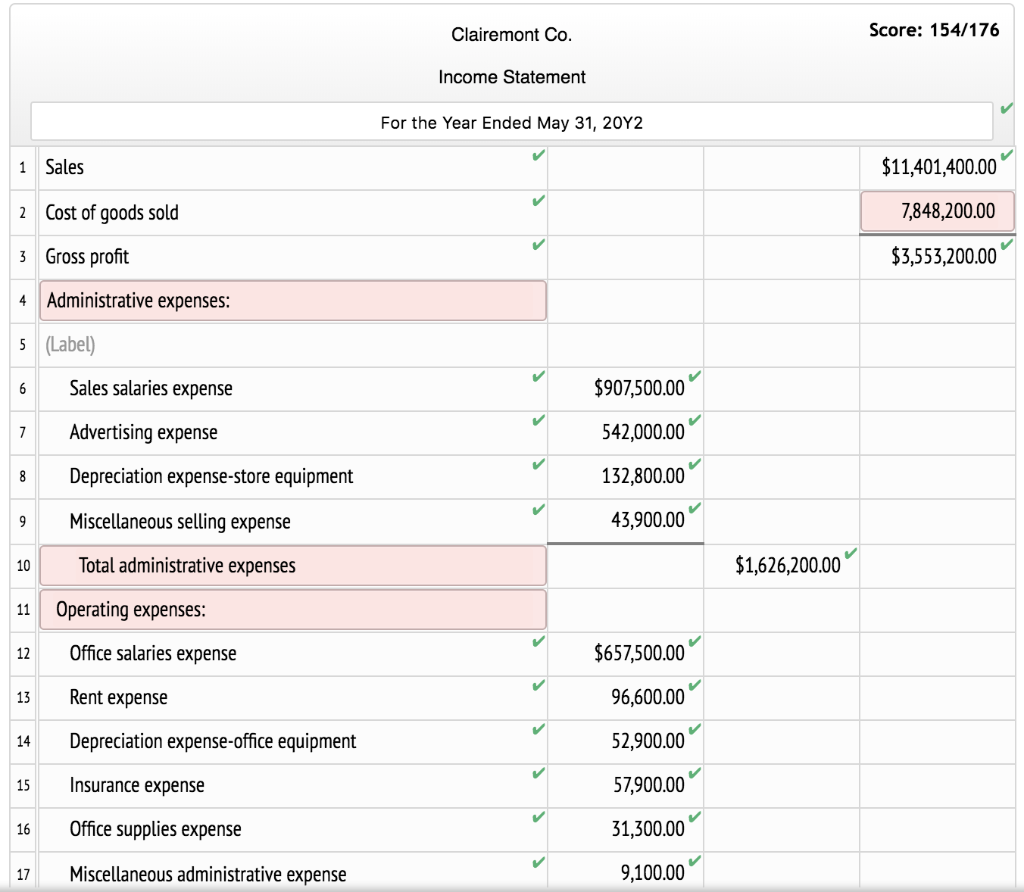

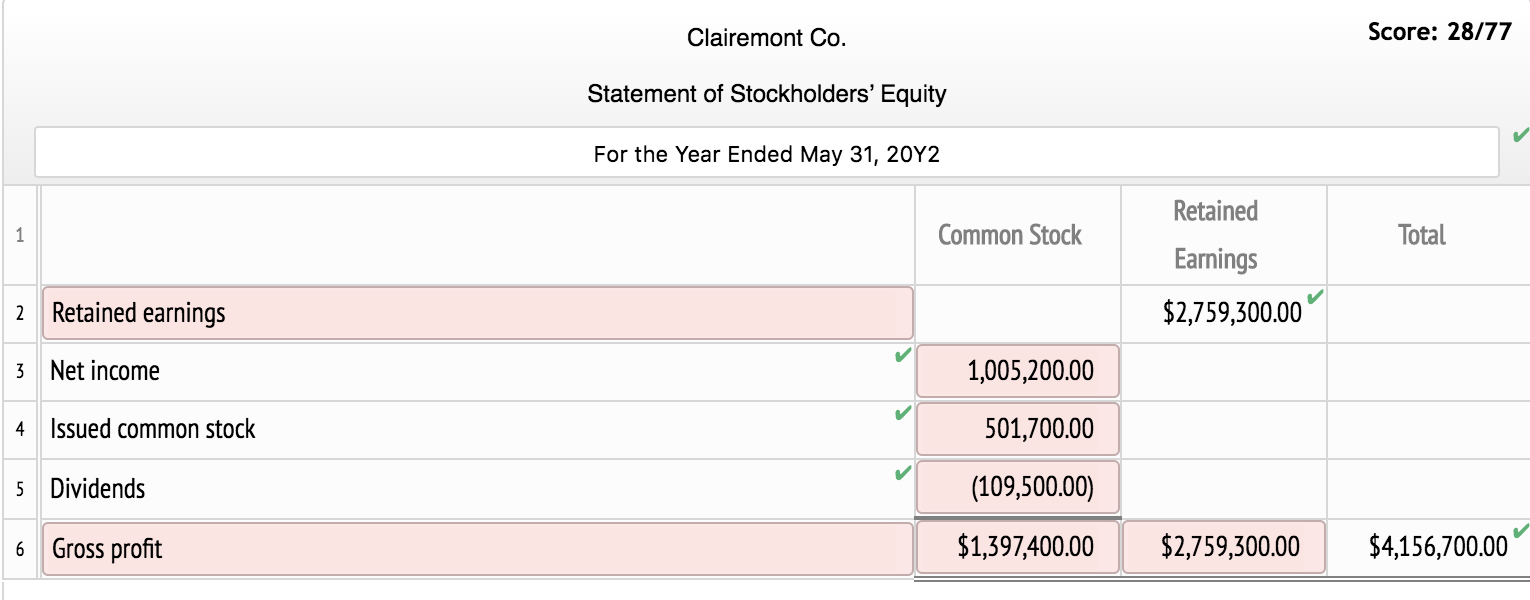

