Answered step by step

Verified Expert Solution

Question

1 Approved Answer

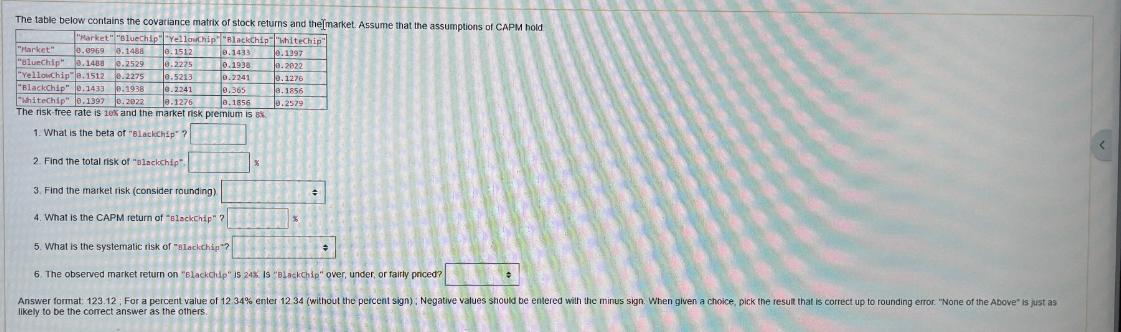

The table below contains the covariance matrix of stock returns and the market. Assume that the assumptions of CAPM hold Harket 0.1512 Market BlueChip

The table below contains the covariance matrix of stock returns and the market. Assume that the assumptions of CAPM hold "Harket" 0.1512 "Market" "BlueChip" "YellowChip" "BlackChip""WhiteChip" 0.0969 0.1488 "aluechip" 0.1430 0.2529. 0.2225 "YellowChip" 0.1512 0.2275 0.5213 "BlackChip" 0.1433 0.1938 0.2241 whiteChip" 0.1397 0.2022 0.1276 The risk free rate is 10% and the market risk premium is 8% 1. What is the beta of "BlackChip" ? 0.1433 0.1938 0.2241 0.365 0.1856 0.1397 0.2022 0.1276 % 8.1856 0.2579 2. Find the total risk of "Blackchip" 3. Find the market risk (consider rounding) 4. What is the CAPM return of "Blackchip" ? 5. What is the systematic risk of "Blackchip"? 6. The observed market return on "Blackchip" IS 24% IS "BlackChip" over, under, or fairly priced? % # # Answer format: 123.12 For a percent value of 12.34% enter 12.34 (without the percent sign), Negative values should be entered with the minus sign. When given a choice, pick the result that is correct up to rounding error. "None of the Above" is just as likely to be the correct answer as the others.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 The beta of BlackChip is 02022 2 The total risk of BlackChip is 81433 3 The market risk is 61997 4 The CAPM return of BlackChip is 2143 5 The system...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started