Question

The Sunbelt Corporation has $34 million of bonds outstanding that were issued at a coupon rate of 11.175 percent seven years ago. Interest rates have

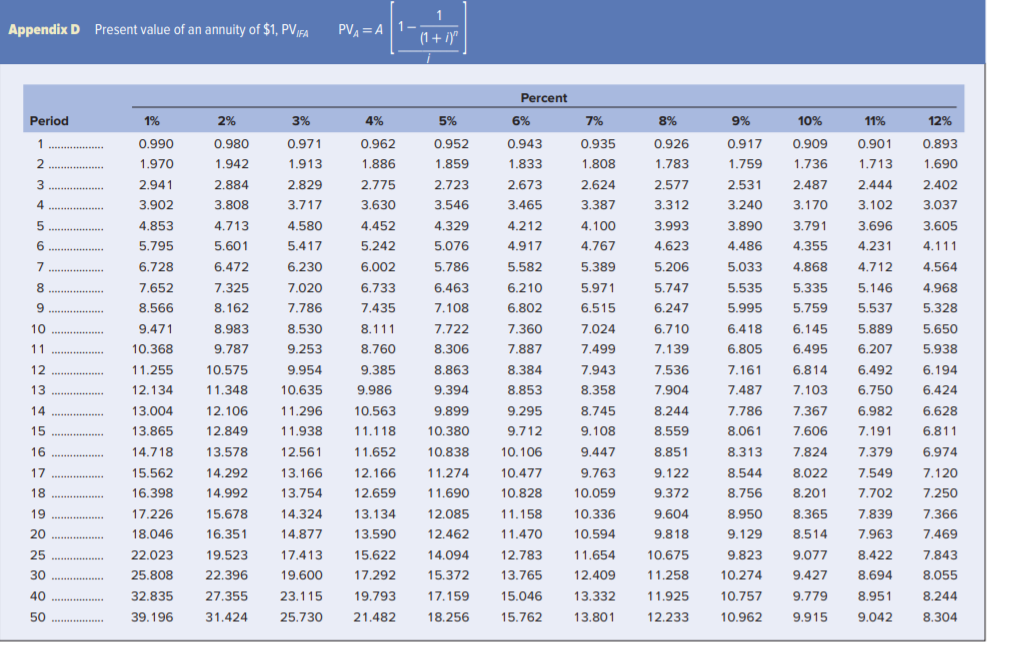

The Sunbelt Corporation has $34 million of bonds outstanding that were issued at a coupon rate of 11.175 percent seven years ago. Interest rates have fallen to 10.50 percent. Mr. Heath, the Vice-President of Finance, does not expect rates to fall any further. The bonds have 18 years left to maturity, and Mr. Heath would like to refund the bonds with a new issue of equal amount also having 18 years to maturity. The Sunbelt Corporation has a tax rate of 36 percent. The underwriting cost on the old issue was 2.1 percent of the total bond value. The underwriting cost on the new issue will be 1.2 percent of the total bond value. The original bond indenture contained a five-year protection against a call, with a 7 percent call premium starting in the sixth year and scheduled to decline by one-half percent each year thereafter (consider the bond to be seven years old for purposes of computing the premium). Use Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods. Assume the discount rate is equal to the aftertax cost of new debt rounded up to the nearest whole percent (e.g. 4.06 percent should be rounded up to 5 percent).

a. Compute the discount rate.

b. Calculate the present value of total outflows.

c. Calculate the present value of total inflows.

d. Calculate the net present value.

Appendix D Present value of an annuity of $1, PVA PV = A 1- Period 0 3.791 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 22.023 25.808 32.835 39.196 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 27.355 31.424 3% 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 4% 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 15.622 17.292 19.793 21.482 Percent 6% 7% .943 0.935 1.833 1.808 2.673 2.624 3.465 3.387 4.212 4.100 4.917 4.767 5.582 5.389 6.210 5.971 6.802 6.515 7.360 7.024 7.887 7.499 8.384 7.943 8.853 8.358 9.295 8.745 9.712 9.108 10.106 9.447 10.477 9.763 10.828 10.059 11.158 10.336 11.470 10.594 12.783 11.654 13.765 12.409 15.046 13.332 15.762 13.801 8.863 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.675 11.258 11.925 12.233 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 9.823 10.274 10.757 10.962 10% 11% 0.909 0.901 1.736 1.713 2.487 2.444 3.170 3.102 3.696 4.355 4.231 4.868 4.712 5.335 5.146 5.759 5.537 6.145 5.889 6.495 6.207 6.814 6.492 7.103 6.750 7.367 6.982 7.606 7.191 7.824 7.379 8.022 7.549 8.201 7.702 8.365 7.839 8.514 7.963 9.077 8.422 9.427 8.694 9.7798.951 9.915 9.042 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 8.244 8.304 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 14.094 15.372 17.159 1 8.256 50 ....... ... Appendix D Present value of an annuity of $1, PVA PV = A 1- Period 0 3.791 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6.463 7.108 7.722 8.306 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13.004 13.865 14.718 15.562 16.398 17.226 18.046 22.023 25.808 32.835 39.196 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14.992 15.678 16.351 19.523 22.396 27.355 31.424 3% 0.971 1.913 2.829 3.717 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11.296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 4% 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7.435 8.111 8.760 9.385 9.986 10.563 11.118 11.652 12.166 12.659 13.134 13.590 15.622 17.292 19.793 21.482 Percent 6% 7% .943 0.935 1.833 1.808 2.673 2.624 3.465 3.387 4.212 4.100 4.917 4.767 5.582 5.389 6.210 5.971 6.802 6.515 7.360 7.024 7.887 7.499 8.384 7.943 8.853 8.358 9.295 8.745 9.712 9.108 10.106 9.447 10.477 9.763 10.828 10.059 11.158 10.336 11.470 10.594 12.783 11.654 13.765 12.409 15.046 13.332 15.762 13.801 8.863 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.675 11.258 11.925 12.233 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 9.823 10.274 10.757 10.962 10% 11% 0.909 0.901 1.736 1.713 2.487 2.444 3.170 3.102 3.696 4.355 4.231 4.868 4.712 5.335 5.146 5.759 5.537 6.145 5.889 6.495 6.207 6.814 6.492 7.103 6.750 7.367 6.982 7.606 7.191 7.824 7.379 8.022 7.549 8.201 7.702 8.365 7.839 8.514 7.963 9.077 8.422 9.427 8.694 9.7798.951 9.915 9.042 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 7.843 8.055 8.244 8.304 9.394 9.899 10.380 10.838 11.274 11.690 12.085 12.462 14.094 15.372 17.159 1 8.256 50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started