Question

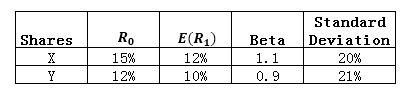

The table below contains information on two shares: X and Y. R 0 is the realized one-year holding period period in the year just ended.

The table below contains information on two shares: X and Y. R0 is the realized one-year holding period period in the year just ended. E(R1) is the forecast return for the next year based on the performance of the company. The market risk premium is 8% and risk free rate is 2%.

a) For a new investor who only wants to invest in one of these two shares, which share should be picked? Explain.

b) For an investor who has already been holding a well-diversified portfolio and only wants to add more shares if doing so will improve portfolios alpha. Should this investor invest in X or Y? Or both? Or neither? Explain.

c) An investor has constructed a risky portfolio Z by combing X and Y. Portfolio Z has an expected return of 10.8% and standard deviation of 20%. If the investor wants to further combine portfolio Z with the risk-free asset to maximize expected return while having a standard deviation not higher than 16%, what should be the weights of X, Y and the risk free asset? (use E(R1) in the table as the forecast expected return for share X and Y for determining share X and Y weights in portfolio Z)

d) If CAPM holds, how are investors expected to trade shares X and Y based on the values you have calculated in part b)? What will happen to the price of X and Y if there is no new information to be revealed to market?

Shares X Y RO 15% 12% E(R1) 12% 10% Beta 1.1 0.9 Standard Deviation 20% 21%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started