Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The subsidiary in Jifi produces Tech-Plough. Annually it produces 800 units and sells all of them to the subsidiary in Camaija for 10,000 each.

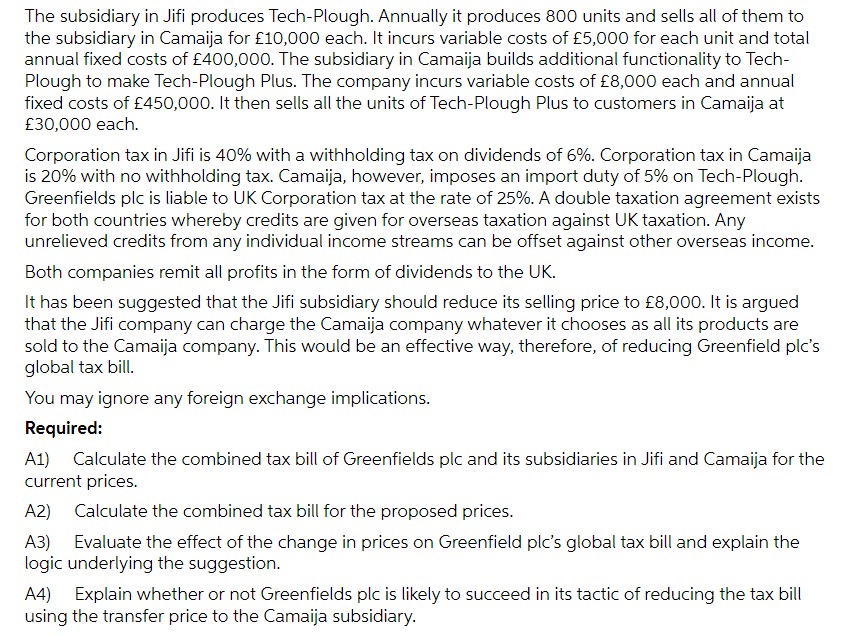

The subsidiary in Jifi produces Tech-Plough. Annually it produces 800 units and sells all of them to the subsidiary in Camaija for 10,000 each. It incurs variable costs of 5,000 for each unit and total annual fixed costs of 400,000. The subsidiary in Camaija builds additional functionality to Tech- Plough to make Tech-Plough Plus. The company incurs variable costs of 8,000 each and annual fixed costs of 450,000. It then sells all the units of Tech-Plough Plus to customers in Camaija at 30,000 each. Corporation tax in Jifi is 40% with a withholding tax on dividends of 6%. Corporation tax in Camaija is 20% with no withholding tax. Camaija, however, imposes an import duty of 5% on Tech-Plough. Greenfields plc is liable to UK Corporation tax at the rate of 25%. A double taxation agreement exists for both countries whereby credits are given for overseas taxation against UK taxation. Any unrelieved credits from any individual income streams can be offset against other overseas income. Both companies remit all profits in the form of dividends to the UK. It has been suggested that the Jifi subsidiary should reduce its selling price to 8,000. It is argued that the Jifi company can charge the Camaija company whatever it chooses as all its products are sold to the Camaija company. This would be an effective way, therefore, of reducing Greenfield plc's global tax bill. You may ignore any foreign exchange implications. Required: A1) Calculate the combined tax bill of Greenfields plc and its subsidiaries in Jifi and Camaija for the current prices. A2) Calculate the combined tax bill for the proposed prices. A3) Evaluate the effect of the change in prices on Greenfield plc's global tax bill and explain the logic underlying the suggestion. A4) Explain whether or not Greenfields plc is likely to succeed in its tactic of reducing the tax bill using the transfer price to the Camaija subsidiary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started