Question

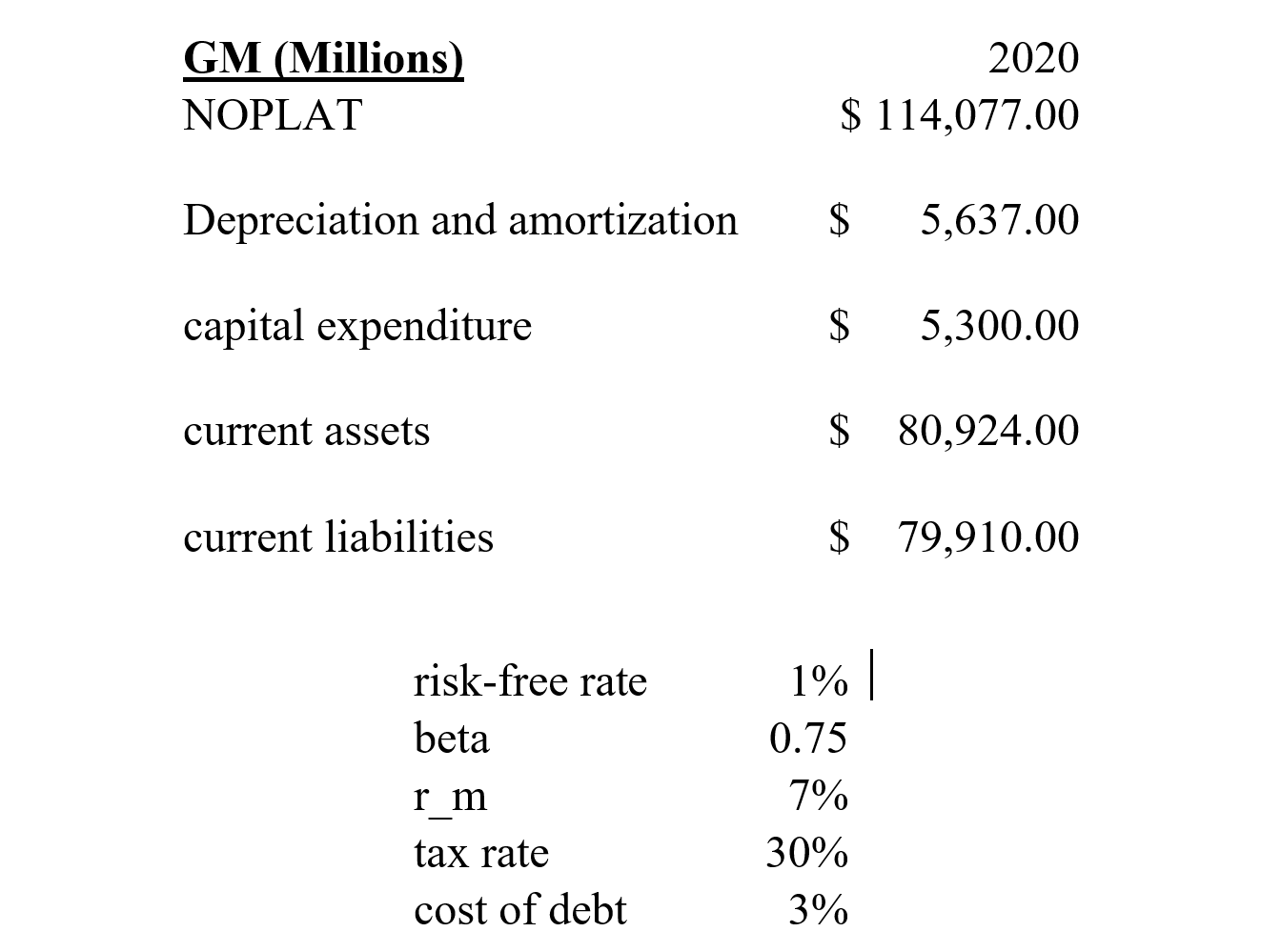

The table above summarizes financial information of General Motors for fiscal year 2020. Its total assets is $235,194 million, and its total liabilities is $185,517

The table above summarizes financial information of General Motors for fiscal year 2020. Its total assets is $235,194 million, and its total liabilities is $185,517 million. Suppose General Motors decides to start another electronic car production line. To implement this decision, GM will increase capital expenditure by 10% each year for the next three years. To finance the increase in capital expenditure, GM will draw its credit lines which increases its current liabilities by 12% each year for the next three years. This new production lines will also require GM to expand its current assets by 15% each year for the next three years. Moreover, GM expects the depreciation and amortization increase by 5% for the next three years. The new production line will increase the net operating profit after tax by 2% for the first three years, and free cash flow after the 3rd grows at 1% permanently thereafter. GM has 1,433 million shares outstanding. What is the fundamental value of GMs common stock?

The table above summarizes financial information of General Motors for fiscal year 2020. Its total assets is $235,194 million, and its total liabilities is $185,517 million. Suppose General Motors decides to start another electronic car production line. To implement this decision, GM will increase capital expenditure by 10% each year for the next three years. To finance the increase in capital expenditure, GM will draw its credit lines which increases its current liabilities by 12% each year for the next three years. This new production lines will also require GM to expand its current assets by 15% each year for the next three years. Moreover, GM expects the depreciation and amortization increase by 5% for the next three years. The new production line will increase the net operating profit after tax by 2% for the first three years, and free cash flow after the 3rd grows at 1% permanently thereafter. GM has 1,433 million shares outstanding. What is the fundamental value of GMs common stock?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started