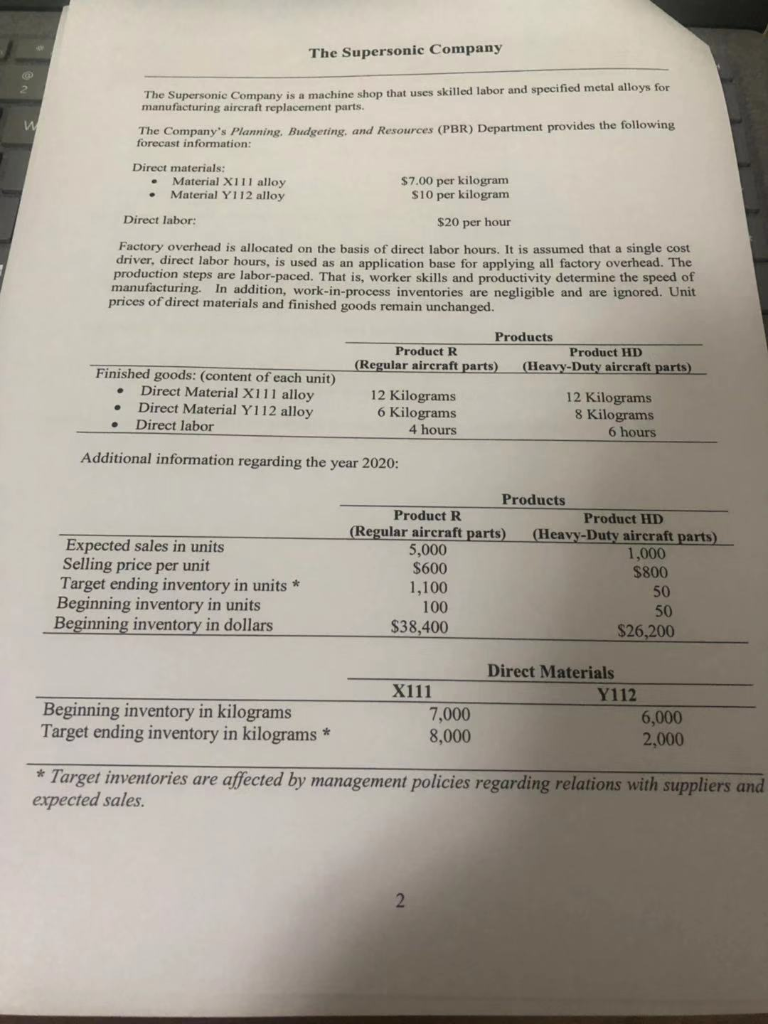

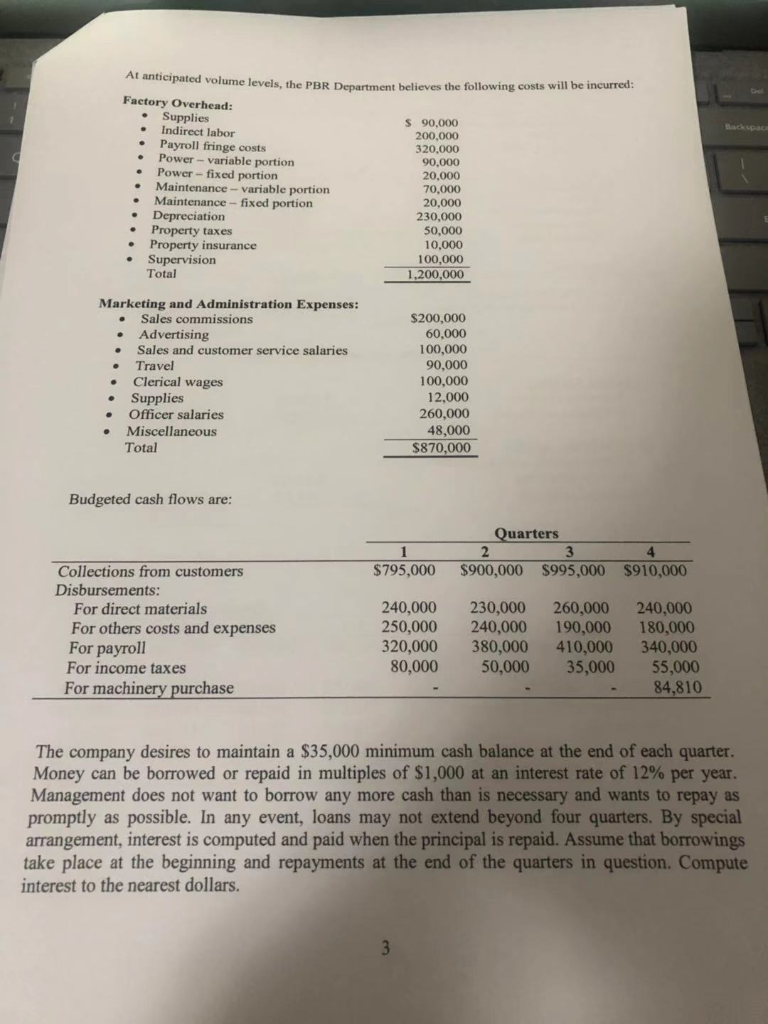

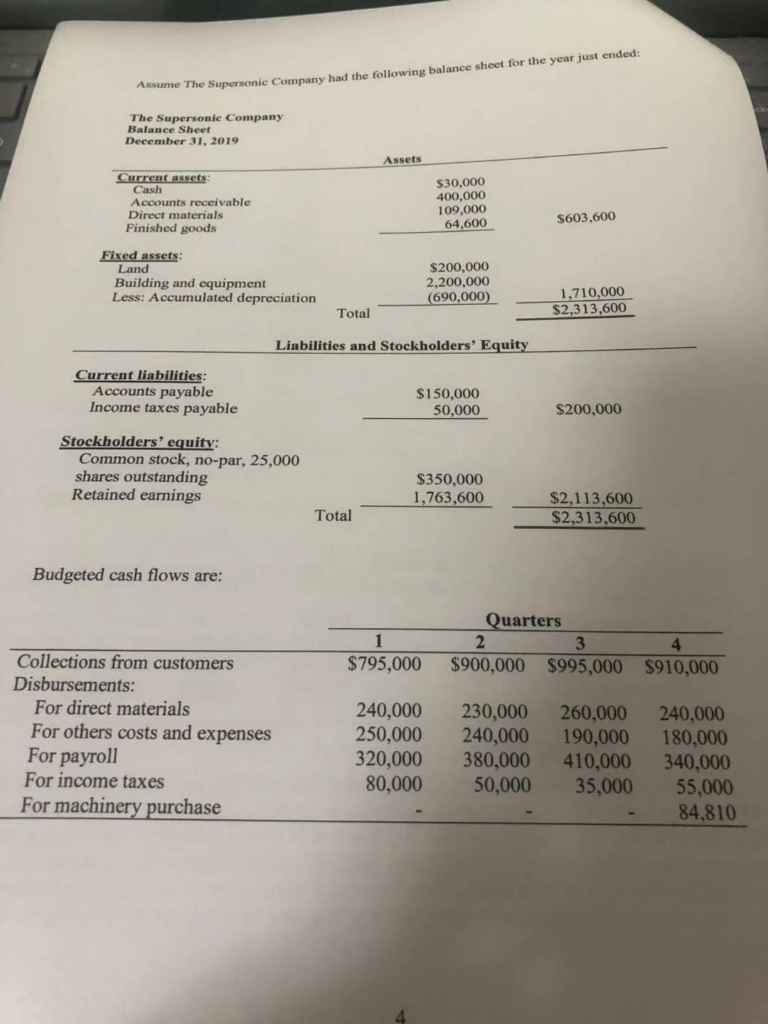

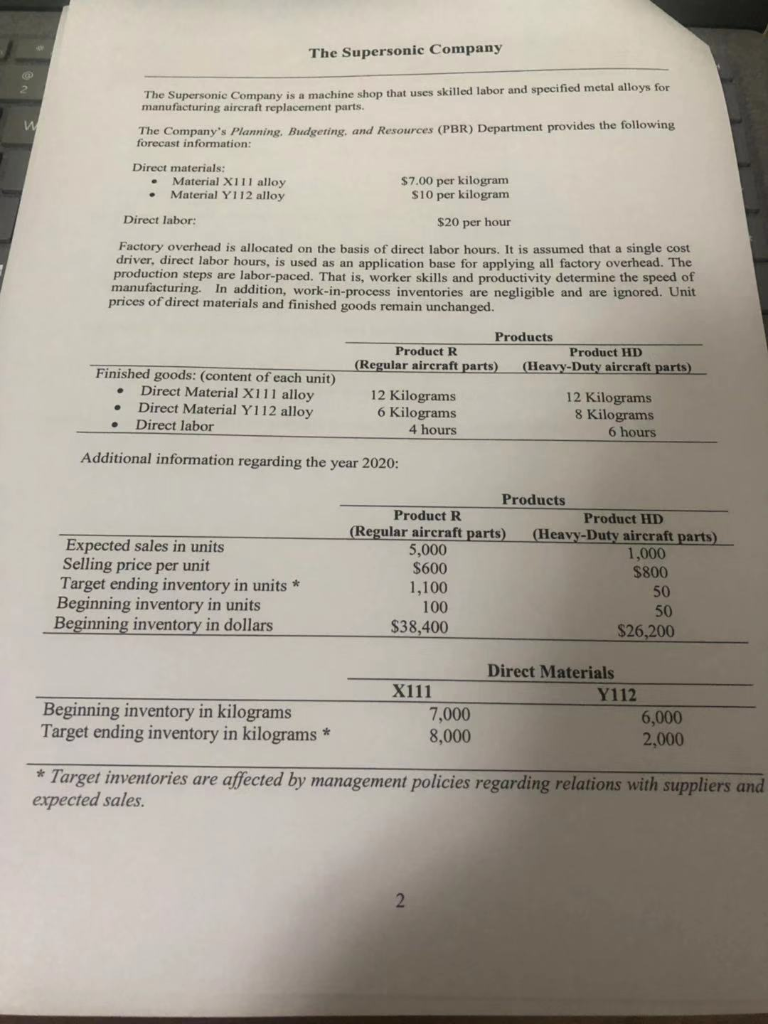

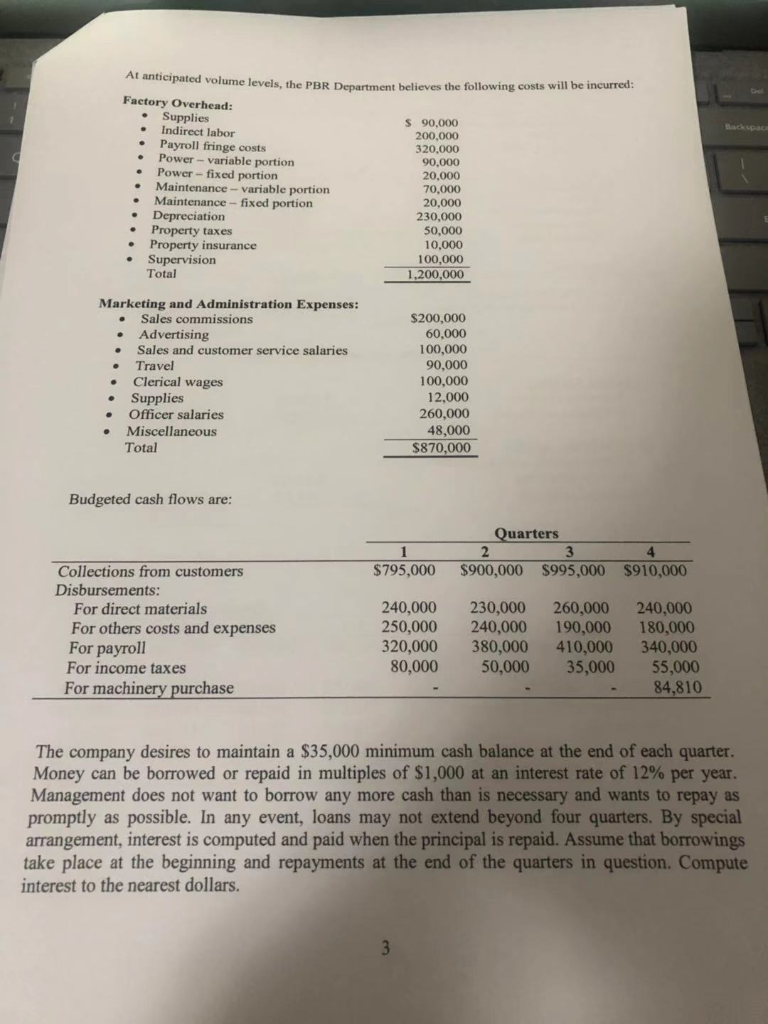

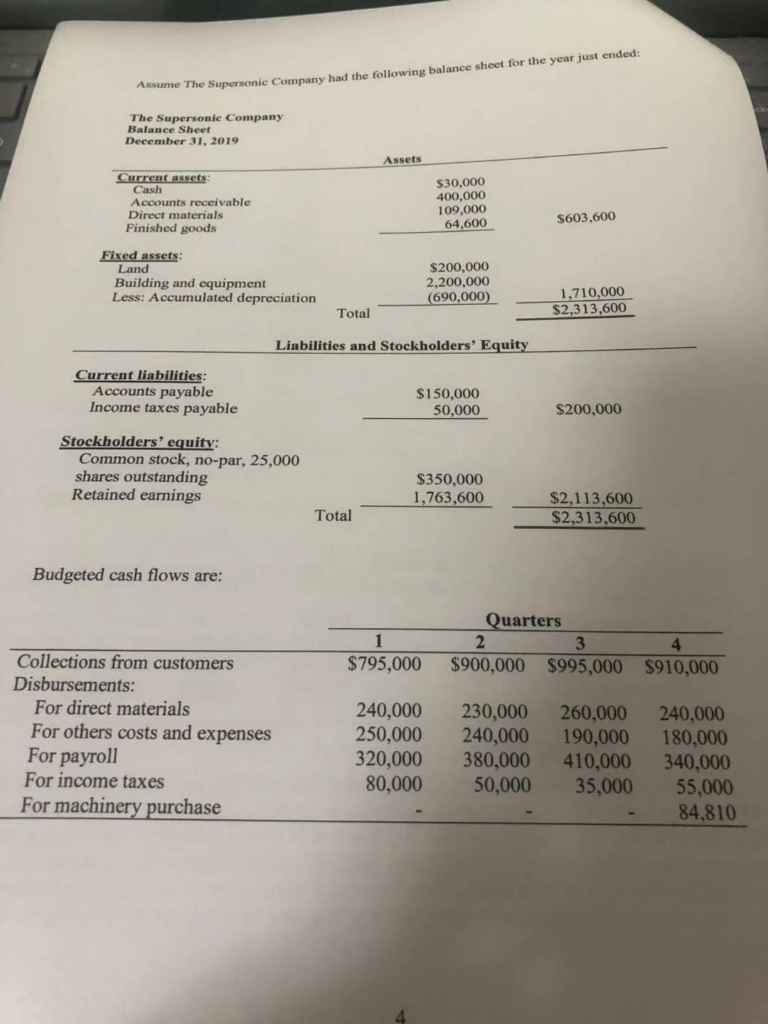

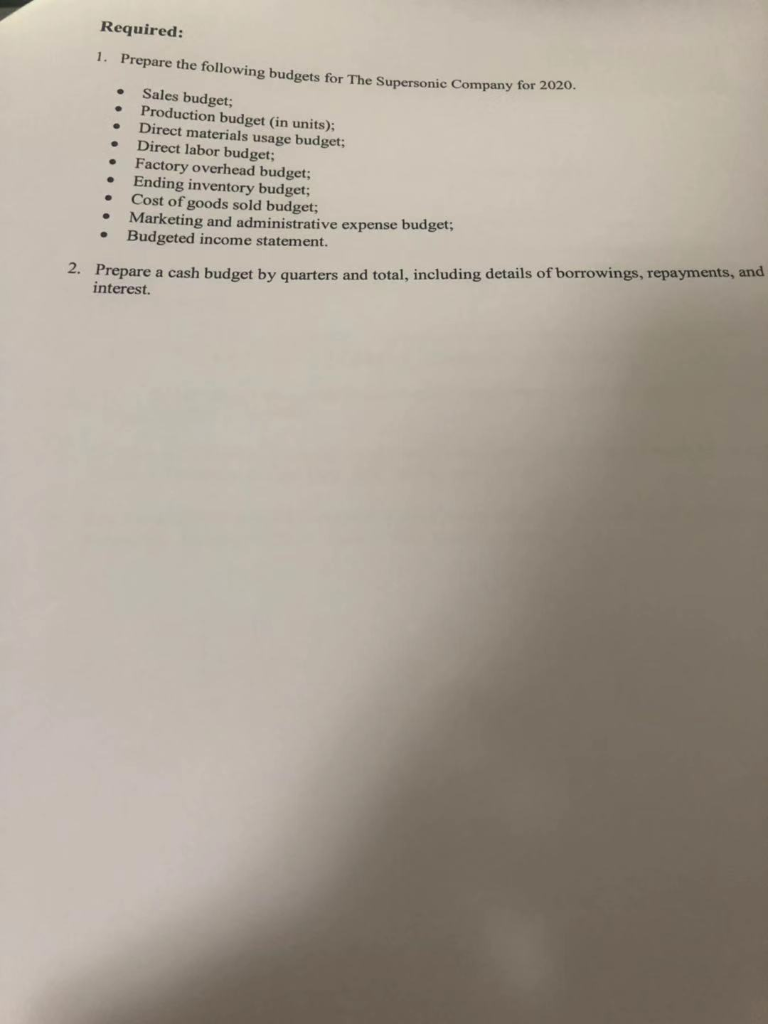

The Supersonic Company The Supersonic Company is a machine shop that uses skilled labor and specified metal alloys for manufacturing aircraft replacement parts. The Company's Planning, Budgeting, and Resources (PBR) Department provides the following forecast information: Direct materials: Material X111 alloy Material Y112 alloy $7.00 per kilogram S10 per kilogram Direct labor: $20 per hour Factory overhead is allocated on the basis of direct labor hours. It is assumed that a single cost driver, direct labor hours, is used as an application base for applying all factory overhead. The production steps are labor-paced. That is, worker skills and productivity determine the speed of manufacturing. In