Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The T accounts in the ledger have been set up for you. Record transactions in the T accounts. Place the letter of the transaction

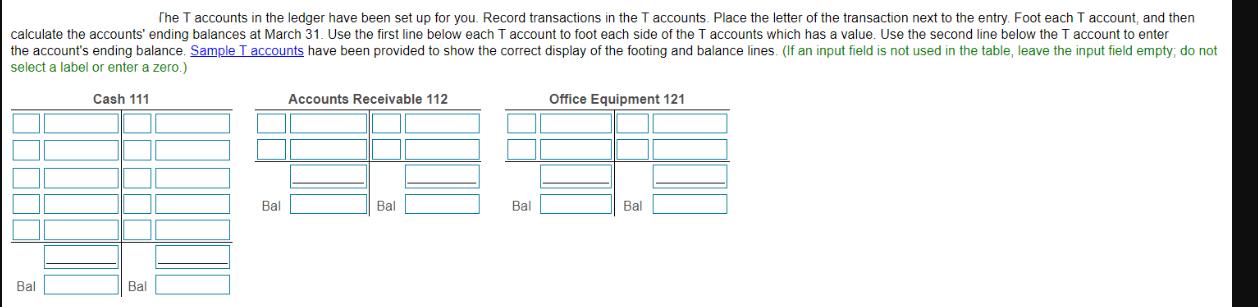

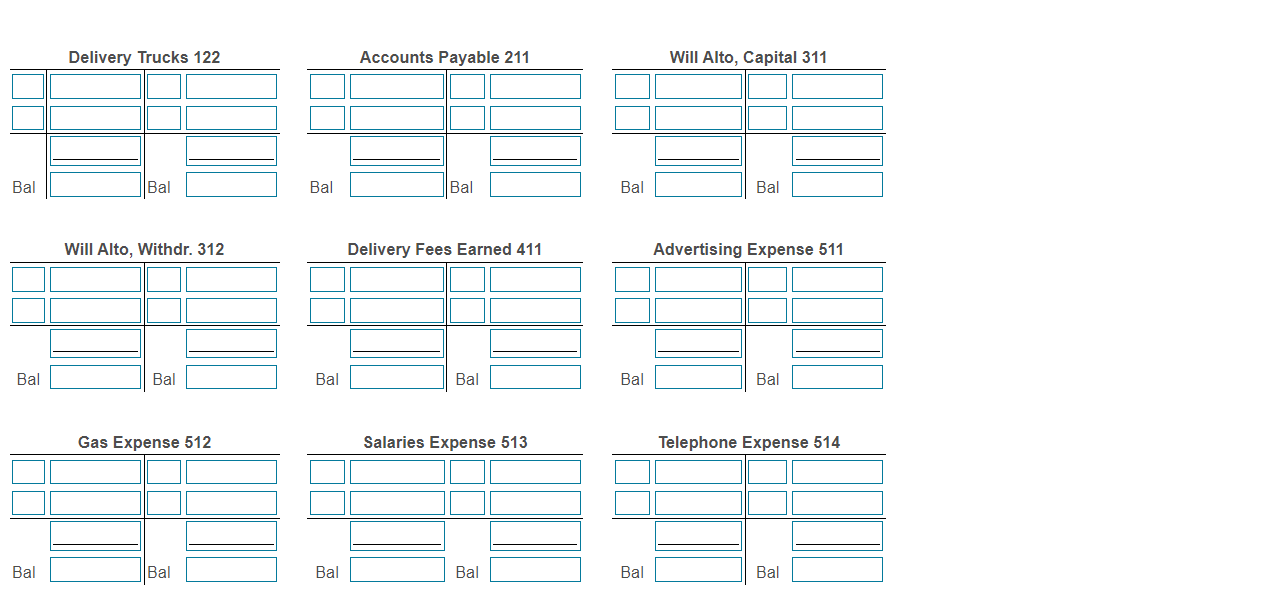

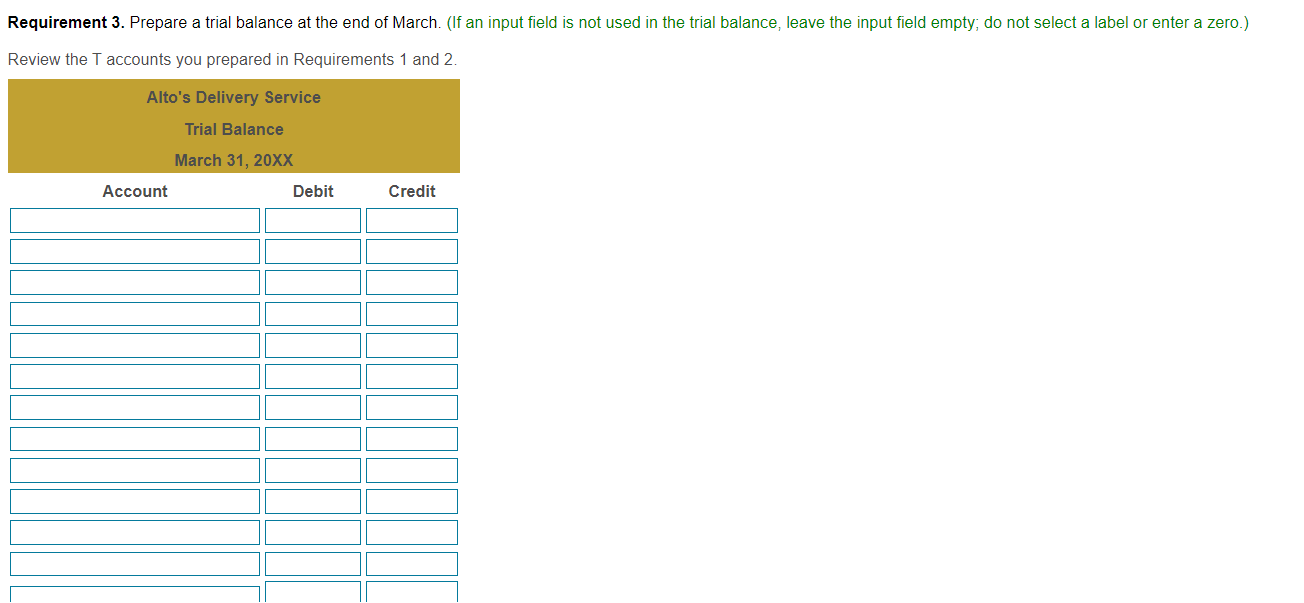

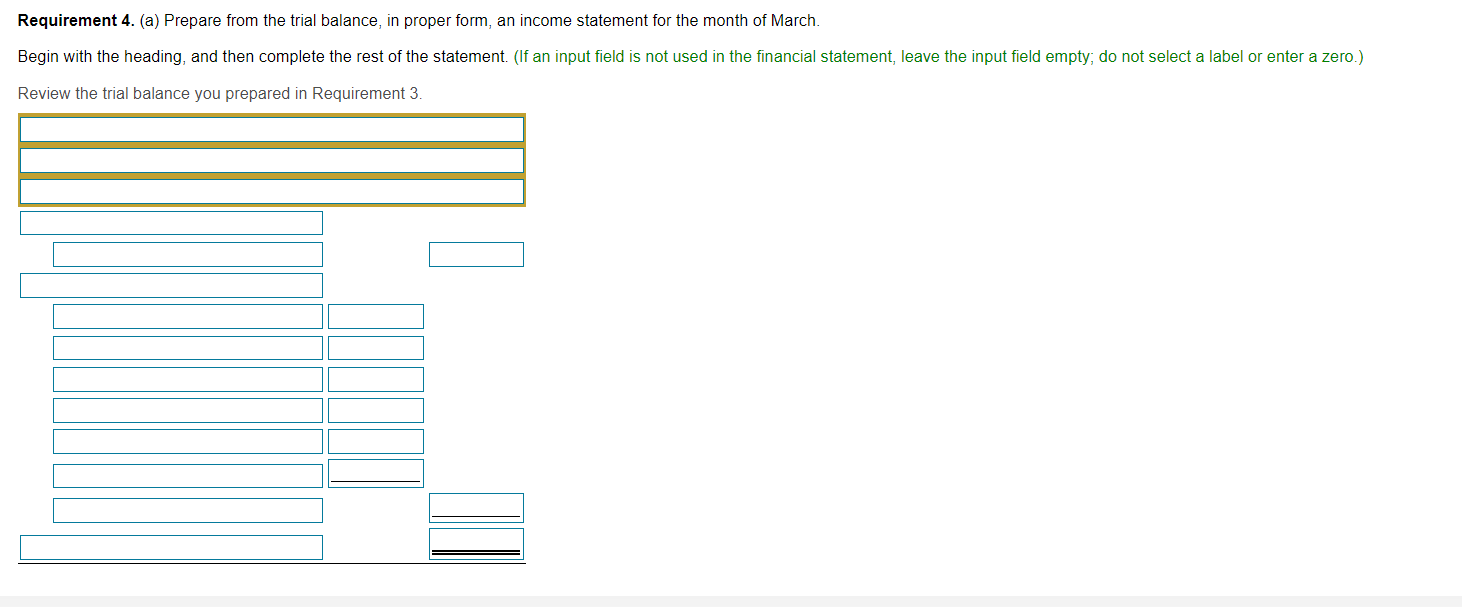

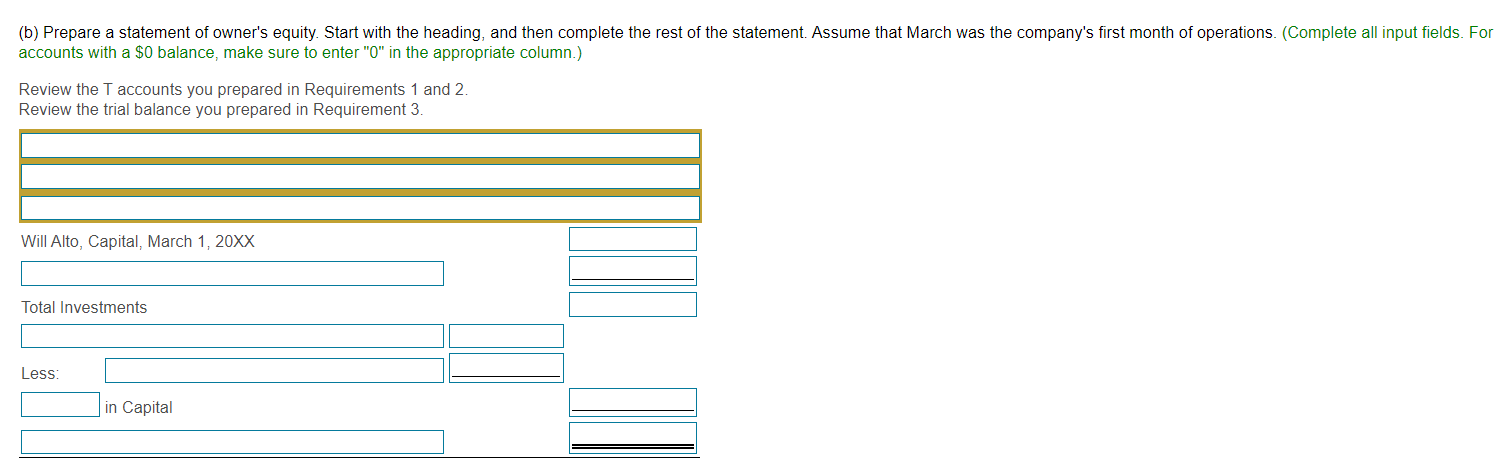

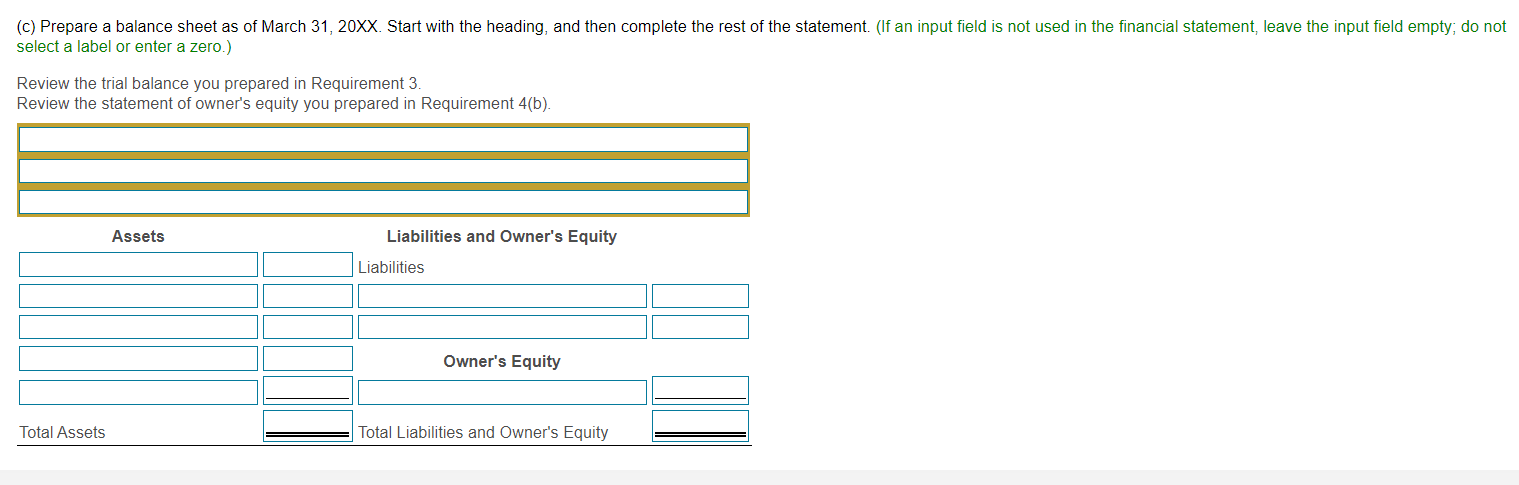

The T accounts in the ledger have been set up for you. Record transactions in the T accounts. Place the letter of the transaction next to the entry. Foot each T account, and then calculate the accounts' ending balances at March 31. Use the first line below each T account to foot each side of the T accounts which has a value. Use the