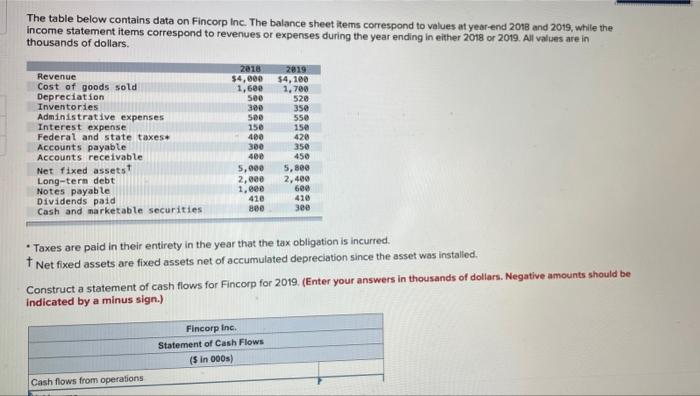

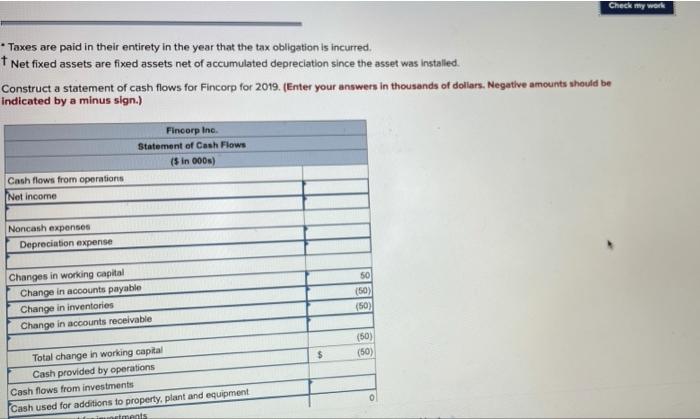

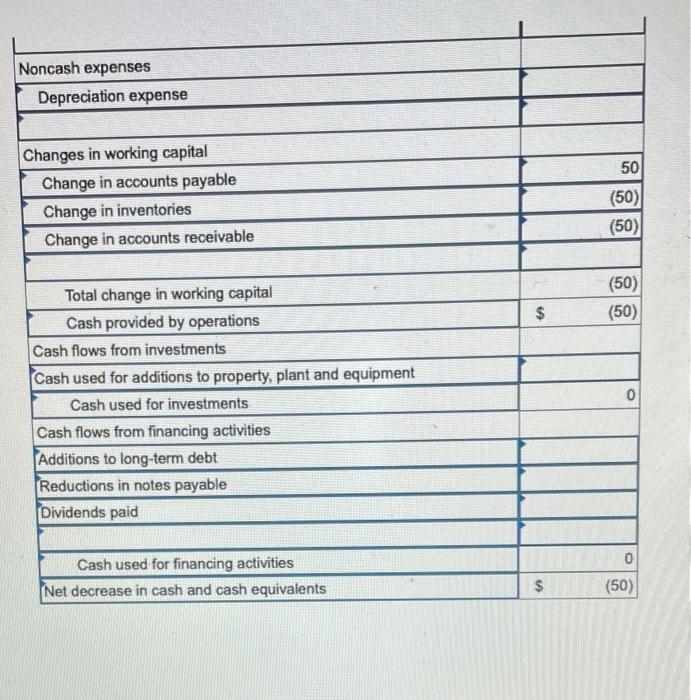

The table below contains data on Fincorp Inc. The balance sheet items correspond to values at year-end 2018 and 2019, while the income statement items correspond to revenues or expenses during the year ending in either 2018 or 2019. All values are in thousands of dollars. 2019 $4,100 1.700 520 350 Revenue Cost of goods sold Depreciation Inventories Administrative expenses Interest expense Federal and state taxes. Accounts payable Accounts receivable Net fixed assetst Long-tern debt Notes payable Dividends paid Cash and marketable securities 2018 $4,000 1,600 500 300 500 150 400 300 400 5,000 2,000 1.ee 410 800 550 150 420 350 450 5,800 2.400 600 410 300 Taxes are paid in their entirety in the year that the tax obligation is incurred. t Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. Construct a statement of cash flows for Fincorp for 2019. (Enter your answers in thousands of dollars. Negative amounts should be indicated by a minus sign.) Fincorp Inc. Statement of Cash Flows (5 in 00s) Cash flows from operations Check my work Taxes are paid in their entirety in the year that the tax obligation is incurred. Net fixed assets are fixed assets net of accumulated depreciation since the asset was installed. Construct a statement of cash flows for Fincorp for 2019. (Enter your answers in thousands of dollars. Negative amounts should be indicated by a minus sign.) Fincorp Inc. Statement of Cash Flows (5 in 000) Cash flows from operations Net income Noncash expenses Depreciation expense 50 Changes in working capital Change in accounts payable Change in inventories Change in accounts receivable (50) (50) (50) (50) $ Total change in working capital Cash provided by operations Cash flows from investments Cash used for additions to property, plant and equipment moments 0 Noncash expenses Depreciation expense 50 Changes in working capital Change in accounts payable Change in inventories Change in accounts receivable (50) (50)| (50) (50) $ 0 Total change in working capital Cash provided by operations Cash flows from investments Cash used for additions to property, plant and equipment Cash used for investments Cash flows from financing activities Additions to long-term debt Reductions in notes payable Dividends paid 0 Cash used for financing activities Net decrease in cash and cash equivalents $ (50)