addition, work-in-process inventories are negligible and are ignored. Unit prices of direct materials and finished goods remain unchanged. Products Product R Product HD (Regular aireraft parts) (Heavy-Duty aircraft parts) Finished goods: (content of each unit) Direct Material X111 alloy Direct Material Y112 alloy Direct labor 12 Kilograms 6 Kilograms 4 hours 12 Kilograms 8 Kilograms 6 hours Additional information regarding the year 2020: Products Product R Product HD (Regular aircraft parts) (Heavy-Duty aircraft parts) 5,000 1,000 $600 1,100 100 $38,400 $26,200 Expected sales in units Selling price per unit Target ending inventory in units * Beginning inventory in units Beginning inventory in dollars $800 50 Direct Materials Y112 6,000 2,000 X111 7,000 8,000 Beginning inventory in kilograms Target ending inventory in kilograms * * Target inventories are affected by management policies regarding relations with suppliers and expected sales. amputed volume levels. the PRR D e t believes the following costs will be incurred: Factory Overhead: Supplies Indirect labor Payroll fringe costs Power - variable portion Power-fixed portion Maintenance - variable portion Maintenance-fixed portion Depreciation Property taxes Property insurance Supervision Total $ 90,000 200,000 320,000 90,000 20,000 70,000 20,000 230,000 50,000 10,000 100,000 1,200,000 Marketing and Administration Expenses: Sales commissions Advertising Sales and customer service salaries Travel Clerical wages Supplies Officer salaries Miscellaneous Total $200,000 60,000 100,000 90,000 100,000 12,000 260,000 48,000 $870,000 Budgeted cash flows are: Quarters 3 $900,000 $995,000 $795,000 $910,000 Collections from customers Disbursements: For direct materials For others costs and expenses For payroll For income taxes For machinery purchase 240,000 250,000 320,000 80,000 230,000 240,000 380,000 50,000 260,000 190,000 410,000 35,000 240,000 180,000 340,000 55,000 84,810 The company desires to maintain a $35,000 minimum cash balance at the end of each quarter. Money can be borrowed or repaid in multiples of $1,000 at an interest rate of 12% per year, Management does not want to borrow any more cash than is necessary and wants to repay as promptly as possible. In any event, loans may not extend beyond four quarters. By special arrangement, interest is computed and paid when the principal is repaid. Assume that borrowings take place at the beginning and repayments at the end of the quarters in question. Compute interest to the nearest dollars. me The Supersonic Company had the following balance sheet for the year just ended: The Supersonic Company Balance Sheet December 31, 2019 Assets Current assets Cash Accounts receivable Direct materials Finished goods $30,000 400,000 109,000 64,600 $603,600 Fixed assets: Land Building and equipment Less: Accumulated depreciation $200,000 2,200,000 (690,000) 1,710,000 $2.313.600 Total Liabilities and Stockholders' Equity Current liabilities: Accounts payable Income taxes payable $150,000 50,000 $200,000 Stockholders' equity: Common stock, no-par, 25,000 shares outstanding Retained earnings $350,000 1,763,600 Total $2,113,600 $2,313,600 Budgeted cash flows are: Quarters 2 $795,000 $900,000 $995,000 $910,000 Collections from customers Disbursements: For direct materials For others costs and expenses For payroll For income taxes For machinery purchase 240,000 250,000 320,000 80,000 230,000 240,000 380,000 50,000 260,000 190,000 410,000 35,000 240,000 180,000 340,000 55,000 84,810 Required: 1. Prepare the following budgets for The Supersonic Company for The Supersonic Company for 2020. Sales budget; Production budget (in units); Direct materials usage budget; Direct labor budget; Factory overhead budget; Ending inventory budget; Cost of goods sold budget; Marketing and administrative expense budget; Budgeted income statement 2. Prepare a cash budget by quarters and total, including details of borrowings, repayments, and interest