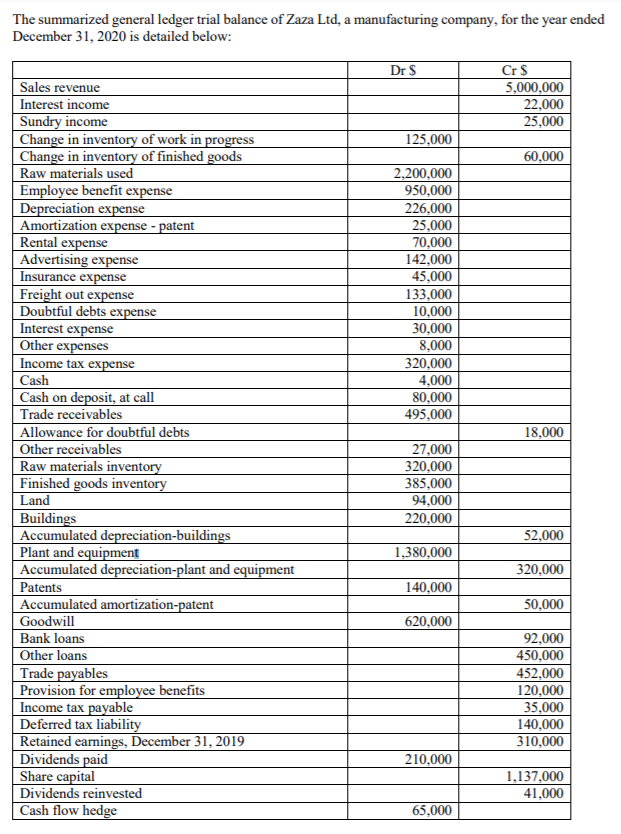

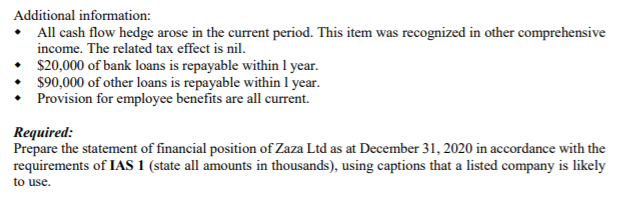

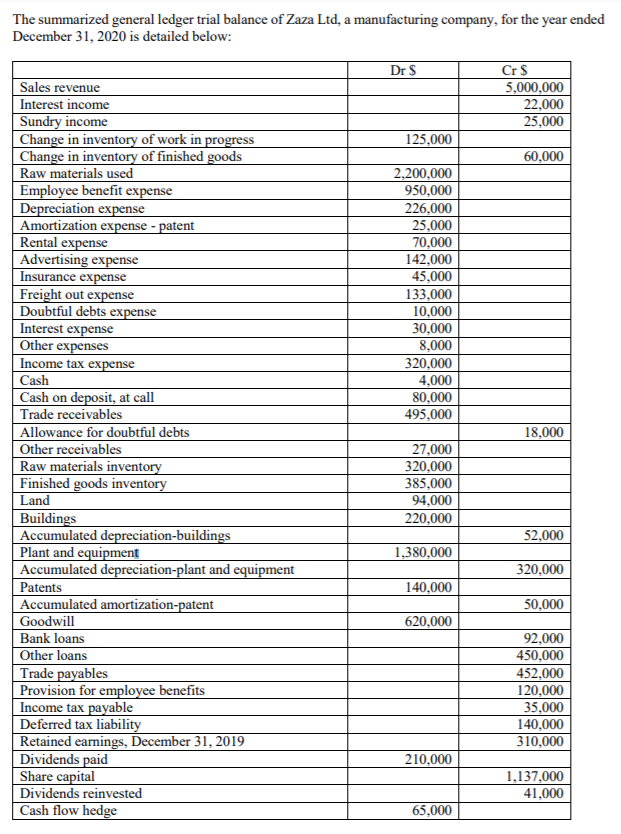

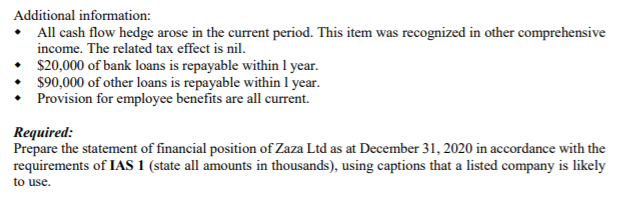

The summarized general ledger trial balance of Zaza Ltd, a manufacturing company, for the year ended December 31, 2020 is detailed below: Dr $ Cr$ 5,000,000 22,000 25,000 125,000 60,000 2,200,000 950,000 226,000 25,000 70,000 142.000 45,000 133,000 10,000 30,000 8,000 320,000 4,000 80,000 495,000 18,000 Sales revenue Interest income Sundry income Change in inventory of work in progress Change in inventory of finished goods Raw materials used Employee benefit expense Depreciation expense Amortization expense - patent Rental expense Advertising expense Insurance expense Freight out expense Doubtful debts expense Interest expense Other expenses Income tax expense Cash Cash on deposit, at call Trade receivables Allowance for doubtful debts Other receivables Raw materials inventory Finished goods inventory Land Buildings Accumulated depreciation-buildings Plant and equipment Accumulated depreciation-plant and equipment Patents Accumulated amortization-patent Goodwill Bank loans Other loans Trade payables Provision for employee benefits Income tax payable Deferred tax liability Retained earnings, December 31, 2019 Dividends paid Share capital Dividends reinvested Cash flow hedge 27,000 320,000 385,000 94,000 220,000 52,000 1,380,000 320,000 140,000 50,000 620,000 92,000 450,000 452,000 120,000 35,000 140,000 310,000 210,000 1,137,000 41,000 65,000 Additional information: All cash flow hedge arose in the current period. This item was recognized in other comprehensive income. The related tax effect is nil. $20,000 of bank loans is repayable within 1 year. $90,000 of other loans is repayable within 1 year. Provision for employee benefits are all current. Required: Prepare the statement of financial position of Zaza Ltd as at December 31, 2020 in accordance with the requirements of IAS 1 (state