Answered step by step

Verified Expert Solution

Question

1 Approved Answer

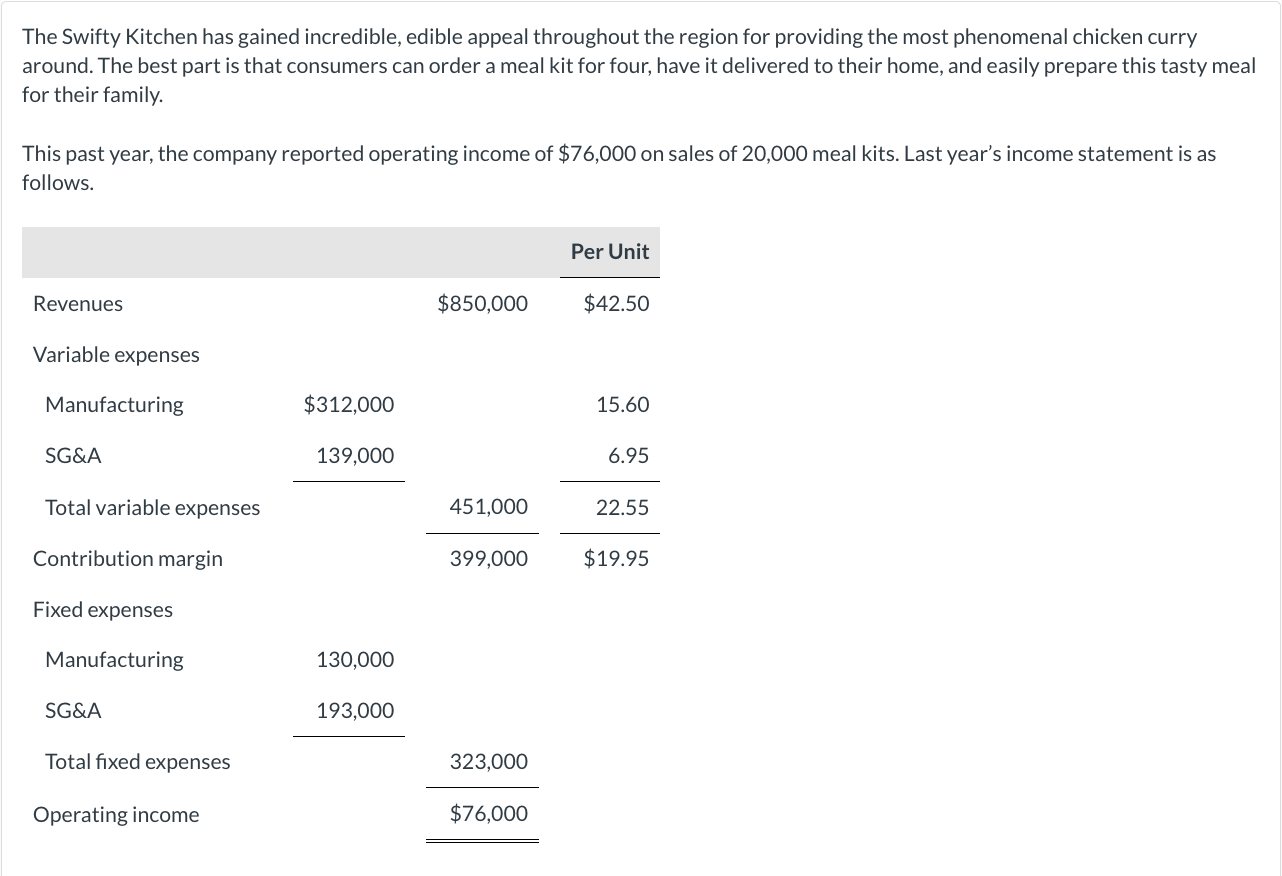

The Swifty Kitchen has gained incredible, edible appeal throughout the region for providing the most phenomenal chicken curry around. The best part is that