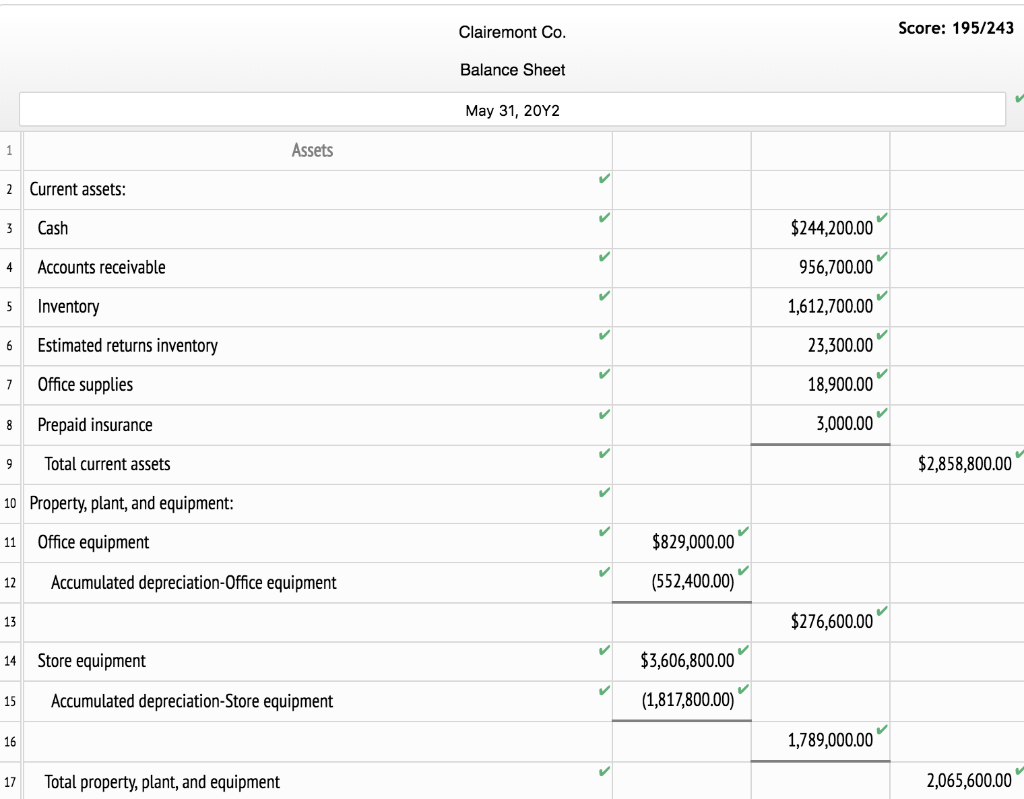

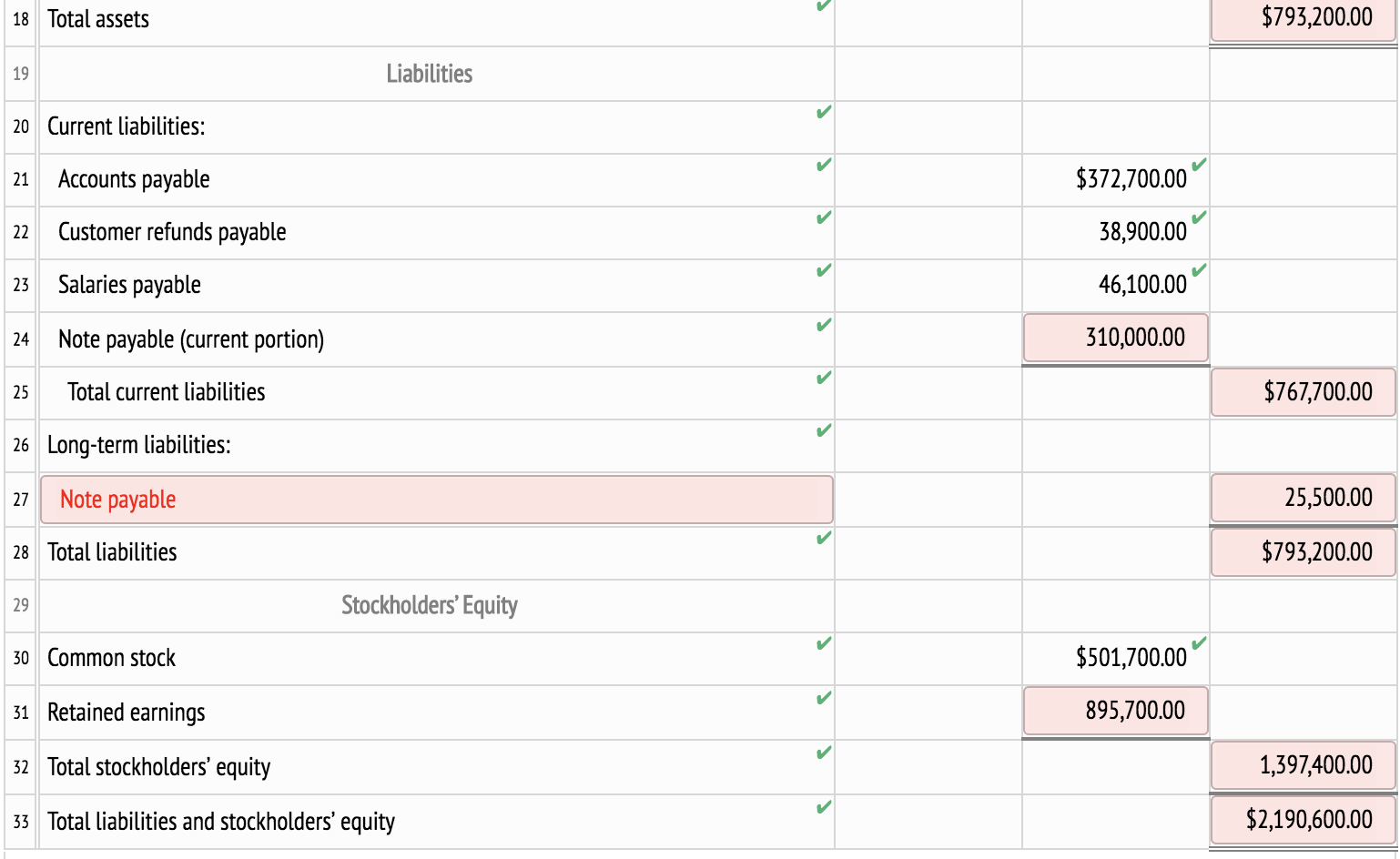

