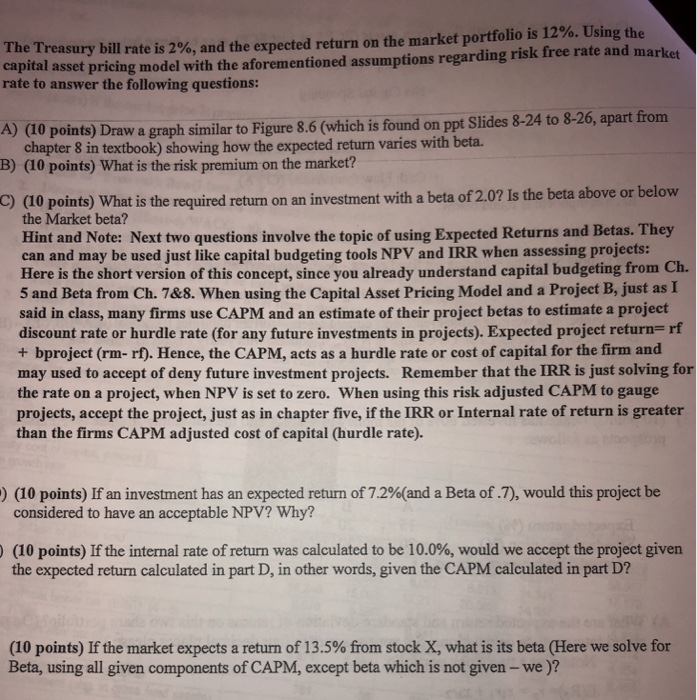

The T reasury bill rate is 2%, and the expected return on the market portfolio is 12%. Using the asset pricing model with the aforementioned assumptions regarding risk free rate and market rate to answer the following questions: (40 points) Draw a graph similar to Figure 8.6 (which is found on ppt Slides 8-24 to 8-26, apart from chapter 8 in textbook) showing how the expected return varies with beta. B) (10 points) What is the risk premium on the market? C) (10 points) What is the required return on an investment with a beta of 2.0? Is the beta above or below the Market beta? Hint and Note: Next two questions involve the topic of using Expected Returns and Betas. They can and may be used just like capital budgeting tools NPV and IRR when assessing projeets: Here is the short version of this concept, since you already understand capital budgeting from C 5 and Beta from Ch. 7&8. When using the Capital Asset Pricing Model and a Project B, just as I said in class, many firms use CAPM and an estimate of their project betas to estimate a project discount rate or hurdle rate (for any future investments in projects). Expected project return,f + bproject (rm- rf). Hence, the CAPM, acts as a hurdle rate or cost of capital for the firm and may used to accept of deny future investment projects. Remember that the IRR is just solving for the rate on a project, when NPV is set to zero. When using this risk adjusted CAPM to gauge projects, accept the project, just as in chapter five, if the IRR or Internal rate of return is greater than the firms CAPM adjusted cost of capital (hurdle rate). ) (10 points) If an investment has an expected return of 7.2%(and a Beta of .7), would this project be considered to have an acceptable NPV? Why? (10 points) If the internal rate of return was calculated to be 10.0%, would we accept the project given the expected return calculated in part D, in other words, given the CAPM calculated in part D? ) (10 points) If the market expects a return of 13.5% from stock X, what is its beta (Here we solve for Beta, using all given components of CAPM, except beta which is not given -we )