The story behind your analysis of your forecast of the future based on your spreadsheet. Why did you choose the specific growth rates? What impact

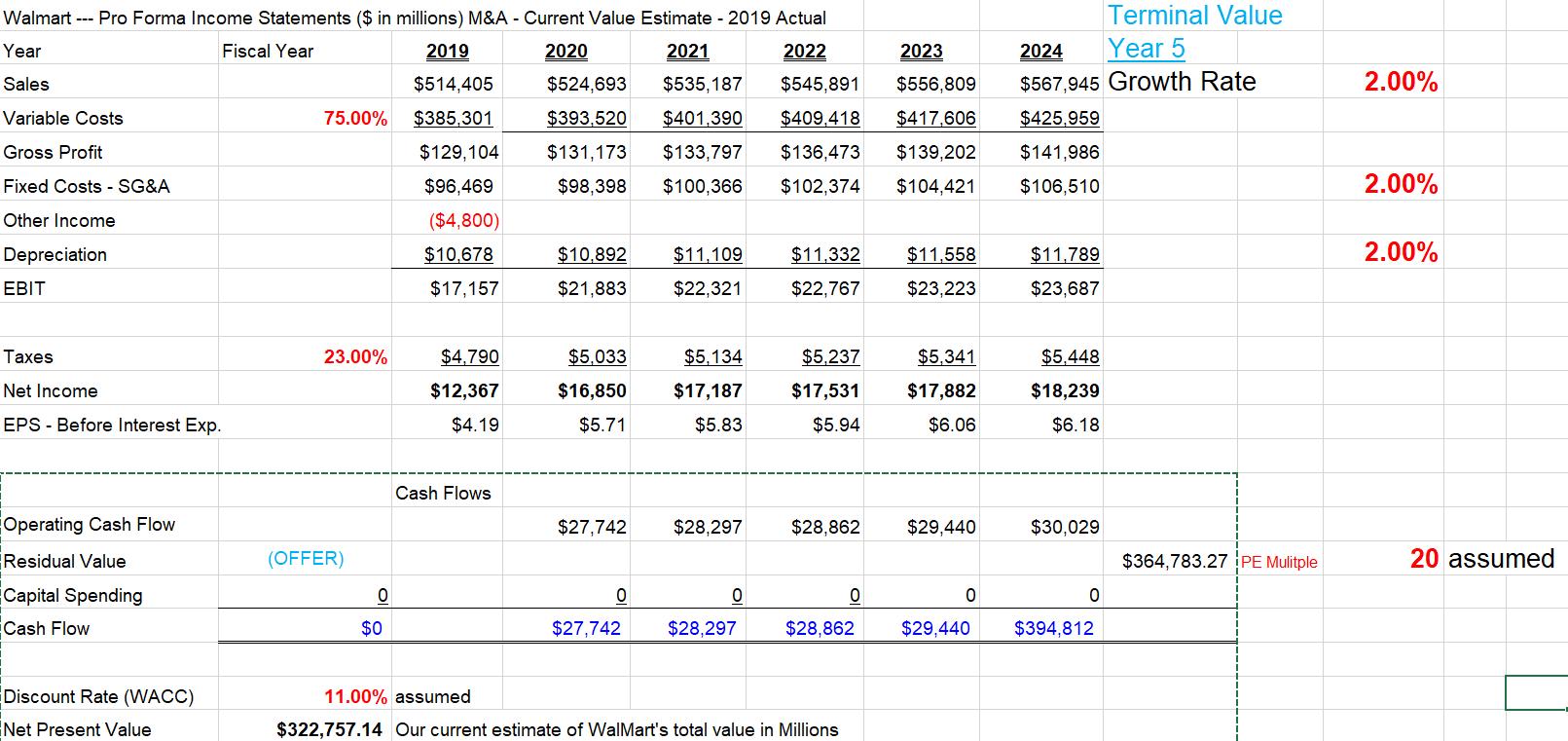

The story behind your analysis of your forecast of the future based on your spreadsheet. Why did you choose the specific growth rates? What impact did they have on the value of Walmart? Use the Walmart Proforma Income Excel spreadsheet