all amounts in thousands), using captions that a listed company is likely to use. The summarized general ledger trial balance of Zaza Ltd, a manufacturing company, for the year ended December 31, 2020 is detailed below: Dr $ Cr$ 5,000,000 22,000 25,000 125,000 60,000 2,200,000 950,000 226,000 25,000 70,000 142.000 45,000 133,000 10,000 30,000 8,000 320,000 4,000 80,000 495,000 18,000 Sales revenue Interest income Sundry income Change in inventory of work in progress Change in inventory of finished goods Raw materials used Employee benefit expense Depreciation expense Amortization expense - patent Rental expense Advertising expense Insurance expense Freight out expense Doubtful debts expense Interest expense Other expenses Income tax expense Cash Cash on deposit, at call Trade receivables Allowance for doubtful debts Other receivables Raw materials inventory Finished goods inventory Land Buildings Accumulated depreciation-buildings Plant and equipment Accumulated depreciation-plant and equipment Patents Accumulated amortization-patent Goodwill Bank loans Other loans Trade payables Provision for employee benefits Income tax payable Deferred tax liability Retained earnings, December 31, 2019 Dividends paid Share capital Dividends reinvested Cash flow hedge 27,000 320,000 385,000 94,000 220,000 52,000 1,380,000 320,000 140,000 50,000 620,000 92,000 450,000 452,000 120,000 35,000 140,000 310,000 210,000 1,137,000 41,000 65,000 Additional information: All cash flow hedge arose in the current period. This item was recognized in other comprehensive income. The related tax effect is nil. $20,000 of bank loans is repayable within 1 year. $90,000 of other loans is repayable within 1 year. Provision for employee benefits are all current. Required: Prepare the statement of financial position of Zaza Ltd as at December 31, 2020 in accordance with the requirements of IAS 1 (state all amounts in thousands), using captions that a listed company is likely to use