second line below the T account to enter the account's ending balance. Sample T accounts have been provided to show the correct display of the footing and balance lines. (If an input field is not used in the table, leave the input field empty; do not select a label or enter a zero.) Cash 111 Bal Bal Accounts Receivable 112 Office Equipment 121 Bal Bal Bal Bal Bal Bal Delivery Trucks 122 Accounts Payable 211 Will Alto, Capital 311 Bal Will Alto, Withdr. 312 Bal Gas Expense 512 Bal Bal Bal Delivery Fees Earned 411 Bal Salaries Expense 513 Bal Bal Bal Advertising Expense 511 Bal Telephone Expense 514 Bal Bal Bal Bal Bal Bal Requirement 3. Prepare a trial balance at the end of March. (If an input field is not used in the trial balance, leave the input field empty; do not select a label or enter a zero.) Review the T accounts you prepared in Requirements 1 and 2. Alto's Delivery Service Trial Balance March 31, 20XX Account Debit Credit Requirement 4. (a) Prepare from the trial balance, in proper form, an income statement for the month of March. Begin with the heading, and then complete the rest of the statement. (If an input field is not used in the financial statement, leave the input field empty; do not select a label or enter a zero.) Review the trial balance you prepared in Requirement 3. (b) Prepare a statement of owner's equity. Start with the heading, and then complete the rest of the statement. Assume that March was the company's first month of operations. (Complete all input fields. For accounts with a $0 balance, make sure to enter "0" in the appropriate column.) Review the T accounts you prepared in Requirements 1 and 2. Review the trial balance you prepared in Requirement 3. Will Alto, Capital, March 1, 20XX Total Investments Less: in Capital (c) Prepare a balance sheet as of March 31, 20XX. Start with the heading, and then complete the rest of the statement. (If an input field is not used in the financial statement, leave the input field empty; do not select a label or enter a zero.) Review the trial balance you prepared in Requirement 3. Review the statement of owner's equity you prepared in Requirement 4(b). Assets Liabilities and Owner's Equity Liabilities Owner's Equity Total Assets Total Liabilities and Owner's Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started