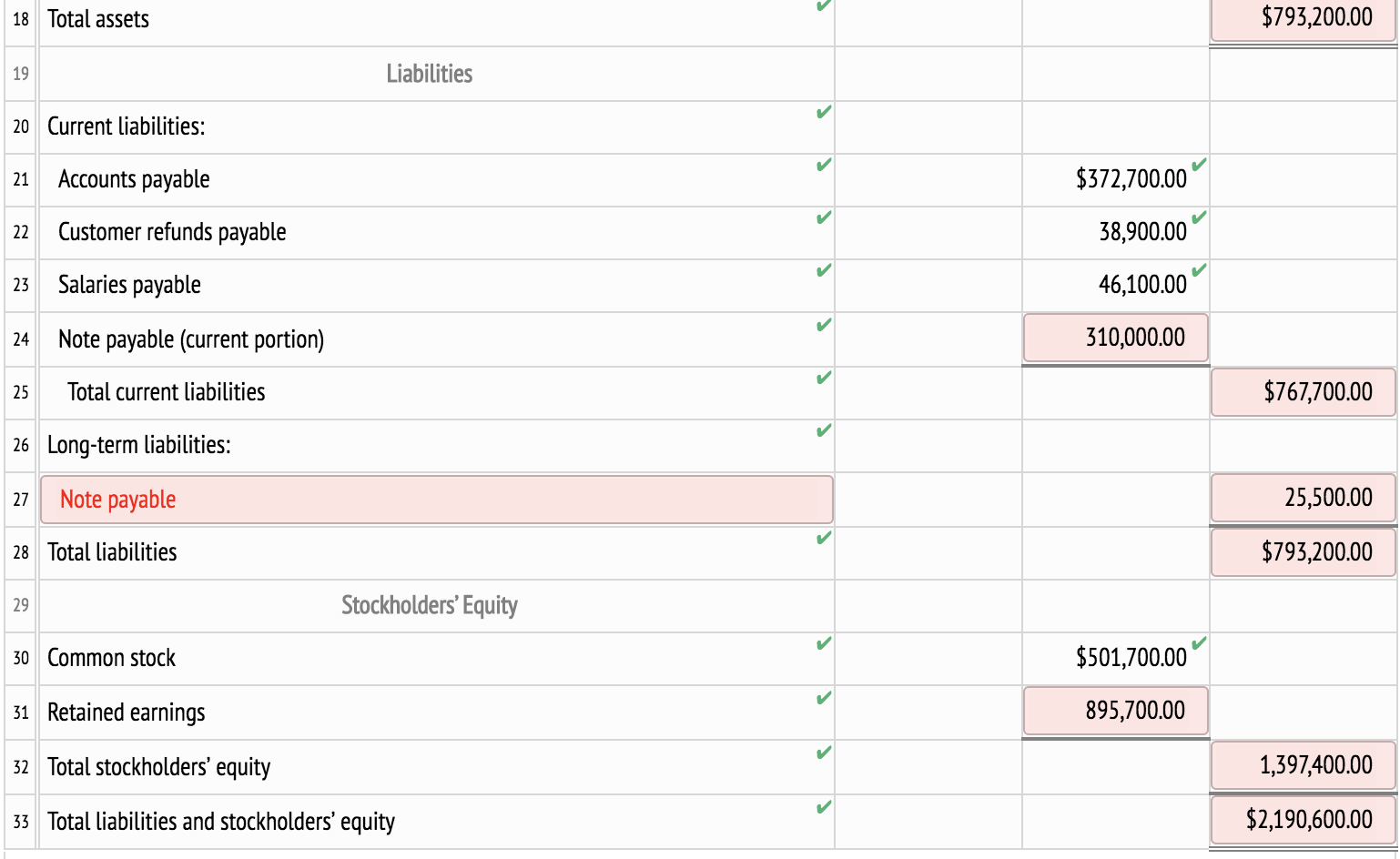

The stuff marked in red are the things i need help with.

