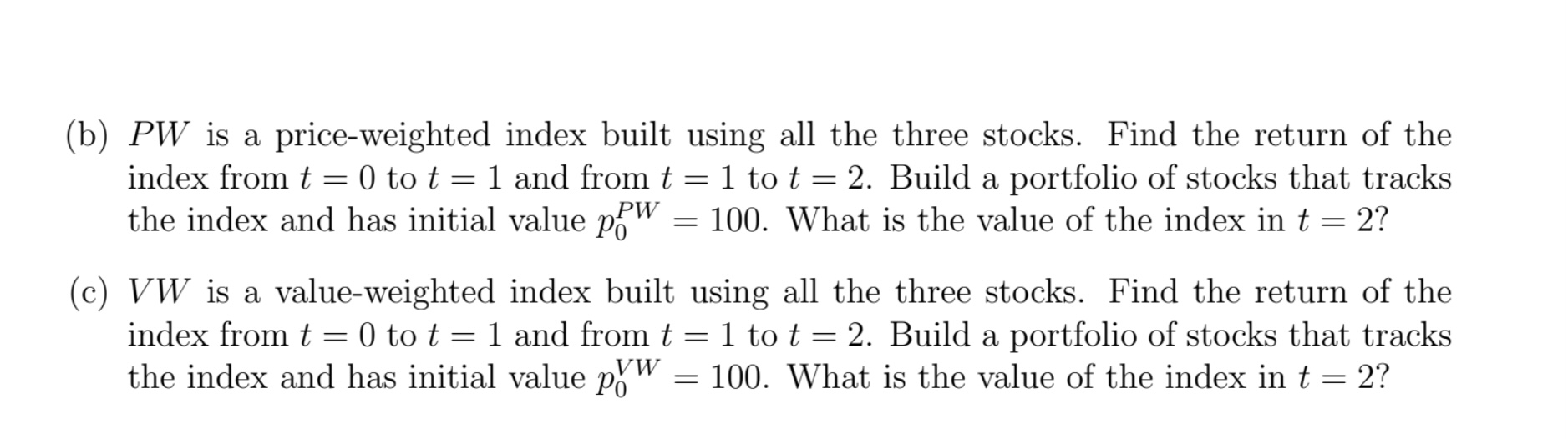

The stocks of three companies are traded in a financial market. Company E (Energy sector) issues NE=10 shares, company H (Health-care sector) issues NH=40 shares, company B (Banking sector) issues NB=20 shares. The following table shows the trading prices of each stock on the first day of 3 consecutive periods t=0,1,2 : Using the data provided above: (a) EW is an equal-weighted index built using all the three stocks. Find the return of the index from t=0 to t=1 and from t=1 to t=2. Build a portfolio of stocks that tracks the index and has initial value p0EW=100. What is the value of the index in t=2 ? (b) PW is a price-weighted index built using all the three stocks. Find the return of the index from t=0 to t=1 and from t=1 to t=2. Build a portfolio of stocks that tracks the index and has initial value p0PW=100. What is the value of the index in t=2 ? (c) VW is a value-weighted index built using all the three stocks. Find the return of the index from t=0 to t=1 and from t=1 to t=2. Build a portfolio of stocks that tracks the index and has initial value p0VW=100. What is the value of the index in t=2

The stocks of three companies are traded in a financial market. Company E (Energy sector) issues NE=10 shares, company H (Health-care sector) issues NH=40 shares, company B (Banking sector) issues NB=20 shares. The following table shows the trading prices of each stock on the first day of 3 consecutive periods t=0,1,2 : Using the data provided above: (a) EW is an equal-weighted index built using all the three stocks. Find the return of the index from t=0 to t=1 and from t=1 to t=2. Build a portfolio of stocks that tracks the index and has initial value p0EW=100. What is the value of the index in t=2 ? (b) PW is a price-weighted index built using all the three stocks. Find the return of the index from t=0 to t=1 and from t=1 to t=2. Build a portfolio of stocks that tracks the index and has initial value p0PW=100. What is the value of the index in t=2 ? (c) VW is a value-weighted index built using all the three stocks. Find the return of the index from t=0 to t=1 and from t=1 to t=2. Build a portfolio of stocks that tracks the index and has initial value p0VW=100. What is the value of the index in t=2 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started