Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Sugar Cane Refining and Processing Company is a comprehensive case covering a firm's investment decision in fixed assets or capital budgeting. Most senior

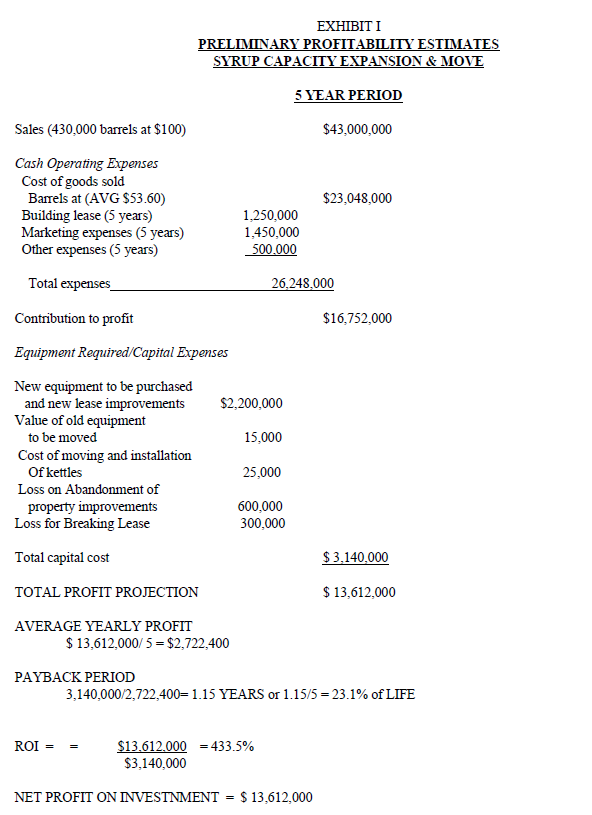

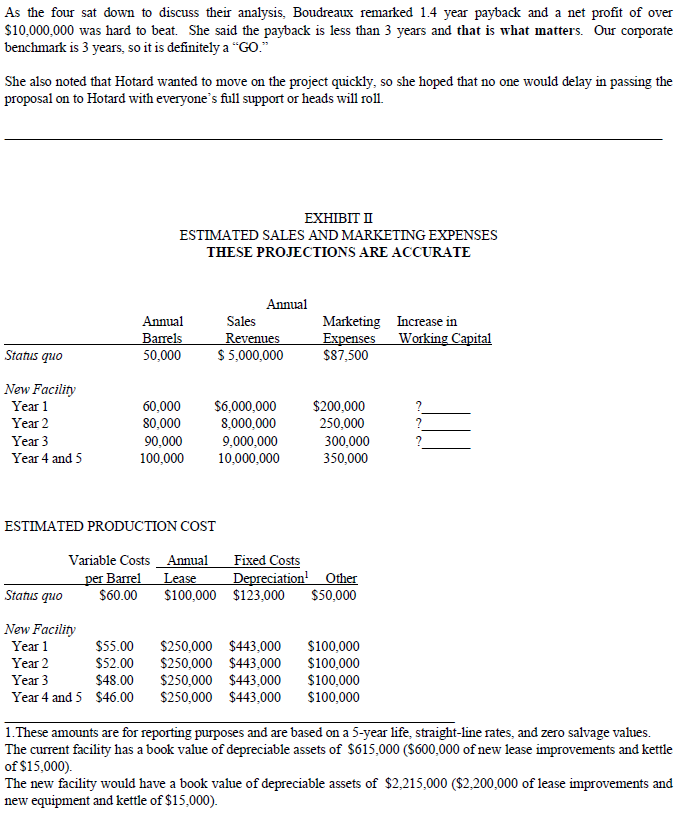

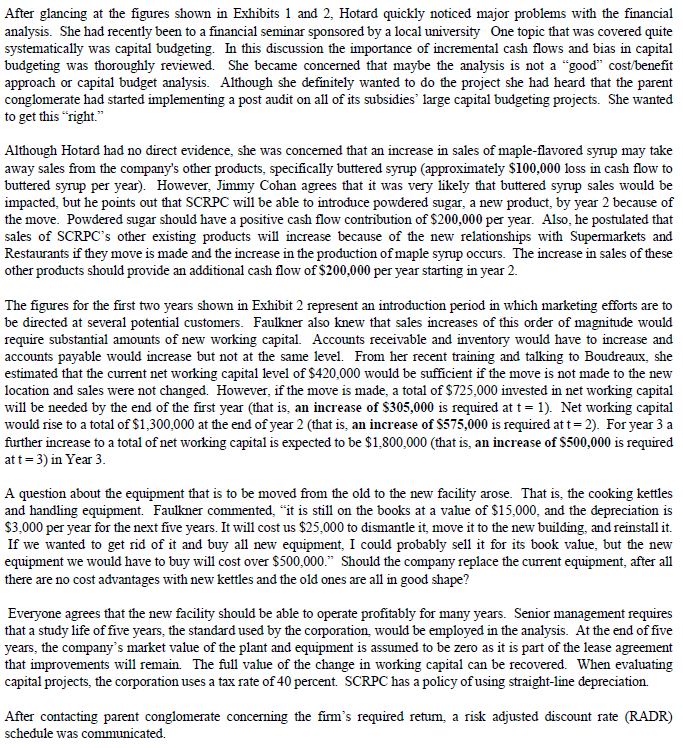

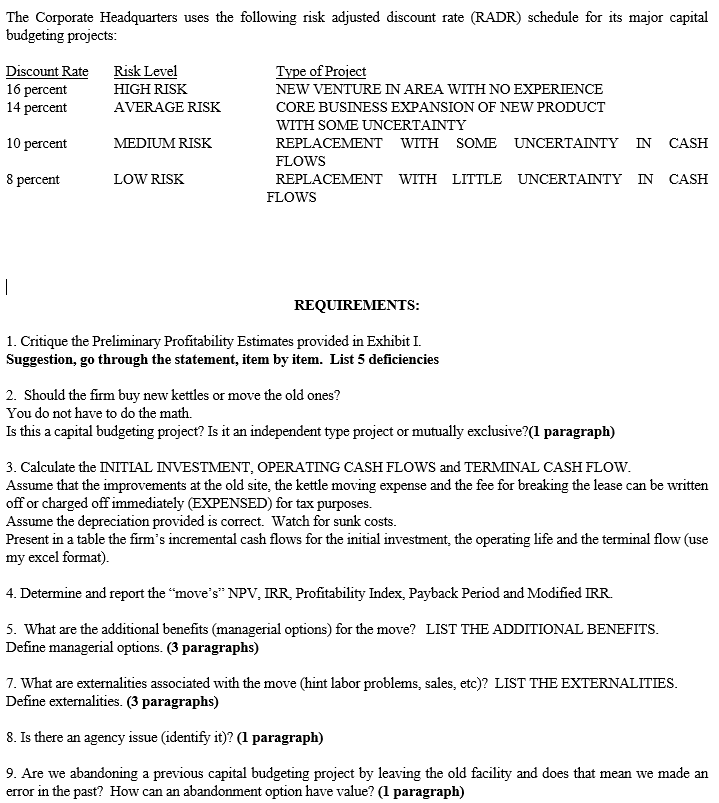

The Sugar Cane Refining and Processing Company is a comprehensive case covering a firm's investment decision in fixed assets or capital budgeting. Most senior level undergraduate and graduate corporate financial management courses cover advanced topics in capital budgeting including measuring complex cash flows, biasness in the capital budgeting process, agency issues, managerial options and risk adjusting techniques. To cover these relevant topics in a single case, the invented or "armchair" approach is used. This case is completely contrived but is very educationally effective. Keywords: Capital budgeting, managerial options, biasness in capital budgeting INTRODUCTION Investment decisions involving fixed assets or capital budgeting are extremely important to the firm's success, cash flows, risk and to a very large part, its market value (Bierman and Smidt 1988). Many financial economists consider capital budgeting to be the most important task facing the financial manager. Finance research has made major advances in theory that provide the tools to correctly evaluate capital investment decisions. These tools are taught in undergraduate and graduate finance classes (for an excellent reference book see Brigham and Capenski 2008). The estimate of true increment cash flows and discounting those projected to cash flows to present value at the appropriate required rate of return has proven to be the correct theoretical method to value a capital project (Woods and Randall 1989). In the last twenty years, possible bias in capital investment decisions' importance has been recognized and addressed in the literature (Pruitt and Gitman 1987). It has been found that many firms error when considering how to include opportunity costs and sunk costs in their cash flow estimates (Reinhardt 1973). Risk has been a very intriguing component in the analysis of cash flows in capital budgeting. Scenario analysis is a very powerful risk investigating technique that considers both the sensitivity of the net present value to changes in key variables and the range of likely variable values (Hiller 1963). The risk-adjusted discount rate approach (RADR) although having a slight theoretical flaw is the most frequently used in practice (Robichek and Myers 1966). Managerial options in capital budgeting have been given much research attention and gaining interest by the business executives (Kulatilaka and Marcus 1992). How to adjust for inflation in capital budgeting is an interesting and well investigated topic (Home 1971). THE CASE Patricia Hotard, the senior manager and top executive of Sugar Cane Refining and Processing Company (SCRPC), picked up the telephone to call Jimmy Cohan, the firm's marketing manager. Cohan had sent her a email earlier that moming suggesting that SCRPC might be able to increase its sales and profits substantially if their "old" or "new" manufacturing plants were allowed to increase the production capacity for making maple-flavored pancake syrup, a high-margin product that is sold primarily in bulk to large grocery chains and restaurants for bottling and sale