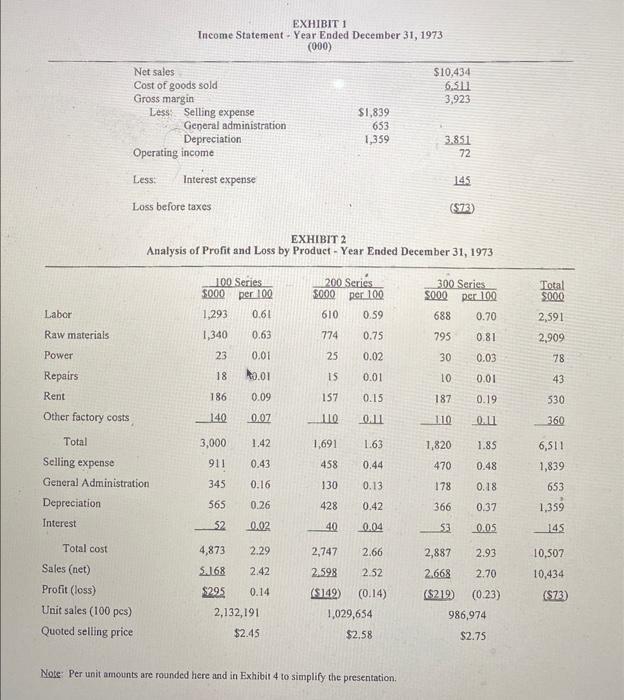

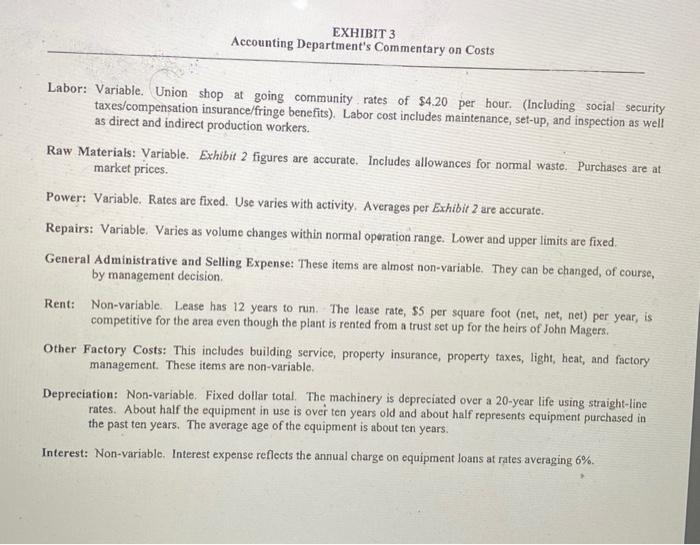

The Structure to be followed: Through a thorough examination and careful reading of the Berkshire Threaded Fasteners case study, you should respond to the associated questions using your own words and personal assumptions and interpretations. Questions: A) If the company had dropped the 300 series as of January 1, 1974, what effect would that action have had on the profit for the first months of 1974 ? B) In July 1974 , should the company have reduced the price of 100 series from $2.45 to $2.25 ? C) Discuss which is Berkshire's most profitable product line? D) What recommendations can you offer to Mr. Magers? Q2: (10 Marks / CLO 2) Discuss whether you agree with each of the following statements. Carefully define terms and, where appropriate, provide an illustrative example. - All direct costs are variable. - Variable costs are controllable and fixed costs are not. - A cost can be direct in respect of one cost objective but an overhead in respect of another. - Including a proportion of fixed production overheads in product costs, as in absorption costing, can be justified since the allocated cost acts as a proxy for hard-to-measure opportunity costs. In February 1974, Brandon Cook was appointed general manager by Joe Magers, president of Berkshire Threaded Fasteners Company. Cook, age 56, had wide executive experience in manufacturing products similar to those of Berkshire. The appointment of Cook resulted from management problems arising from the death of John Magers, founder and until his death in early 1973 , president of the company. Joe Magers had only four years experience with the company and in early 1974 he was 34 years old. His father had hoped to train Joe over a 10-year period, but the father's untimely death had cut this seasoning period short. The younger Magers became president after his father's death, and he had exercised full control until he hired Cook. Joe Magers knew that he had made several poor decisions during 1973 and that the morale of the organization had suffered, apparently through lack of confidence in him. When he received the income statement for 1973 (Exhibit 1); the loss of over $70,000 during a good business year convinced him that he needed help. He attracted Cook from a competitor by offering a stock option incentive in addition to salary. The arrangement was that Cook, as general manager, would have full authority to execute any changes he desired. In addition, Cook would explain the reasons for his decisions to Magers and thereby train him for successful leadership upon Cook's retirement. Berkshire Threaded Fasteners Company made only three lines of metal fasteners (nuts and bolts)-the 100 series, the 200 series, and the 300 series. These were sold by the company sales force for use by heavy industrial manufacturers. All of the sales force, on a salary basis, sold all three lines, but in varying proportions. Berkshire sold throughout New England and was one of eight companies with similar products. Several of its competitors were larger and manufactured a larger variety of products. The dominant company was Bosworth Machine Company, which operated a plant in Berkshire's market area. Joe Magers had heard many people describe threaded fasteners as a "commodity" business. But he had also heard a speaker say once that the term is only used by losers in a business. Price cutting was rare; the only variance from quotod selling prices took the form of cash discounts. Customarily, Bosworth announced prices anneally and the other producers followed suit. In the past, attempts af price-cutting had followed a consistent pattern: All competitors met the price reduction, and the industry as a whole sold about the same quantity but at the lower prices. Demand was very "inelastic," at least in the short. run, for a "derived demand" product like metal fasteners. Eventually Bosworth, with its strong financial position, again stabilized the situation following a general recognition of the failure of price-cutting. Purthermore, because sales were to industrial buyers and because the products of different manufacturers were very similar, Berkshire was convinced it could not individually raise prices without