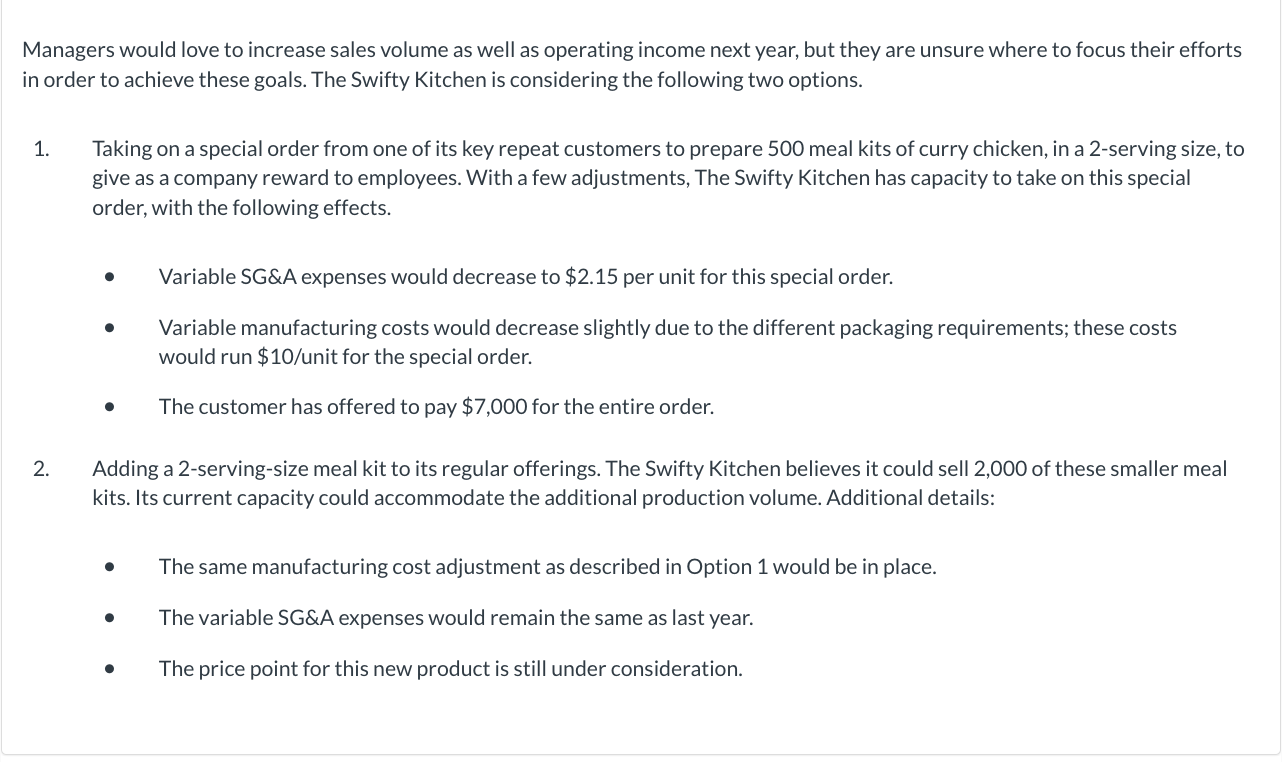

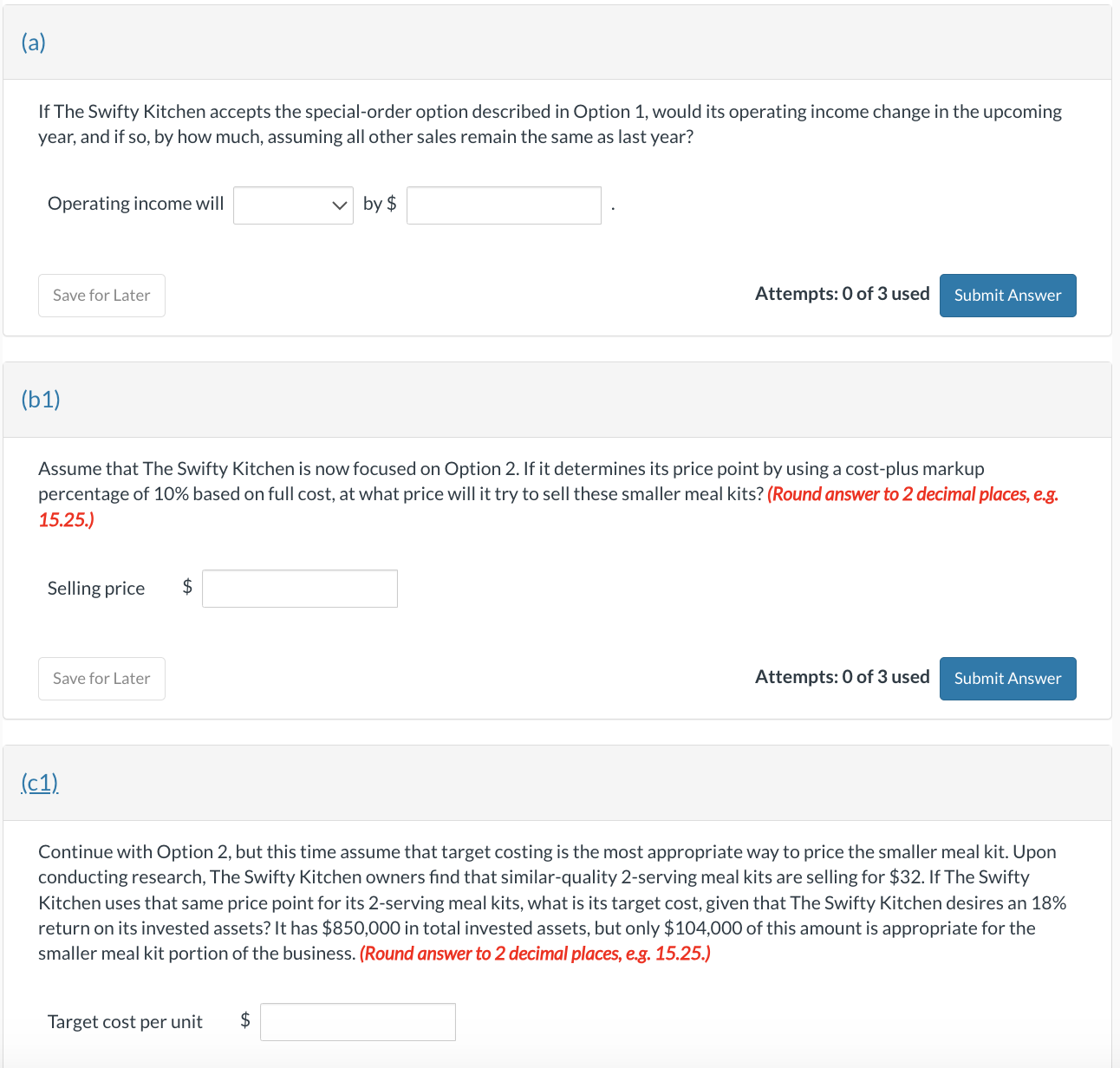

The Swifty Kitchen has gained incredible, edible appeal throughout the region for providing the most phenomenal chicken curry around. The best part is that consumers can order a meal kit for four, have it delivered to their home, and easily prepare this tasty meal for their family. This past year, the company reported operating income of $76,000 on sales of 20,000 meal kits. Last year's income statement is as follows. Revenues Variable expenses Manufacturing SG&A Total variable expenses Contribution margin Fixed expenses Manufacturing SG&A Total fixed expenses Operating income $312,000 139,000 130,000 193,000 $850,000 451,000 399,000 323,000 $76,000 Per Unit $42.50 15.60 6.95 22.55 $19.95 Managers would love to increase sales volume as well as operating income next year, but they are unsure where to focus their efforts in order to achieve these goals. The Swifty Kitchen is considering the following two options. 1. 2. Taking on a special order from one of its key repeat customers to prepare 500 meal kits of curry chicken, in a 2-serving size, to give as a company reward to employees. With a few adjustments, The Swifty Kitchen has capacity to take on this special order, with the following effects. Adding a 2-serving-size meal kit to its regular offerings. The Swifty Kitchen believes it could sell 2,000 of these smaller meal kits. Its current capacity could accommodate the additional production volume. Additional details: Variable SG&A expenses would decrease to $2.15 per unit for this special order. Variable manufacturing costs would decrease slightly due to the different packaging requirements; these costs would run $10/unit for the special