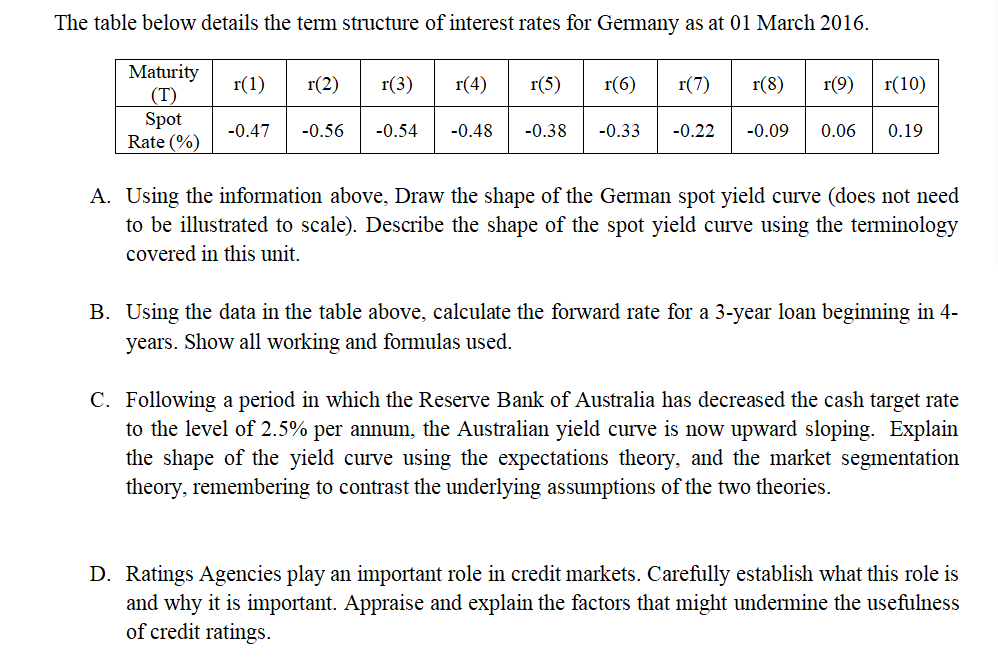

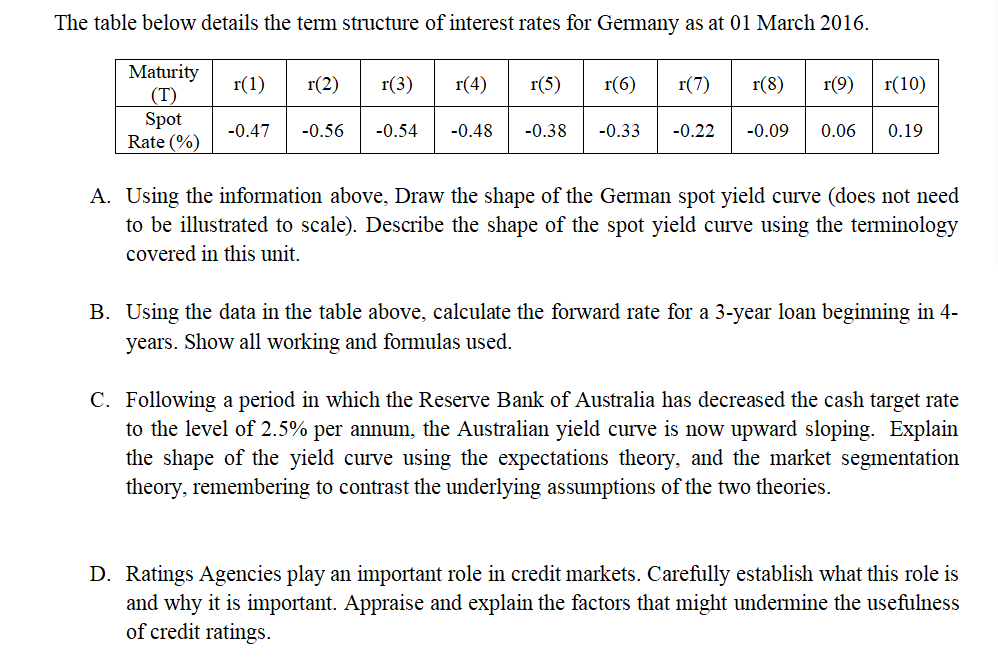

The table below details the term structure of interest rates for Germany as at 01 March 2016. r(1) r(2) r(3) r(4) r(5) r(6) r(7) r(8) r(9) r(10) Maturity (T) Spot Rate(%) -0.47 -0.56 -0.54 -0.48 -0.38 -0.33 -0.22 -0.09 0.06 0.19 A. Using the information above, Draw the shape of the German spot yield curve (does not need to be illustrated to scale). Describe the shape of the spot yield curve using the terminology covered in this unit. B. Using the data in the table above, calculate the forward rate for a 3-year loan beginning in 4- years. Show all working and formulas used. C. Following a period in which the Reserve Bank of Australia has decreased the cash target rate to the level of 2.5% per annum, the Australian yield curve is now upward sloping. Explain the shape of the yield curve using the expectations theory, and the market segmentation theory, remembering to contrast the underlying assumptions of the two theories. D. Ratings Agencies play an important role in credit markets. Carefully establish what this role is and why it is important. Appraise and explain the factors that might undermine the usefulness of credit ratings. The table below details the term structure of interest rates for Germany as at 01 March 2016. r(1) r(2) r(3) r(4) r(5) r(6) r(7) r(8) r(9) r(10) Maturity (T) Spot Rate(%) -0.47 -0.56 -0.54 -0.48 -0.38 -0.33 -0.22 -0.09 0.06 0.19 A. Using the information above, Draw the shape of the German spot yield curve (does not need to be illustrated to scale). Describe the shape of the spot yield curve using the terminology covered in this unit. B. Using the data in the table above, calculate the forward rate for a 3-year loan beginning in 4- years. Show all working and formulas used. C. Following a period in which the Reserve Bank of Australia has decreased the cash target rate to the level of 2.5% per annum, the Australian yield curve is now upward sloping. Explain the shape of the yield curve using the expectations theory, and the market segmentation theory, remembering to contrast the underlying assumptions of the two theories. D. Ratings Agencies play an important role in credit markets. Carefully establish what this role is and why it is important. Appraise and explain the factors that might undermine the usefulness of credit ratings