Question

The Sunshine Solar Panel Company is planning a $150 million expansion that will generate cash flows for 10 years. As an analyst in the companys

The Sunshine Solar Panel Company is planning a $150 million expansion that will generate cash flows for 10 years. As an analyst in the companys Finance Department, you are being tasked to determine if this expansion is worth doing. To do that, you must go through the following steps.

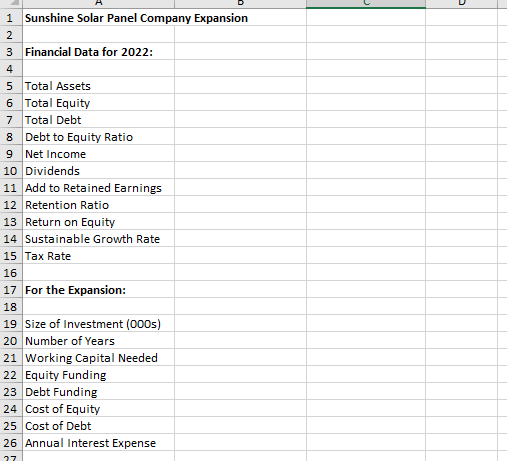

An Excel worksheet, Sunshine Solar Panel Expansion, contains information on the projected cash flows generated by the expansion. You can use that worksheet to complete tasks 1 through 12. You will need to input values in cells on the worksheet and calculate on your own the following items in addition to those noted in Tasks 1 through 12:

Step 1: After calculating the companys 2022 Return on Equity and retention ratio, find its sustainable growth rate.

Step 2: Will the company need external funding for this expansion?

Step 3: Calculate the companys current debt to equity ratio and use that to calculate how much equity and how much debt will be needed to fund the expansion.

Step 4: Using 9.50% as the cost of debt, calculate how much interest on the debt you found in Step 2 will be paid in each of the 10 years.

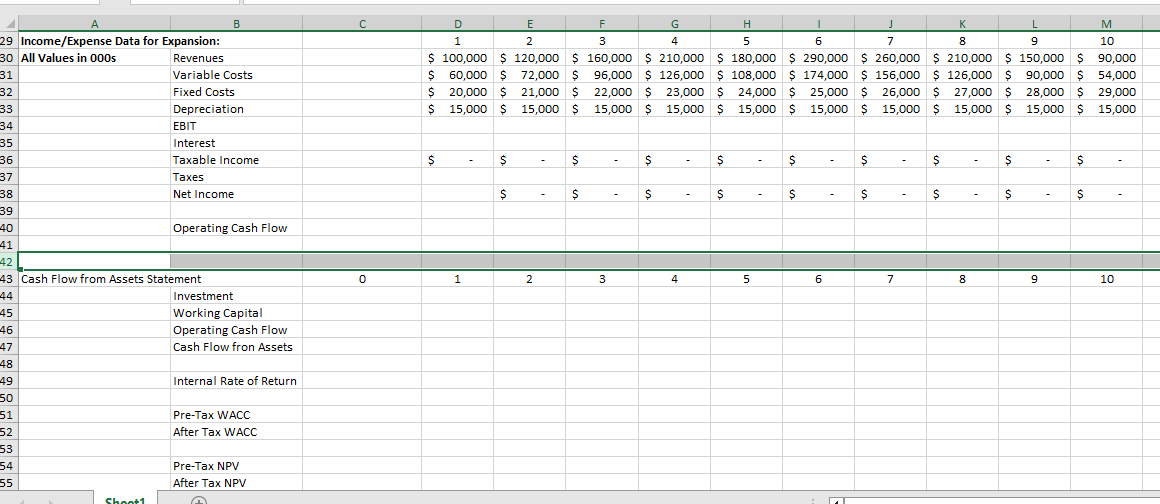

Step 5: Using the projected income statements for years 1 through 10, calculate each years EBIT using the equation for EBIT. Note: These are not complete income statements.

Step 6: Add the interest expense calculated in Step 3 to the Interest line in the income statement. Remember to put this amount as thousands not the actual amount (for instance, if you calculated $2 million in Step 3, put $2,000 in as interest).

Step 7: Find the companys 2022 tax rate and use that to determine taxes in the in the income statement. That tax rate will be in effect for all 10 years.

Step 8: Now that the income statement is complete, determine each years operating cash flow, using the correct equation for operating cash flow.

Step 9: Assuming that the project will need $ 10 million in working capital at the beginning, prepare a cash flow from assets statement for the expansion. (Remember that any net working capital added at the beginning of a project comes back as a cash inflow at the end of a project.). Note: All values in the cash flow from assets statement are in terms of thousands, not their actual amounts, so if you use cell references for the investment and working capital, make sure what you have in cells C19 and C21 are in thousands.

Step 10: Find the expansions internal rate of return using the =IRR function.

Step 11: Using the amount of equity and amount of debt you found in Task 2 and costs of equity of 18% and pre-tax costs of debt of 9.50%, calculate pre-tax and after tax weighted average costs of capital. For the tax rate, use the companys current tax rate you found in Task 6.

Step 12: Use the pre-tax and after tax weighted average costs of capital to find the expansions net present value.

You can use the following information from Sunshine Solar Panel Companys 2022 Balance Sheet and Income Statement for Tasks 1 through 3.

Total Assets: $600 million

Total Equity: $430.5 million

Total Debt: $169.5 million

Taxable Income: $102.55 million

Taxes Paid: $ 25.638 million

Dividends Paid: $ 46.148 million

this is complete informatin and send me in excel with formula

1 Sunshine Solar Panel Company Expansion Financial Data for 2022: Total Assets 6 Total Equity 7 Total Debt 8 Debt to Equity Ratio 9 Net Income 10 Dividends 11 Add to Retained Earnings 12 Retention Ratio 13 Return on Equity 14 Sustainable Growth Rate 15 Tax Rate For the Expansion: Size of Investment (000s) Number of Years Working Capital Needed Equity Funding Debt Funding Cost of Equity Cost of Debt Annual Interest ExpenseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started