Answered step by step

Verified Expert Solution

Question

1 Approved Answer

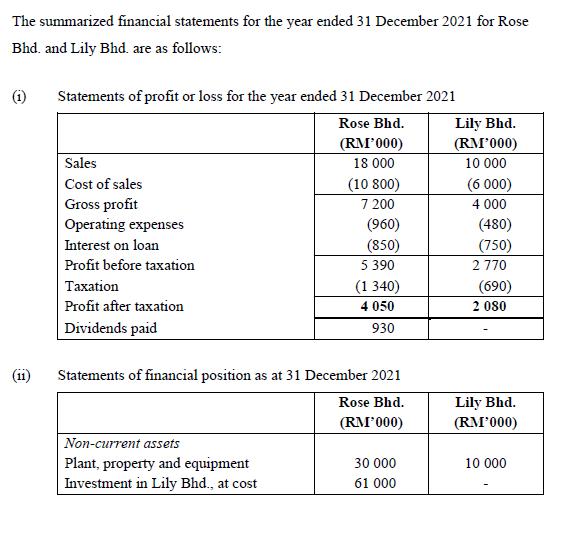

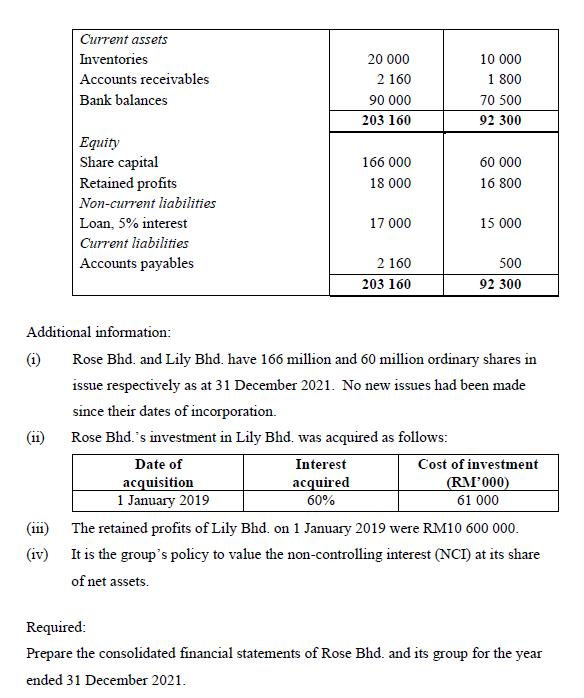

The summarized financial statements for the year ended 31 December 2021 for Rose Bhd. and Lily Bhd. are as follows: (1) (11) Statements of

The summarized financial statements for the year ended 31 December 2021 for Rose Bhd. and Lily Bhd. are as follows: (1) (11) Statements of profit or loss for the year ended 31 December 2021 Rose Bhd. (RM'000) 18 000 (10 800) 7 200 Sales Cost of sales Gross profit Operating expenses Interest on loan Profit before taxation Taxation Profit after taxation Dividends paid (960) (850) Non-current assets Plant, property and equipment Investment in Lily Bhd., at cost 5.390 (1340) 4 050 930 Statements of financial position as at 31 December 2021 Rose Bhd. (RM'000) 30 000 61 000 Lily Bhd. (RM'000) 10 000 (6 000) 4 000 (480) (750) 2770 (690) 2 080 Lily Bhd. (RM'000) 10 000 (1) (11) Current assets Inventories Accounts receivables Bank balances (111) (iv) Equity Share capital Retained profits Non-current liabilities Loan, 5% interest Current liabilities Accounts payables 20 000 2 160 90 000 203 160 Interest acquired 60% 166 000 18 000 17 000 2 160 203 160 10 000 1 800 70 500 92 300 Additional information: Rose Bhd. and Lily Bhd. have 166 million and 60 million ordinary shares in issue respectively as at 31 December 2021. No new issues had been made since their dates of incorporation. Rose Bhd.'s investment in Lily Bhd. was acquired as follows: Date of acquisition 1 January 2019 60 000 16 800 15 000 500 92 300 Cost of investment (RM'000) 61 000 The retained profits of Lily Bhd. on 1 January 2019 were RM10 600 000. It is the group's policy to value the non-controlling interest (NCI) at its share of net assets. Required: Prepare the consolidated financial statements of Rose Bhd. and its group for the year ended 31 December 2021.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Rose Bhd and Group Consolidated Statements of Financial Position As at 31 December 2021 RM000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started