Question

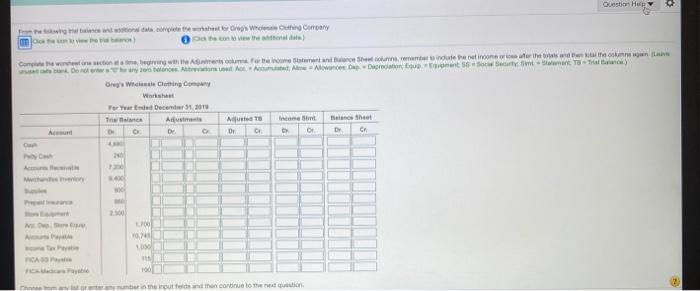

the Swing hal balance and ational data complete the worksheet for Greg's Who ck the con to view the Cluthing Company old) Question Help Compile

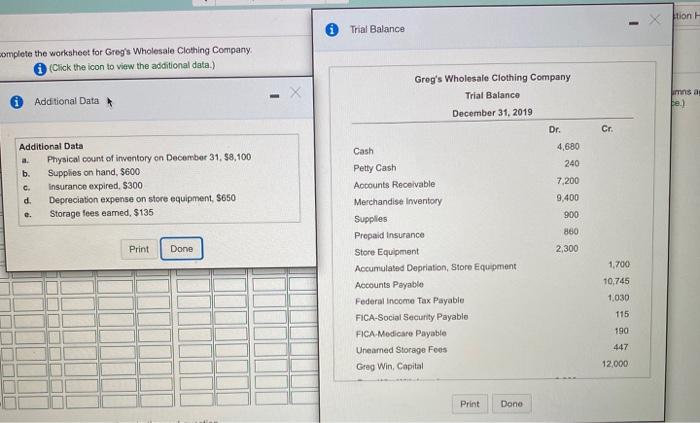

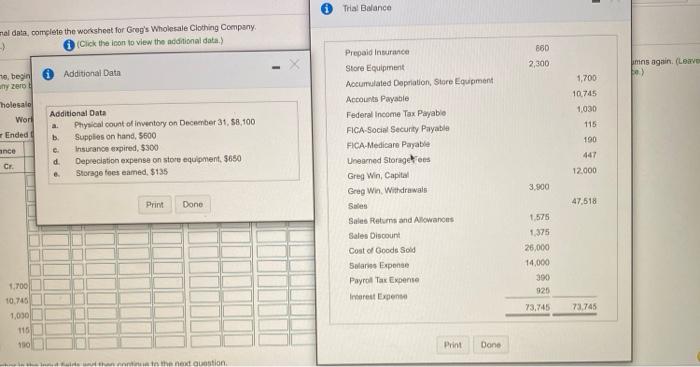

the Swing hal balance and ational data complete the worksheet for Greg's Who ck the con to view the Cluthing Company old) Question Help Compile the winchew one action at a time, begiving with the Adjustments colum. For the income Statement and Balance Sheet columns, remember to include the net income or ices after the totals and then total the column again blank. Do not enter a hrany ze balances Abbreviations use Act Accumulated Alo Alowances Dep Depreciation Equp Equipment 55 Social Security Smt Statement TB Trial Balance) Greg's Wholesale Clothing Company Worksheet For Year Ended December 31, 2019 Tric Account Ca Putty Cash 4380 240 Accours va Marchand mentory 400 A Dep 2.300 1.700 10,24 Adjustments Dr. 8 Adjusted T Dr Income Stmt Belance Sheet Dr. 8 Or Dr. Cr FICASS Tax Payable FICA Medicare Payable 1,000 100 anter any number in the input felds and than continue to the next question Xtion H complete the worksheet for Greg's Wholesale Clothing Company. (Click the icon to view the additional data.) Additional Data Trial Balance Greg's Wholesale Clothing Company Trial Balance December 31, 2019. mns as be) Dr. Cr. Additional Data a. Physical count of inventory on December 31, $8,100 Cash 4,680 b. Supplies on hand, $600 Petty Cash 240 c. Insurance expired, $300 Accounts Receivable 7,200 d. e. Storage fees eamed, $135 Depreciation expense on store equipment, $650 Supplies Merchandise Inventory 9,400 900 Prepaid Insurance 860 Print Done Store Equipment 2,300 Accumulated Depriation, Store Equipment: 1,700 Accounts Payable 10,745 Federal Income Tax Payable 1,030 FICA-Social Security Payable 115 FICA-Medicare Payable Uneamed Storage Fees 190 447 Greg Win, Capital 12,000 Print Done mal data, complete the worksheet for Greg's Wholesale Clothing Company. (Click the icon to view the additional data.) + e, begin why zero Additional Data Trial Balance holesale Additional Data Physical count of inventory on December 31, $8,100. Work a. r Ended t b. Supplies on hand, $600 ance a Insurance expired, $300 d. Cr. Depreciation expense on store equipment, $650 Storage fees eamed, $135 1,700 10,745 1,030 115 190 Print Done wide and than continue to the next question. Prepaid Insurance Store Equipment Accumulated Depriation, Store Equipment Accounts Payable Federal Income Tax Payable FICA-Social Security Payable 860 2,300 mns again. (Leave 1,700 10,745 1,030 115 FICA-Medicare Payable 190 Unearned Storage Fees 447 Greg Win, Capital 12.000. Greg Win, Withdrawals 3,900 Sales 47,518 Sales Returns and Allowances 1,575) Sales Discount 1,375 Cost of Goods Sold 26,000 Salaries Expense 14,000 Payroll Tax Expense 390 925 Interest Expense 73,745 73,745 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started