Answered step by step

Verified Expert Solution

Question

1 Approved Answer

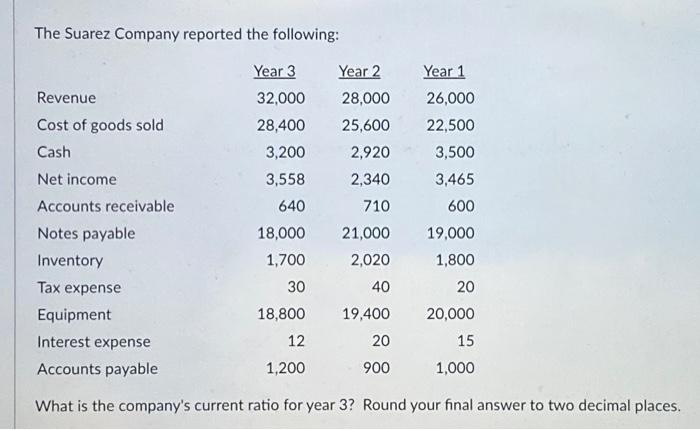

The Suarez Company reported the following: Revenue Cost of goods sold Cash Net income Year 3 32,000 28,400 3,200 3,558 640 Year 2 28,000 25,600

The Suarez Company reported the following: Revenue Cost of goods sold Cash Net income Year 3 32,000 28,400 3,200 3,558 640 Year 2 28,000 25,600 2,920 2,340 710 18,000 1,700 30 18,800 12 1,200 Accounts receivable Notes payable Inventory Tax expense Equipment Interest expense Accounts payable What is the company's current ratio for year 3? Round your final answer to two decimal places. Year 1 26,000 22,500 3,500 3,465 600 21,000 2,020 40 19,400 20 900 19,000 1,800 20 20,000 15 1,000

The Suarez Company reported the following: Year 3 Year 2 Year 1 Revenue 32,000 28,000 26,000 Cost of goods sold 28,400 25,600 22,500 Cash 3,200 2,920 3,500 Net income 3,558 2,340 3,465 Accounts receivable 640 710 600 Notes payable 18,000 21,000 19,000 Inventory 1,700 2,020 1,800 Tax expense 30 40 20 Equipment 18,800 19,400 20,000 Interest expense 12 20 15 Accounts payable 1,200 900 1,000 What is the company's current ratio for year 3? Round your final answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Current Assets is Cash Accounts Receivable Inventory 3200 640 170...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started