under their own store and restaurant labels. "Your suggestion interests me," said Patricia, "but I can't give you an answer until the "financials" have been worked up. Also, we are at or near full capacity at both locations so we would have to expand one of our current facilities or look for another location. I am not sure we can expand enough at either site but talk to "production" and get their thoughts. Not to bias you or put any pressure but I really hope the increase in sales looks as good as you say. You know we will both probably get a "sweet" bonus and a nice increase in salary if we can markedly increase sales and profits. We must find out if profits from the increased sales you expect to get will give us a big enough return on our capital investment. As soon as you have firm estimates for sales, and how much money you will need for advertising and promotions, get with Stephanie Boudreaux (the company's controller). She can get the other data she needs to make the calculations from purchasing and production, and I will ask her to send me her capital budgeting analysis and recommendation by early next week. If it is as profitable as you think it will be, we will move on it immediately." SCRPC's first plant ("old plant") which is the focus of this capital budget study is located on the outskirts of a mid size city in south Louisiana and had been in operation for over 50 years. It was the first sugar refinery to locate in the heart of what was a newly developing sugar cane growing area, and it remains by far the largest processor in the region. SCRPC leased the facility under a long-term contract for many years. For the first twenty years, SCRPC would refine the sugar cane into sugar and package and sell the finished sugar under its own label. In the last twenty years, SCRPC leased a building adjacent to the refinery and added a processing plant that converts the raw sugar into syrups and other sweetener products. In recent years, the property owner of the adjacent building and SCRPC agreed to shorten the lease to eight years with provisions to break the lease. The refinery would remain operating; the adjacent processing planet is being considered to be expanded or replaced. Ten years ago, SCRPC added a second processing plant and built its corporate headquarters at this new site. The newer plant is located in another city that is over 40 miles away. Although a conglomerate acquired the company in the 1960s, it continues to operate autonomously. In addition to the title of senior manager, Patricia Hotard also serves as a vice-president of the parent conglomerate in charge of agricultural product operations. The SCRPC plants now produces a range of products, from granulated sugar (new plant), maple flavored syrup (old and new plant), buttered syrup (new plant), fruit flavored syrups molasses (new plant) to specialty sweeteners (new plant) used by other food and beverage processors. The new plant has a small section devoted to producing certain sugar based candies (candy cigarettes, love hearts and candy canes). Approximately 20 percent of the plant's current output is sold under the SCRPC label, with the remaining production sold under other firm's names/labels. The product line (maple flavored syrup), which Jimmy Cohan wants to expand, was first introduced in 1944 under the SCRPC brand name, but its real sales growth came in the early 1980s. At that time, contracts were signed that provided for bulk delivery to several