suffering substantial volume declines. During 1973 , Berkshire's share of industry sales. was 12% for the 100 series, 8% for the 200 series and 10% for the 300 series. The industry-wide quoted selling prices were $2.45,$2.58 and $2.75 per 100 pieces, respectively. Upon taking office in Febnuary 1974, Cook decided igainst immediate major changes; he chose instead to analyze 1973 operations and to wait for the results of the first half of 1974. He instructed the accounting department to provide detailed expenses and an earnings statement by product line for 1973 (see Exhibir 2). In addition, he requested an explanation of the nature of the costs including their expected future behavior (see Exhibit 3). To familiarize Joe Magers with his approach to financial analysis, Cook seat copies of these exhibits to Magers. When they discussed them, Magers stated that he thought the 300 series should be dropped immediately, as it would be inpossible to lower expenses on 300s as much as 23 cents per 100 pieces, In addition, he stressed the need for economies on the 200 series line. Cook relied on the authority arrangement Magers bad agreed to earlier and continued production of the three lines. For control purposes, be had the accounting department prepare monthly statements using as standard costs the costs per 100 pieces from the analytical profit and loss statement for 1973 (Ex/hibir 2). These monthly statements were his basis for making minor marketing and production changes during the spriag of 1974. Late in July, 1974, Cook received the six month' statement of cumulative standard costs from the accounting department, including yariances of actual costs from standard (see Exhibit 4 ). They showed that the first half of 1974 was a modestly succesfial period. In July 1974, Bosworth announced a price reduction on the 100 series from $2.45 to $2.25 per 100 pieces. This created in immediste pricing prosten for its competitors. Cook forccast that if Berkehire held to the $2.45 price during the last sit mooths of 1974 , urit sales would be 750,000 100-piece loce. He felt that if the price were dropped to $2.25 per 100 pieces, the six months" volume would be 1,000,000. Cook fricw that competing managements anticipated a further decline in activity. He thought a general decline in prices was quite probable. Cook and Magers discussed the pricing problem. A sales price of $2.25 would be below cost. Magers wanted 52.45 to be contineed, since he folt the company could not be profitable while selling a key product line below cost. EXHIBIT 1 Income Statement - Year Ended December 31, 1973 (000) EXHIBIT 2 Analysis of Profit and Loss by Product - Year Ended December 31, 1973 Note: Per unit amounts are rounded here and in Exhibit 4 to simplify the presentation. Labor: Variable. Union shop at going community rates of $4.20 per hour. (Including social security taxes/compensation insurance/fringe benefits). Labor cost includes maintenance, set-up, and inspection as well as direct and indirect production workers. Raw Materials: Variable. Exhibit 2 figures are accurate. Includes allowances for normal waste. Purchases are at market prices. Power: Variable. Rates are fixed. Use varies with activity. Averages per Exhibit 2 are accurate. Repairs: Variable. Varies as volume changes within normal operation range. Lower and upper limits are fixed. General Administrative and Selling Expense: These items are almost non-variable. They can be changed, of course, by management decision. Rent: Non-variable. Lease has 12 years to run. The lease rate, $5 per square foot (net, net, net) per year, is competitive for the area even though the plant is rented from a trust set up for the heirs of John Magers. Other Factory Costs: This includes building service, property insurance, property taxes, light, heat, and factory management. These items are non-variable. Depreciation: Non-variable. Fixed dollar total. The machinery is depreciated over a 20-year life using straight-line rates. About half the equipment in use is over ten years old and about half represents equipment purehased in the past ten years. The average age of the equipment is about ten years. Interest: Non-variable. Interest expense reflects the annual charge on equipment loans at rates averaging 6%