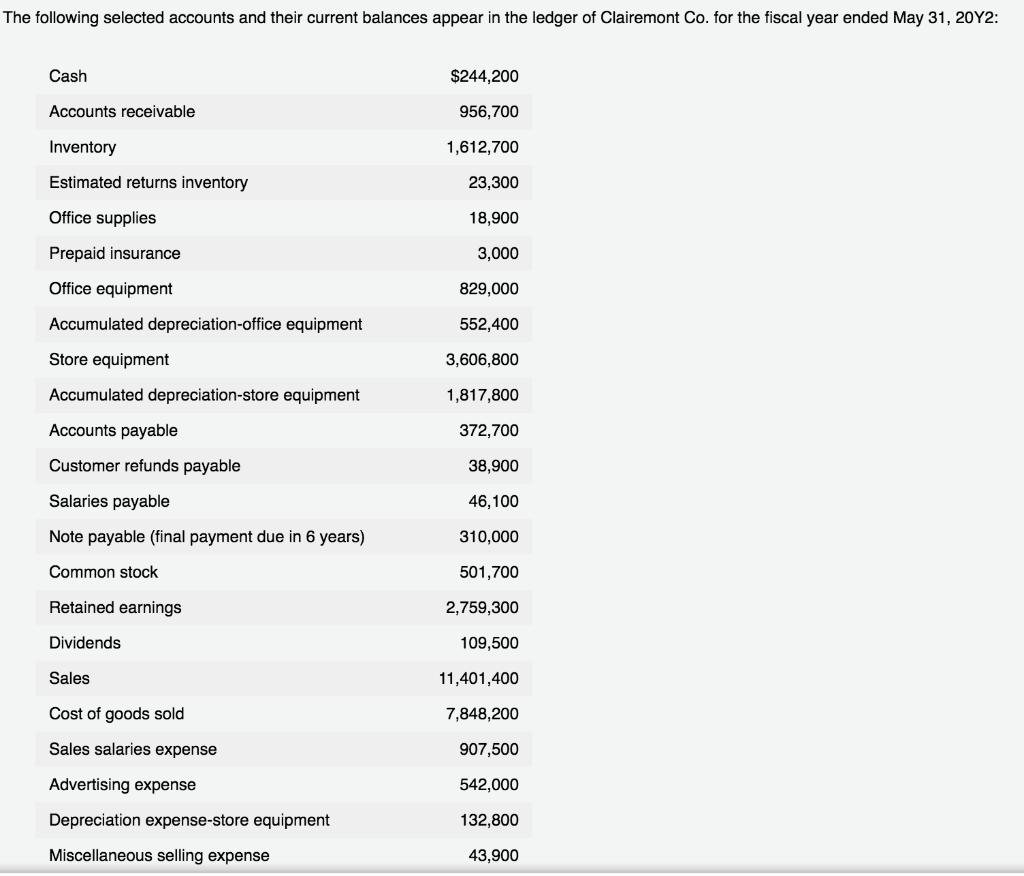

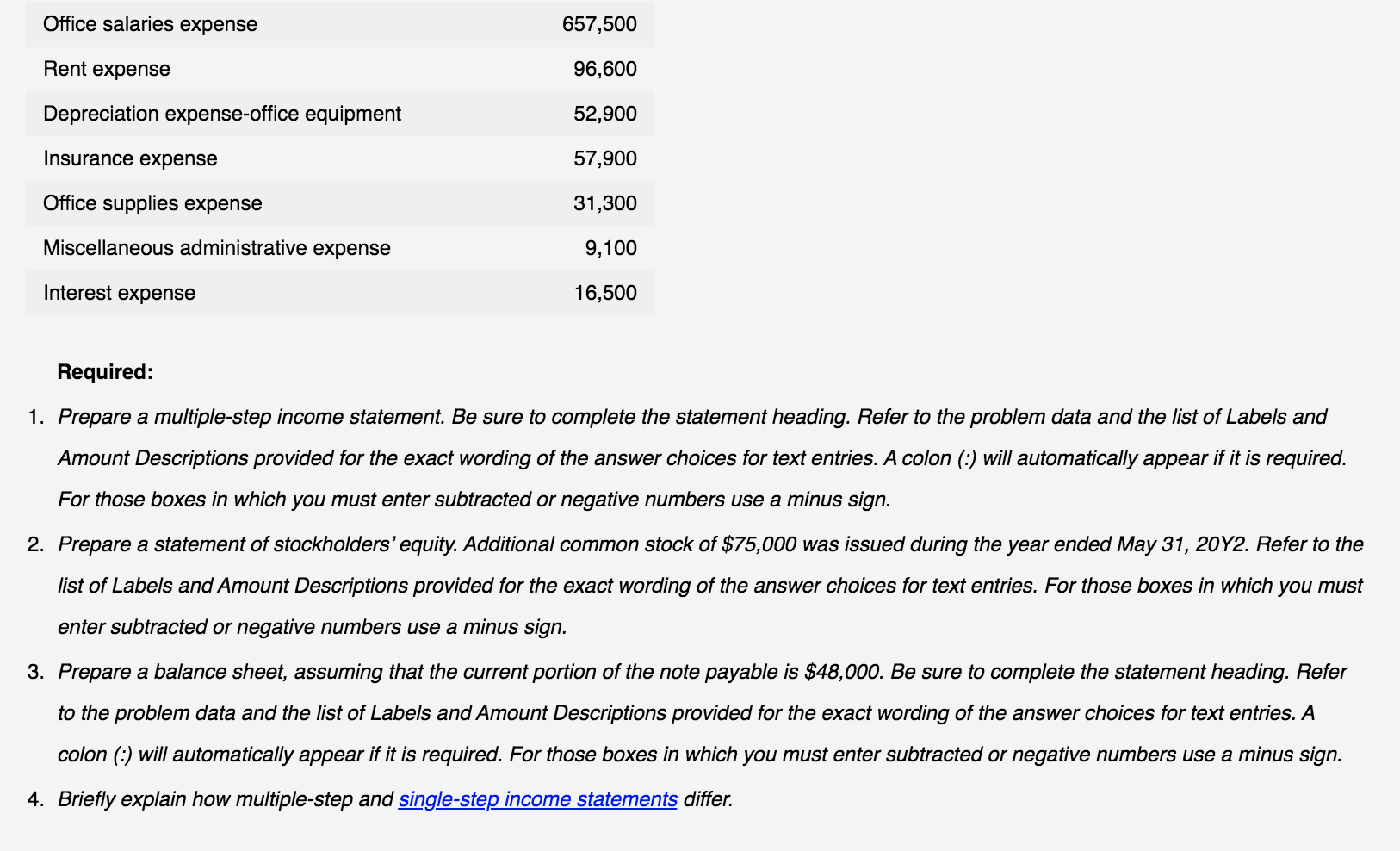

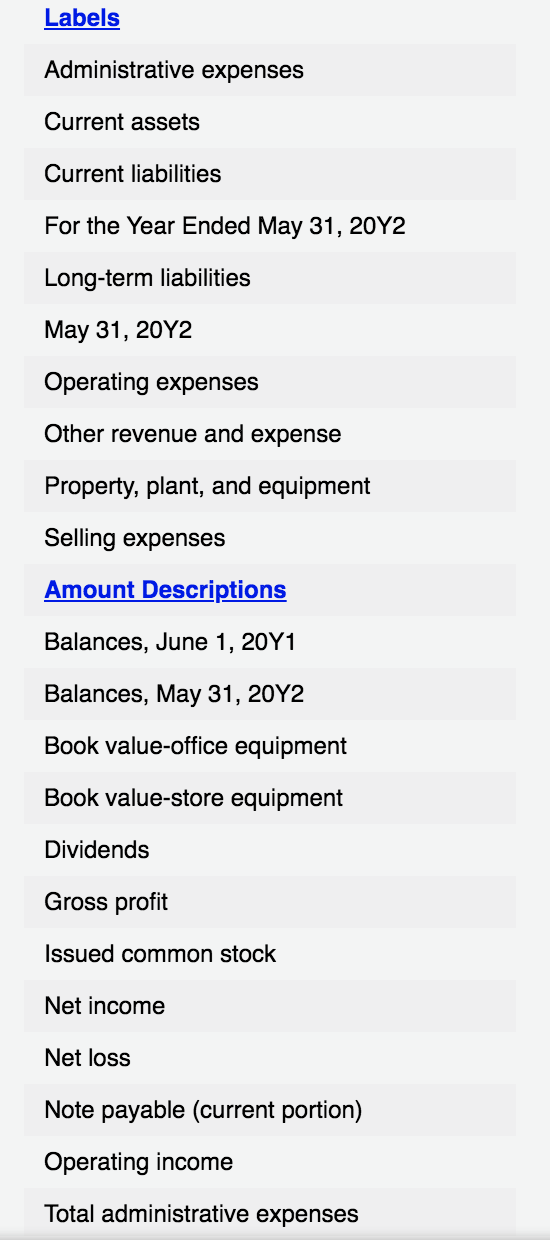

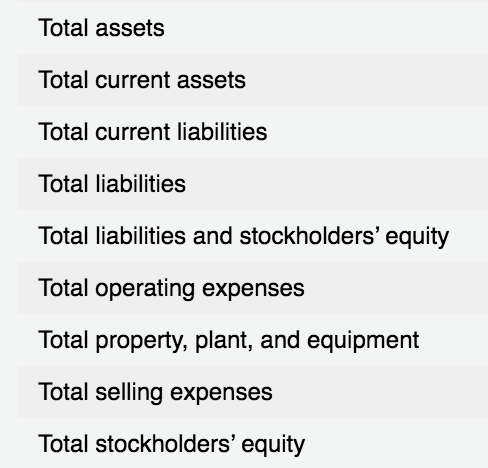

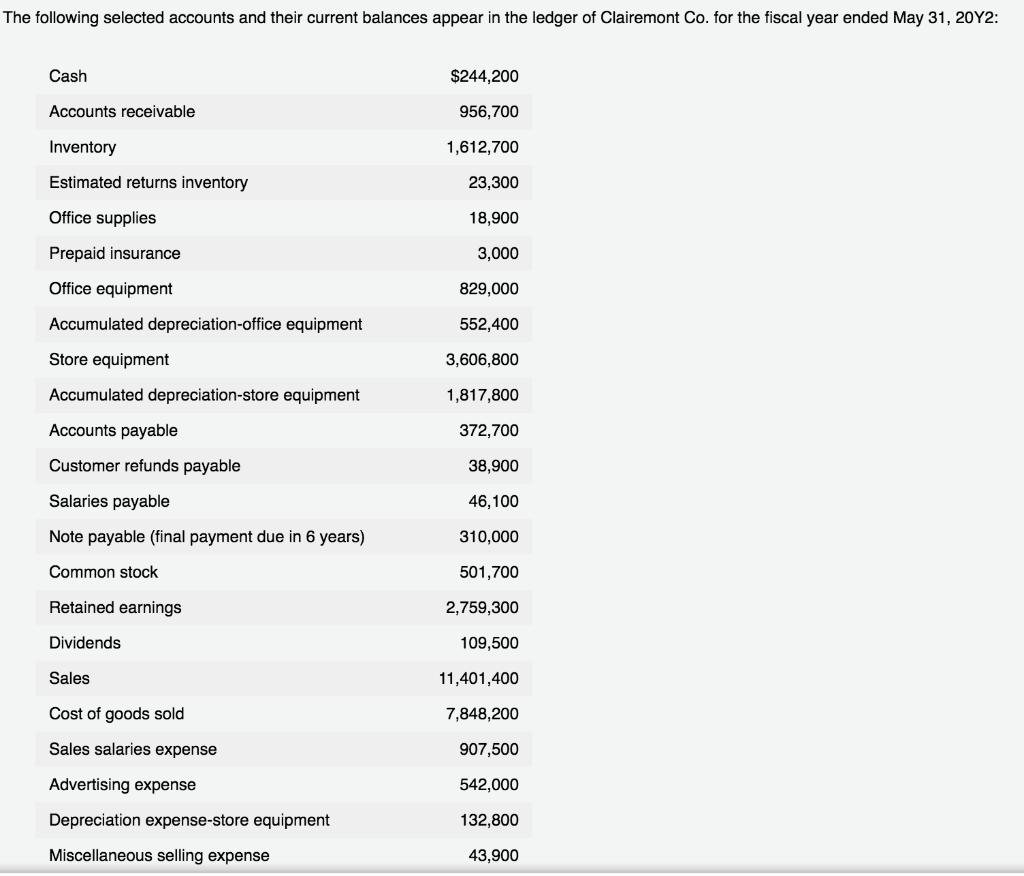

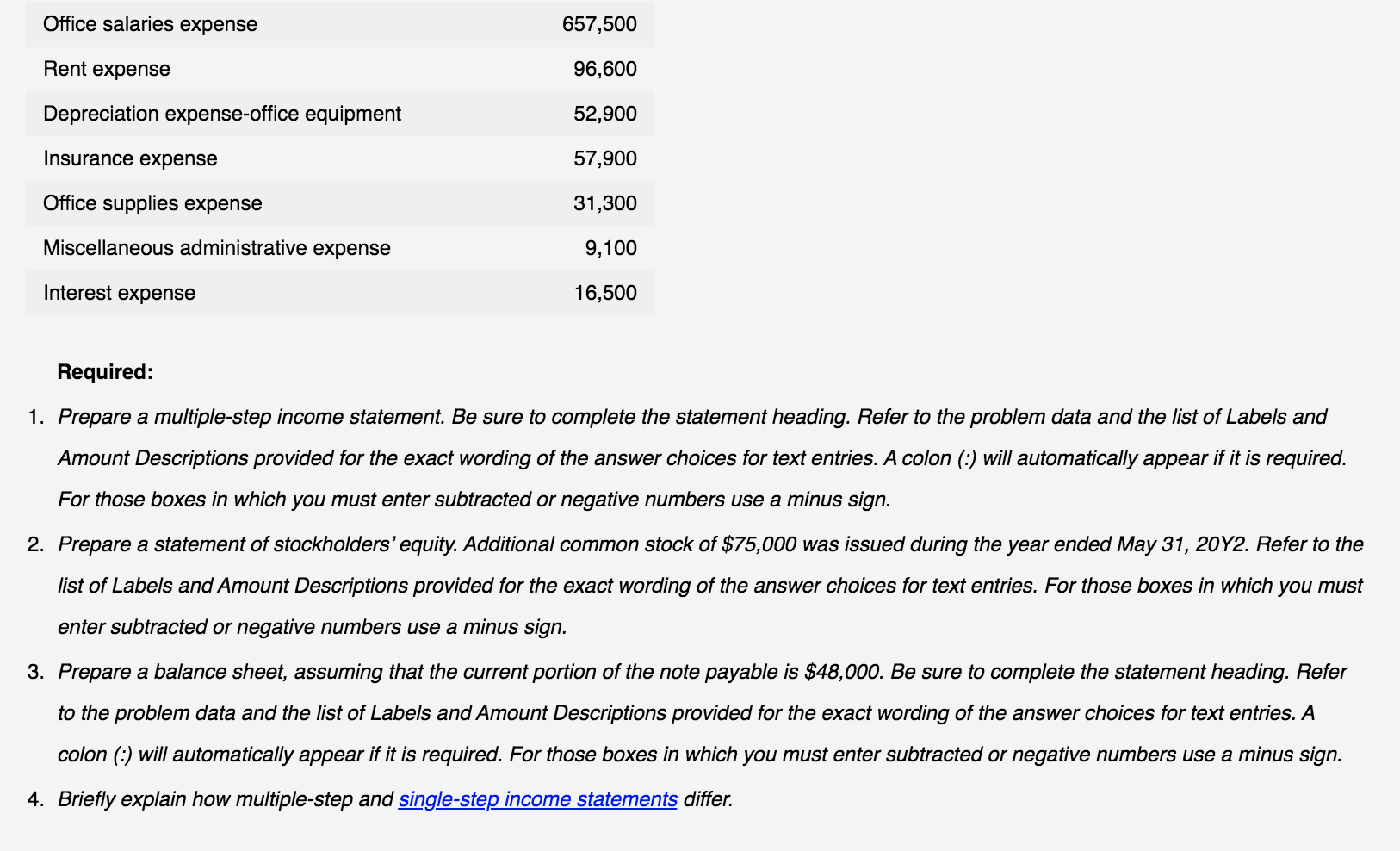

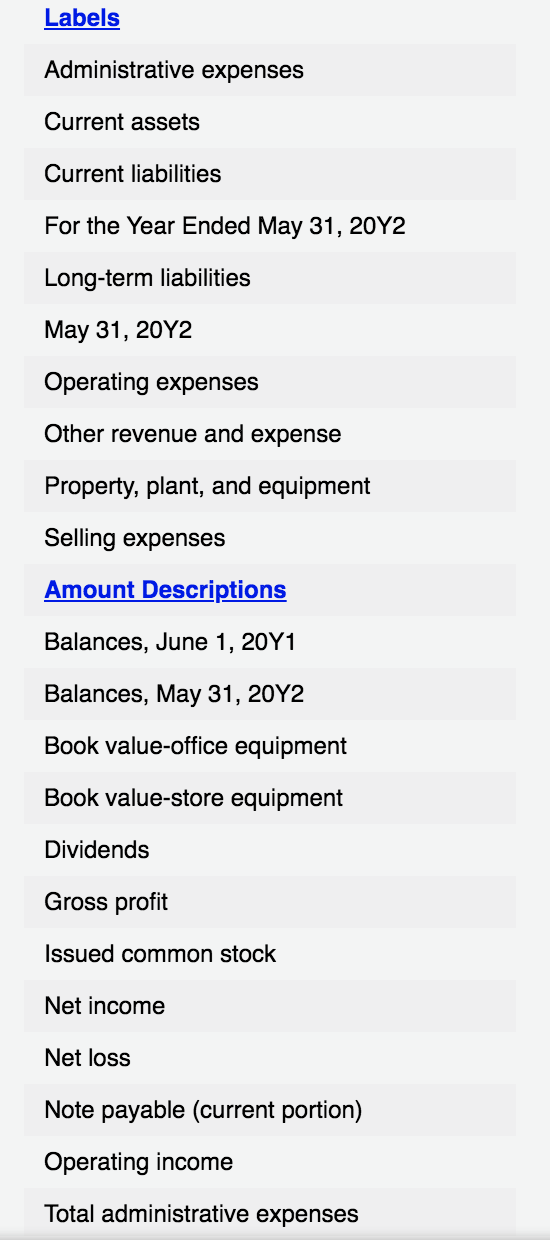

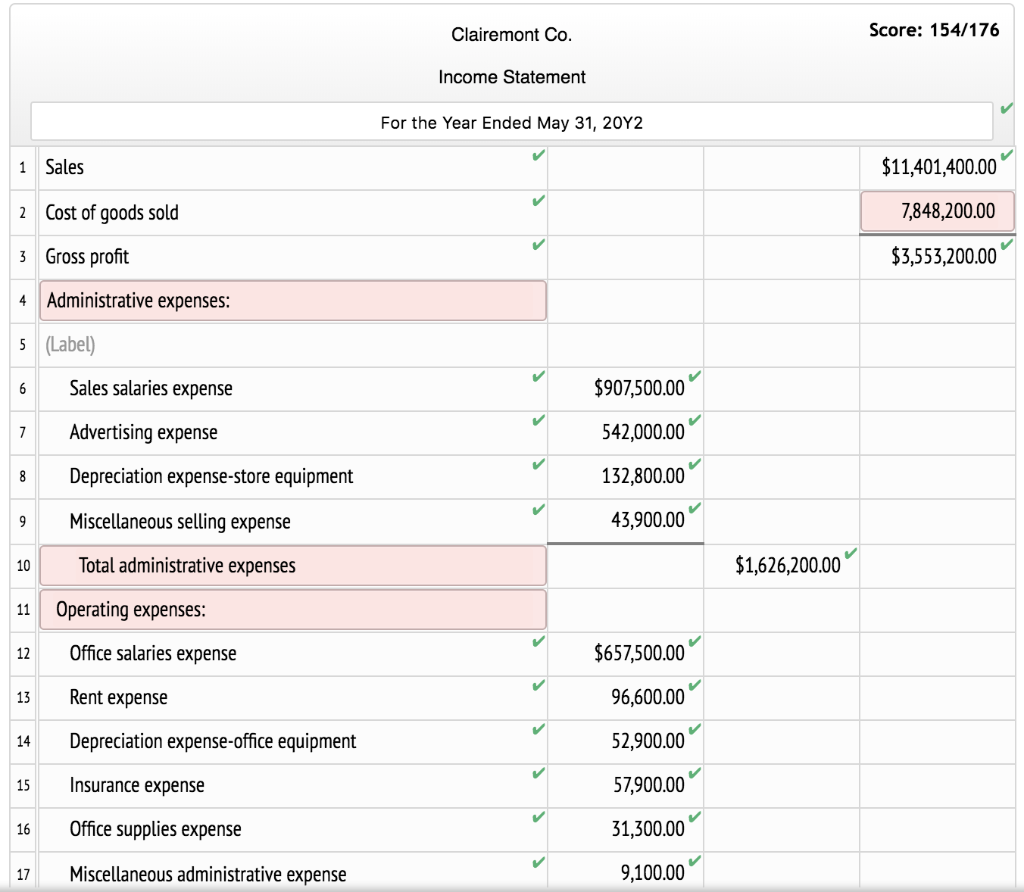

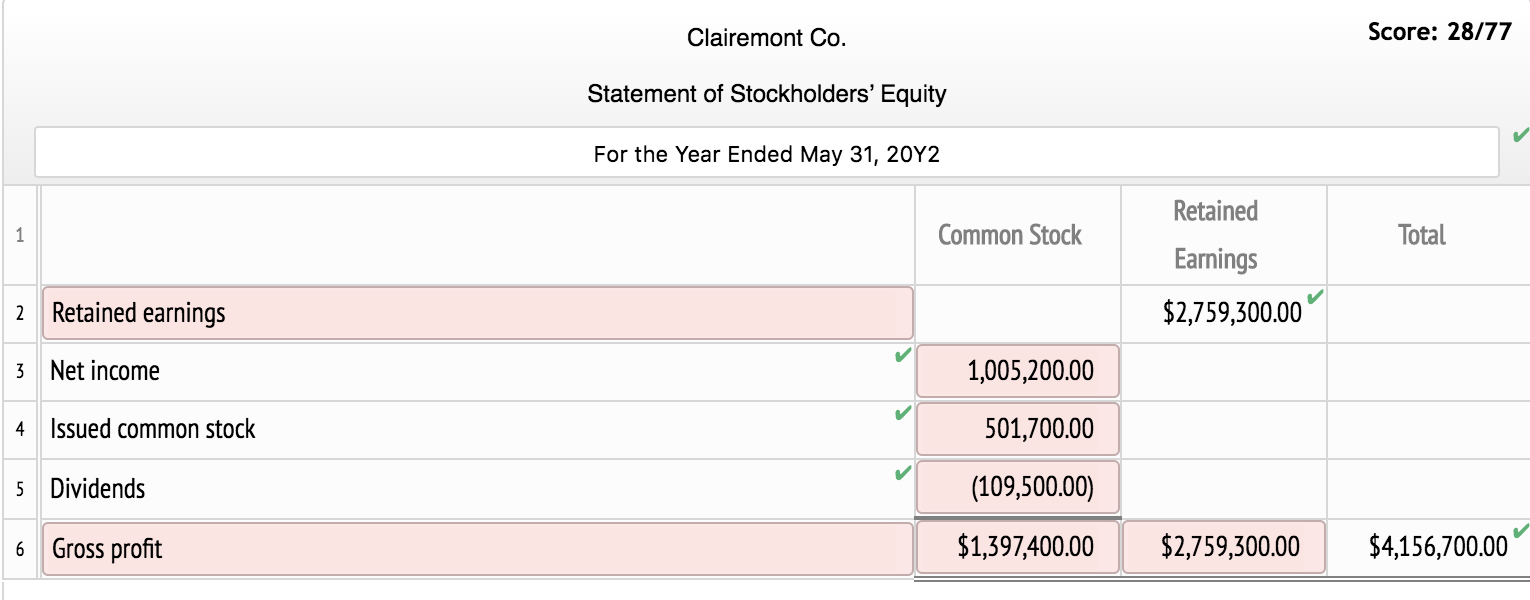

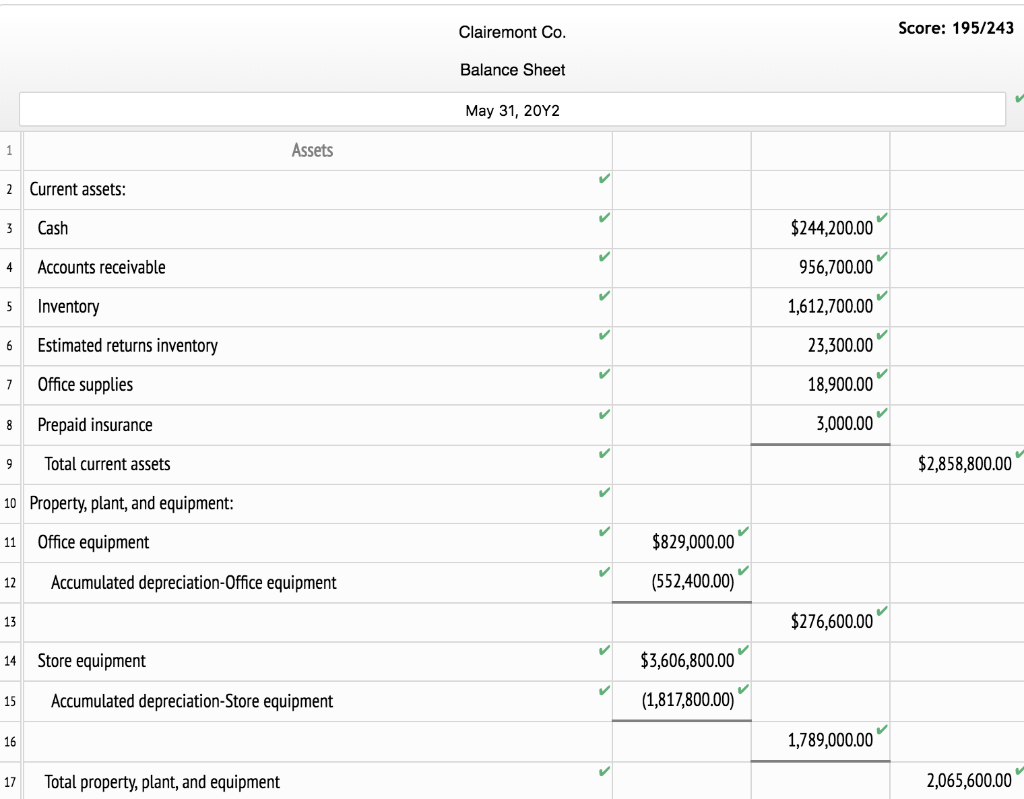

The following selected accounts and their current balances appear in the ledger of Clairemont Co. for the fiscal year ended May 31, 20Y2: Cash $244,200 Accounts receivable 956,700 Inventory 1,612,700 23,300 Estimated returns inventory Office supplies 18,900 Prepaid insurance 3,000 Office equipment 829,000 Accumulated depreciation-office equipment 552,400 3,606,800 Store equipment Accumulated depreciation-store equipment 1,817,800 Accounts payable 372,700 38,900 Customer refunds payable 46,100 Salaries payable Note payable (final payment due in 6 years) 310,000 Common stock 501,700 Retained earnings 2,759,300 Dividends 109,500 Sales 11,401,400 7,848,200 