regional grocery chains and small restaurant chains for bottling and sale under their own labels. In the past few years, Cohan has had inquiries from several larger grocery chains and expanding restaurant chains (I-HOP, INT'L PANCAKES, etc) about similar arrangements, but the present production facilities are already producing at its maximum design capacity. Additionally, these chains have hinted that they would consider purchasing other (buttered and fruit flavored syrups) existing SCRPC products if the bulk maple-flavored syrup arrangement "works out." Jimmy Cohan's staff has just completed a marketing study, which indicates that several large grocery chains would like to purchase and sell under their own names, powdered sugar. Although SCRPC is not producing powdered sugar, this product could be manufactured using the same equipment and technology used to manufacture syrup. The profit margin on this product, powdered sugar appears to be very high. After talking to Patricia Hotard, Jimmy Cohan discussed the expansion idea with Jamie Fontenot, plant manager of the old facility and Justin Taylor, head of production at both plants. According to Fontenot, there is not enough room to significantly expand production capacity at the old facility. It is located what has turned into a heavy industrial zone with all types of manufacturing plants located very close to it. The old refinery and processing plant is also located over forty miles from the headquarters which houses marketing, accounting and senior management as well being collocated with the manufacturing facility for syrups, sweeteners, etc. Justin Taylor reveals that the new facility is also land locked and expansion is not an option. Other tenants presently occupy all of the land and buildings adjacent to the new plant. Justin Taylor tells Jimmy Cohan and Jamie Fontenot that he knows of a company that has recently been placed in receivership whose manufacturing facility is both very near the SCRPC "new plant/headquarters" and is available for lease. It has much more than enough floor space and utilities in place, and it can be leased for 5 years at $250,000 per year. "I've wanted to get rid of the old processing facility for years," said Taylor. "It's a real inconvenience to have to go all the way over there whenever they have a problem - and they have quite a few since they operate at full capacity all the time. Besides being time consuming and inconvenient to visit and support this operation, it is difficult to get big trucks in and out of the processing plant. There have been several accidents and near accidents in the past three years and our insurance rates have skyrocketed. Moving the old processing plant to a location practically across the street from our headquarters and expanding capacity would really make things better. We will have a higher cost to transport the raw materials to this new facility for processing but we should save a lot of money by reducing the cost of manufacturing or processing at this more modern site (these costs are in the Variable Costs and Other Costs in Exhibit II)." Jimmy learns that at the old site, the lease is for another five years but we can break if we pay them $300,000. Jamie Fontenot tells Jimmy and Justin Taylor, "There are some very big advantages and disadvantages of the move. As stated earlier, the old site has big logistic problems. If we do move, we could use state of the art equipment to manufacture our products and even