order. The customer has offered to pay $7,000 for the entire order. The same manufacturing cost adjustment as described in Option 1 would be in place. The variable SG&A expenses would remain the same as last year. The price point for this new product is still under consideration. If The Swifty Kitchen accepts the special-order option described in Option 1, would its operating income change in the upcoming year, and if so, by how much, assuming all other sales remain the same as last year? Operating income will Save for Later (b1) Selling price Assume that The Swifty Kitchen is now focused on Option 2. If it determines its price point by using a cost-plus markup percentage of 10% based on full cost, at what price will it try to sell these smaller meal kits? (Round answer to 2 decimal places, e.g. 15.25.) Save for Later (c1) $ by $ Attempts: 0 of 3 used Submit Answer Target cost per unit $ Attempts: 0 of 3 used Submit Answer Continue with Option 2, but this time assume that target costing is the most appropriate way to price the smaller meal kit. Upon conducting research, The Swifty Kitchen owners find that similar-quality 2-serving meal kits are selling for $32. If The Swifty Kitchen uses that same price point for its 2-serving meal kits, what is its target cost, given that The Swifty Kitchen desires an 18% return on its invested assets? It has $850,000 in total invested assets, but only $104,000 of this amount is appropriate for the smaller meal kit portion of the business. (Round answer to 2 decimal places, e.g. 15.25.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Option 1 Special Order Variable SGA Expenses Decrease 215 per unit Variable Manufacturing Costs Decr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started