Cost of goods sold Sales salaries expense 907,500 Advertising expense 542,000 Depreciation expense-store equipment 132,800 Miscellaneous selling expense 43,900 Office salaries expense 657,500 Rent expense 96,600 Depreciation expense-office equipment 52,900 Insurance expense 57,900 Office supplies expense 31,300 Miscellaneous administrative expense 9,100 Interest expense 16,500 Required: 1. Prepare a multiple-step income statement. Be sure to complete the statement heading. Refer to the problem data and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colon (-) will automatically appear if it is required. For those boxes in which you must enter subtracted or negative numbers use a minus sign. 2. Prepare a statement of stockholders' equity. Additional common stock of $75,000 was issued during the year ended May 31, 20Y2. Refer to the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. 3. Prepare a balance sheet, assuming that the current portion of the note payable is $48,000. Be sure to complete the statement heading. Refer to the problem data and the list of Labels and Amount Descriptions provided for the exact wording of the answer choices for text entries. A colon (0) will automatically appear if it is required. For those boxes in which you must enter subtracted or negative numbers use a minus sign. 4. Briefly explain how multiple-step and single-step income statements differ. Labels Administrative expenses Current assets Current liabilities For the Year Ended May 31, 20Y2 Long-term liabilities May 31, 20Y2 Operating expenses Other revenue and expense Property, plant, and equipment Selling expenses Amount Descriptions Balances, June 1, 20Y1 Balances, May 31, 20Y2 Book value-office equipment Book value-store equipment Dividends Gross profit Issued common stock Net income Net loss Note payable (current portion) Operating income Total administrative expenses Total assets Total current assets Total current liabilities Total liabilities Total liabilities and stockholders' equity Total operating expenses Total property, plant, and equipment Total selling expenses Total stockholders' equity Clairemont Co. Score: 