have enough space for future expansion. With new more efficient equipment and economies of scale, we could lower our per-unit cost even though we would have to truck the processed sugar from the old refinery to the new processing plant. Also, we could finally offer our employees a decent break room and maybe even perks such as a recreation room and shower area. This is all very positive." However, there are some major negative points. "We just spent over $600,000 on lease improvements for that old site including heating and air-conditioning upgrades that I had requested and had to beg the top brass. I have my name on that yellow slip and depreciation has not even started. We cannot transfer these improvements to the new building so that would be lost. I can not just throw away $600,000 (you can expense this loss as well as the $300,000 to break the lease). The rent is going to increase by 250% and the new equipment and lease improvements will cost $2,200,000. That means more fixed cost to cover. Also, there is movement in our society to consume less sugar products. Are we sure of estimated growth rates? Or if we have a major down turn in the economy like 6 years ago, we might be in trouble. Not only that but I don't know if all of the employees from the old plant would drive an additional hour or so to work. It would be very costly to hire and train a large number of new employees and we may have some major down time because of this. My step-son works at the old plant and I know that lazy man won't drive an extra 2 hours round trip and I don't want him moving back in my house. I don't know if you can count on my help on convincing the boss to make the move. I must review the analysis when we finish the study." Working with Taylor, Jamie and Cohan, Stephanie Boudreaux prepared the preliminary analysis shown in Exhibit 1. Sales (430,000 barrels at $100) Cash Operating Expenses Cost of goods sold Barrels at (AVG $53.60) EXHIBIT I PRELIMINARY PROFITABILITY ESTIMATES SYRUP CAPACITY EXPANSION & MOVE 5 YEAR PERIOD $43,000,000 $23,048,000 Building lease (5 years) 1,250,000 Marketing expenses (5 years) 1,450,000 Other expenses (5 years) 500.000 Total expenses 26,248,000 $16,752,000 Contribution to profit Equipment Required/Capital Expenses New equipment to be purchased and new lease improvements $2,200,000 Value of old equipment to be moved 15,000 Cost of moving and installation Of kettles 25,000 Loss on Abandonment of property improvements 600,000 Loss for Breaking Lease 300,000 Total capital cost $3,140,000 TOTAL PROFIT PROJECTION $ 13,612,000 AVERAGE YEARLY PROFIT $ 13,612,000/ 5 = $2,722,400 PAYBACK PERIOD 3,140,000/2,722,400- 1.15 YEARS or 1.15/5=23.1% of LIFE ROI = = $13.612.000 433.5% $3,140,000 NET PROFIT ON INVESTNMENT = $ 13,612,000 As the four sat down to discuss their analysis, Boudreaux remarked 1.4 year payback and a net profit of over $10,000,000 was hard to beat. She said the payback is less than 3 years and that is what matters. Our corporate benchmark is 3 years, so it is definitely a "GO." She also noted that Hotard wanted to move on the project quickly, so she hoped that no one would delay in passing the proposal on to Hotard with everyone's full support or heads will roll. EXHIBIT II ESTIMATED SALES AND MARKETING EXPENSES THESE PROJECTIONS ARE ACCURATE Annual Annual Sales Marketing Increase in Barrels Revenues Expenses Working Capital Status quo 50,000 $ 5,000,000 $87,500 New Facility Year 1 60,000 $6,000,000 $200,000 ? Year 2 80,000 8,000,000 250,000 ? Year 3 90,000 9,000,000 300,000 ? Year 4 and 5 100,000 10,000,000 350,000 ESTIMATED PRODUCTION COST Variable Costs Annual Fixed Costs per Barrel Lease Depreciation Other Status quo $60.00 $100,000 $123,000 $50,000 New Facility Year 1 Year 2 Year 3 $55.00 $250,000 $443,000 $100,000 $52.00 $250,000 $443,000 $48.00 $250,000 $443,000 Year 4 and 5 $46.00 $100,000 $100,000 $250,000 $443,000 $100,000 1.These amounts are for reporting purposes and are based on a 5-year life, straight-line rates, and zero salvage values. The current facility has a book value of depreciable assets of $615,000 ($600,000 of new lease improvements and kettle of $15,000). The new facility would have a book value of depreciable assets of $2,215,000 ($2,200,000 of lease improvements and new equipment and kettle of $15,000). After glancing at the figures shown in Exhibits 1 and 2, Hotard quickly noticed major problems with the financial analysis. She had recently been to a financial seminar sponsored by a local university One topic that was covered quite systematically was capital budgeting. In this discussion the importance of incremental cash flows and bias in capital budgeting was thoroughly reviewed. She became concerned that maybe the analysis is not a "good" cost/benefit approach or capital budget analysis. Although she definitely wanted to do the project she had heard that the parent conglomerate had started implementing a post audit on all of its subsidies' large capital budgeting projects. She wanted to get this "right." Although Hotard had no direct evidence, she was concerned that an increase in sales of maple-flavored syrup may take away sales from the company's other products, specifically buttered syrup (approximately $100,000 loss in cash flow to buttered syrup per year). However, Jimmy Cohan agrees that it was very likely that buttered syrup sales would be impacted, but he points out that SCRPC will be able to introduce powdered sugar, a new product, by year 2 because of the move. Powdered sugar should have a positive cash flow contribution of $200,000 per year. Also, he postulated that sales of SCRPC's other existing products will increase because of the new relationships with Supermarkets and Restaurants if they move is made and the increase in the production of maple syrup occurs. The increase in sales of these other products should provide an additional cash flow of $200,000 per year starting in year 2. The figures for the first two years shown in Exhibit 2 represent an introduction period in which marketing efforts are to be directed at several potential customers. Faulkner also knew that sales increases of this order of magnitude would require substantial amounts of new working capital. Accounts receivable and inventory would have to increase and accounts payable would increase but not at the same level. From her recent training and talking to Boudreaux, she estimated that the current net working capital level of $420,000 would be sufficient if the move is not made to the new location and sales were not changed. However, if the move is made, a total of $725,000 invested in net working capital will be needed by the end of the first year (that is, an increase of $305,000 is required at t=1). Net working capital would rise to a total of $1,300,000 at the end of year 2 (that is, an increase of $575,000 is required at t=2). For year 3 a further increase to a total of net working capital is expected to be $1,800,000 (that is, an increase of $500,000 is required at t = 3) in Year 3. A question about the equipment that is to be moved from the old to the new facility arose. That is, the cooking kettles and handling equipment. Faulkner commented, "it is still on the books at a value of $15,000, and the depreciation is $3,000 per year for the next five years. It will cost us $25,000 to dismantle it, move it to the new building, and reinstall it. If we wanted to get rid of it and buy all new equipment, I could probably sell it for its book value, but the new equipment we would have to buy will cost over $500,000." Should the company replace the current equipment, after all there are no cost advantages with new kettles and the old ones are all in good shape? Everyone agrees that the new facility should be able to operate profitably for many years. Senior management requires that a study life of five years, the standard used by the corporation, would be employed in the analysis. At the end of five years, the company's market value of the plant and equipment is assumed to be zero as it is part of the lease agreement that improvements will remain. The full value of the change in working capital can be recovered. When evaluating capital projects, the corporation uses a tax rate of 40 percent. SCRPC has a policy of using straight-line depreciation. After contacting parent conglomerate concerning the firm's required return, a risk adjusted discount rate (RADR) schedule was communicated. | The Corporate Headquarters uses the following risk adjusted discount rate (RADR) schedule for its major capital budgeting projects: Discount Rate Risk Level 16 percent HIGH RISK 14 percent AVERAGE RISK 10 percent MEDIUM RISK 8 percent LOW RISK Type of Project NEW VENTURE IN AREA WITH NO EXPERIENCE CORE BUSINESS EXPANSION OF NEW PRODUCT WITH SOME UNCERTAINTY REPLACEMENT WITH SOME UNCERTAINTY IN CASH FLOWS REPLACEMENT WITH LITTLE UNCERTAINTY IN CASH FLOWS REQUIREMENTS: 1. Critique the Preliminary Profitability Estimates provided in Exhibit I. Suggestion, go through the statement, item by item. List 5 deficiencies 2. Should the firm buy new kettles or move the old ones? You do not have to do the math. Is this a capital budgeting project? Is it an independent type project or mutually exclusive?(1 paragraph) 3. Calculate the INITIAL INVESTMENT, OPERATING CASH FLOWS and TERMINAL CASH FLOW. Assume that the improvements at the old site, the kettle moving expense and the fee for breaking the lease can be written off or charged off immediately (EXPENSED) for tax purposes. Assume the depreciation provided is correct. Watch for sunk costs. Present in a table the firm's incremental cash flows for the initial investment, the operating life and the terminal flow (use my excel format). 4. Determine and report the "move's" NPV, IRR, Profitability Index, Payback Period and Modified IRR. 5. What are the additional benefits (managerial options) for the move? LIST THE ADDITIONAL BENEFITS. Define managerial options. (3 paragraphs) 7. What are externalities associated with the move (hint labor problems, sales, etc)? LIST THE EXTERNALITIES. Define externalities. (3 paragraphs) 8. Is there an agency issue (identify it)? (1 paragraph) 9. Are we abandoning a previous capital budgeting project by leaving the old facility and does that mean we made an error in the past? How can an abandonment option have value? (1 paragraph)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started