Question

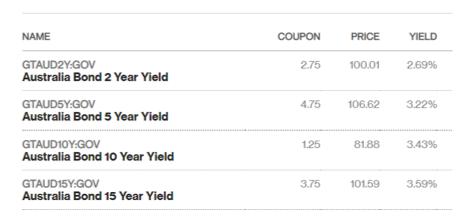

The table above indicated the Australian government bond yield is ranged from 2.69% to 3.59%, one of your friends who is really obsessed with Cryptocurrency

The table above indicated the Australian government bond yield is ranged from 2.69% to 3.59%, one of your friends who is really obsessed with Cryptocurrency made a comment that "why would someone in the right mind would invest in the government bond when you can just invest in bitcoin or tesla where the rate of return is much higher" To support his argument, he also showed you the chart below on the rate of yield of both investments where those investments generate much higher rate.The Low Rate Credit Card is a no annual fee card with an interest rate of 6.99% per annum calculated daily on purchases and cash advances, but with up to 108 days interest free on purchases if you pay the full balance off each month.

REQUIRED: Calculate how much interest charge you are avoiding if you buy $3,000 of purchases at the start of the cycle and pay the full amount when due 108 days later (show all workings).

Suppose Salford City FC convinces a former player named Paul Scholes to come out of retirement and play for three seasons. The team offers the player $2.5 million in year 1, $3 million in year 2, and $4 million in year 3. To sweeten the deal Salford City FC also offers a signing bonus of $500,000 payable at the beginning year.

REQUIRED: Assuming end-of-year salary payments, how do you find the value of the player's contract today if the player has a discount rate of 7%?

The table above indicated the Australian government bond yield is ranged from 2.69% to 3.59%, one of your friends who is really obsessed with Cryptocurrency made a comment that "why would someone in the right mind would invest in the government bond when you can just invest in bitcoin or tesla where the rate of return is much higher" To support his argument, he also showed you the chart below on the rate of yield of both investments where those investments generate much higher rate.

The table above indicated the Australian government bond yield is ranged from 2.69% to 3.59%, one of your friends who is really obsessed with Cryptocurrency made a comment that "why would someone in the right mind would invest in the government bond when you can just invest in bitcoin or tesla where the rate of return is much higher" To support his argument, he also showed you the chart below on the rate of yield of both investments where those investments generate much higher rate.

REQUIRED:

Explain this situation to your friend why someone would opt to invest in a government bond instead of cryptocurrency or stock? add reference.

The yield on 5-year Australian Government bonds as at 3 April 2019 is 3.46%. Mochaccinos Ltd's share price at 7 December 2020 is $100.32 per share while it has a beta coefficient of 1.77. Trailing twelve months (TTM) return on the ASX S&P 200 is 15.74%.

REQUIRED: Estimate the cost of equity using the Capital Asset Pricing Model (show all workings). What does the cost of equity tell you?

Robby Parks is looking to raise capital by issuing a bond to his followers on social media on 1st April 2023. The total amount money is going to be raised is $1,000,000 with a 2.52% coupon rate compounding monthly and a maturity of 15 years. To make it assessable to potential investors, each investor could purchase a small portion bond of $2,000, meaning in total there would be 500 bonds available to be purchased.

REQUIRED: If the required return of a similar bond is 3.54%, what is each bond's price of Robby Parks?

NAME GTAUD2Y.GOV Australia Bond 2 Year Yield GTAUD5Y:GOV Australia Bond 5 Year Yield GTAUD10Y.GOV Australia Bond 10 Year Yield GTAUD15Y.GOV Australia Bond 15 Year Yield COUPON 2.75 4.75 1.25 3.75 PRICE 100.01 81.88 YIELD 106.62 3.22% 101.59 2.69% 3.43% 3.59%

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the responses to the questions 1 There are several reasons why someone might opt to invest in a government bond instead of cryptocurrency or stocks Government bonds are generally considered a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started