154/176 Income Statement For the Year Ended May 31, 20Y2 1 Sales $11,401,400.00 2 Cost of goods sold 7,848,200.00 3 Gross profit $3,553,200.00 Administrative expenses: 5 (Label) Sales salaries expense $907,500.00 Advertising expense 542,000.00 Depreciation expense-store equipment 132,800.00 Miscellaneous selling expense 43,900.00 Total administrative expenses $1,626,200.00 Operating expenses: Office salaries expense Rent expense $657,500.00 96,600.00 52,900.00 57,900.00 Depreciation expense-office equipment Insurance expense Office supplies expense 31,300.00 Miscellaneous administrative expense 9,100.00 18 Total operating expenses 905,300.00 2,531,500.00 20 Operating income $1,021,700.00 21 Selling expenses: 22 Interest expense (16,500.00) 23 Net income $1,005,200.00 Clairemont Co. Score: 28/77 Statement of Stockholders' Equity For the Year Ended May 31, 20Y2 Retained Common Stock Total Earnings $2,759,300.00 2 Retained earnings Net income 1,005,200.00 Issued common stock 501,700.00 5 Dividends (109,500.00) Gross profit $1,397,400.00 $2,759,300.00 $4,156,700.00 Clairemont Co. Score: 195/243 Balance Sheet May 31, 20Y2 Assets 2 Current assets: Cash $244,200.00 Accounts receivable 956,700.00 5 Inventory Estimated returns inventory 1,612,700.00 23,300.00 18,900.00 Office supplies 8 Prepaid insurance 3,000.00 Total current assets $2,858,800.00 10 Property, plant, and equipment: $829,000.00 11 12 Office equipment Accumulated depreciation Office equipment (552,400.00) $276,600.00 14 Store equipment $3,606,800.00 (1,817,800.00) Accumulated depreciation-Store equipment 1,789,000.00 17 Total property, plant, and equipment 2,065,600.00 18 Total assets $793,200.00 Liabilities 20 Current liabilities: Accounts payable Customer refunds payable Salaries payable $372,700.00 38,900.00 22 46,100.00 | Note payable (current portion) 310,000.00 Total current liabilities $767,700.00 26 Long-term liabilities: Note payable 25,500.00 Total liabilities $793,200.00 Stockholders' Equity 30 Common stock $501,700.00 Retained earnings 895,700.00 32 Total stockholders' equity 1,397,400.00 33 Total liabilities and stockholders' equity $2,190,600.00