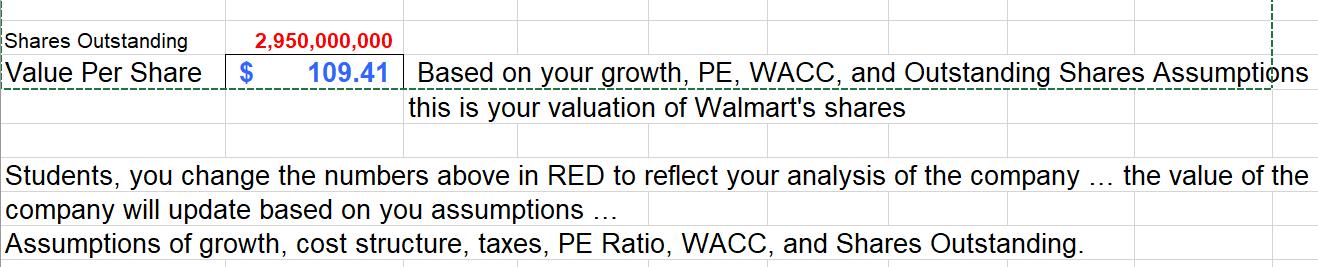

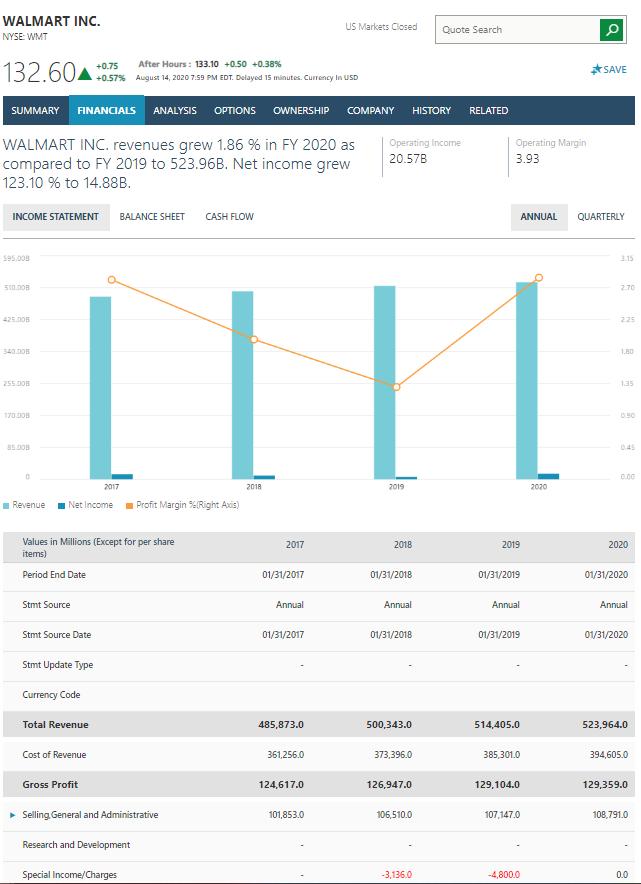

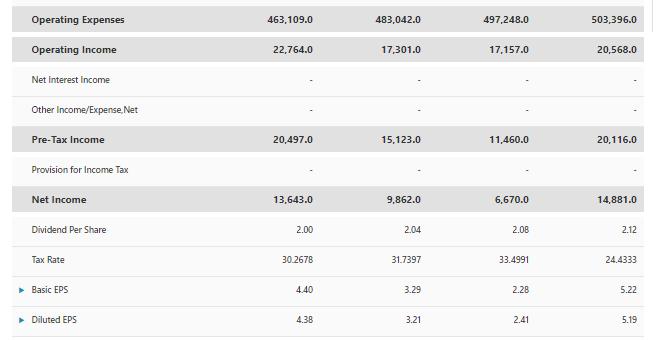

Walmart --- Pro Forma Income Statements ($ in millions) M&A - Current Value Estimate - 2019 Actual Terminal Value Year Fiscal Year 2019 2020 2021 2022 2023 2024 Year 5 Sales $514,405 $524,693 $535,187 $545,891 $556,809 $567,945 Growth Rate 2.00% Variable Costs 75.00% $385,301 $393,520 $401,390 $409,418 $417,606 $425,959 Gross Profit $129,104 $131,173 $133,797 $136,473 $139,202 $141,986 Fixed Costs - SG&A $96,469 $98,398 $100,366 $102,374 $104,421 $106,510 2.00% Other Income ($4,800) Depreciation $10,678 $10,892 $11,109 $11,332 $11,558 $11,789 2.00% $17,157 $21,883 $22,321 $22,767 $23,223 $23,687 Taxes 23.00% $4,790 $5,033 $5,134 $5,237 $5,341 $5.448 Net Income $12,367 $16,850 $17,187 $17,531 $17,882 $18,239 EPS - Before Interest Exp. $4.19 $5.71 $5.83 $5.94 $6.06 $6.18 Cash Flows Operating Cash Flow $27,742 $28,297 $28,862 $29,440 $30,029 Residual Value (OFFER) $364,783.27 PE Mulitple 20 assumed Capital Spending Cash Flow $0 $27,742 $28,297 $28,862 $29,440 $394,812 Discount Rate (WACC) 11.00% assumed Net Present Value $322,757.14 Our current estimate of WalMart's total value in Millions

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

lulting the grwth rte revels hw yur mny is trending Hwever ne yu knw whether grwth is delining r inresing yu need t t un tht infrmtin If yu lulte grwt...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started