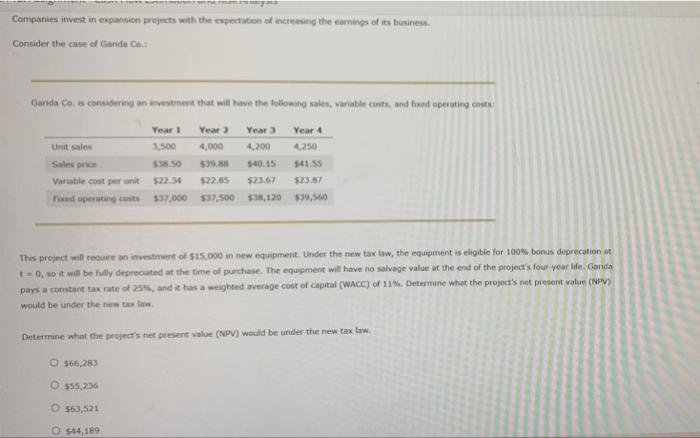

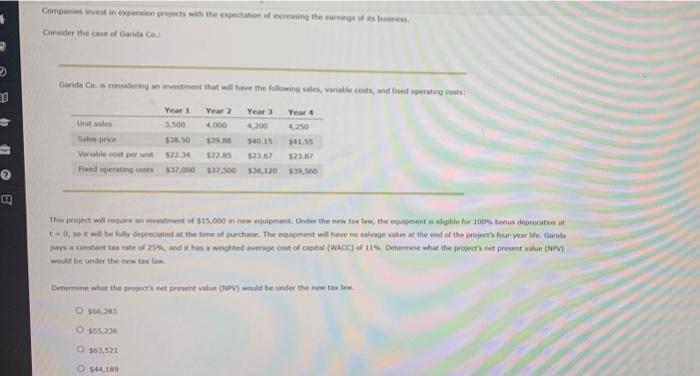

THE SUN ewan ew nary as Companies invest in expansion projects with the expectation of increasing the earnings of its business. Consider the case of Ganda Co. Ganda Co. is considering an investment that will have the following sales, variable costs, and fixed operating costs: Year 1 Year 2 Year 3 Year 4 Unit sales 3,500 4,000 4,200 4,250 Sales price $38.50 $39.88 $40.15 $41.55 Variable cost per unit $23.87 $22.34 $22.85 $23.67 $37,000 $37,500 $38,120 Fixed operating costs $39,560 This project will require an investment of $15,000 in new equipment. Under the new tax law, the equipment is eligible for 100% bonus deprecation at 1-0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project's four-year life. Ganda pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be under the new tax law. Determine what the project's net present value (NPV) would be under the new tax law. O $66,283 O $55,236 O $63,521 O$44,189 Companies invest in expansion projects with the expectation of increasing the earnings of its business. Consider the case of Garda Ca Garda Cas considering an investment that will have the following sales, variable costs, and faxed operating costs B Year 2 Year 3 Year 4 Year 1 3,500 Unit sales 4,000 4,200 4,250 Sales price $38.50 $39.08 $40.15 $41.55 Variable cost per unit $22.34 $22.85 $23.67 Fised operating costs $37,000 $37,500 $38,120 $39,560 This project will require an investment of $15,000 in new equipment. Under the new tax law, the equipment is eligible for 100% bonus deprecation at 1-0, so it will be fully depreciated at the time of purchase. The equipment will have no salvage value at the end of the project's four year life. Garda pays a constant tax rate of 25%, and it has a weighted average cost of capital (WACC) of 11%. Determine what the project's net present value (NPV) would be under the new tax law. Determine what the project's not present value (NPV) would be under the new tax law O $66,283 O $55,236 O $63,521 O $44,189