Question

CASE 3 XYZ Bhd recently issued 10-year bonds at a price of RM1,000. These bonds pay 3% in interest each six months. Their price

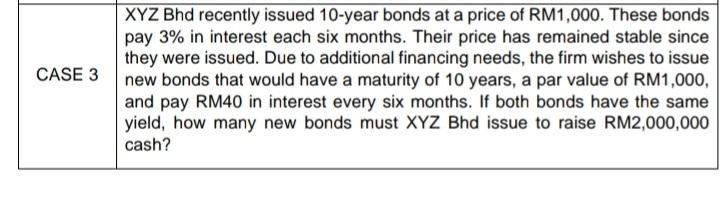

CASE 3 XYZ Bhd recently issued 10-year bonds at a price of RM1,000. These bonds pay 3% in interest each six months. Their price has remained stable since they were issued. Due to additional financing needs, the firm wishes to issue new bonds that would have a maturity of 10 years, a par value of RM1,000, and pay RM40 in interest every six months. If both bonds have the same yield, how many new bonds must XYZ Bhd issue to raise RM2,000,000 cash?

Step by Step Solution

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 2 3 4 A The price of recently issued bonds is RM 1000 The par value of the bond is also Rm 1000 T...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Microeconomics

Authors: Dean Karlan, Jonathan Morduch

1st edition

978-0077332587, 007733258X, 978-0077332648, 77332644, 978-1259163531

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App