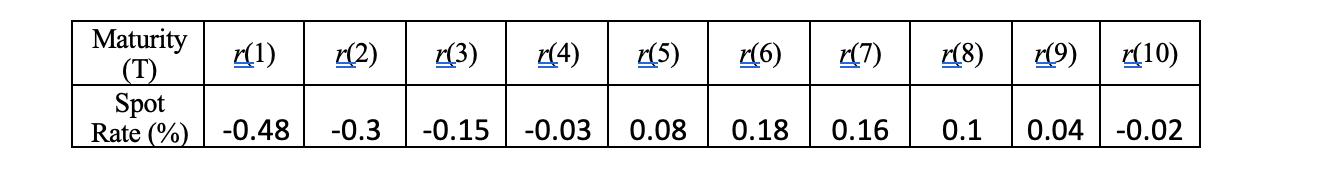

The table below details the term structure of interest rates as at 01 January 2020: A. Using the information above, describe the shape of

A. Using the information above, describe the shape of the spot yield curve using the terminology covered in this unit.

B. Using the data in the table above, which of the three curves: par curve, spot curve and forward curve is the highest before year 7. How would you expect the forward curve to change at year 8 relative to the spot curve (i.e. lie above or below). Please explain your answers.

C. Using the data in the table above, calculate all forward rates that can be found using year 2, year 3 and year 4 spot rates. Show all working and formulas used.

D. Based on the data in the table above, explain the term structure of the yield curve using the expectations theory, and the market segmentation theory, remembering to contrast the underlying assumptions of the two theories.

E. Covid-19 has led to the global contraction. Considering the negative impact of covid-19 on financial markets, how would this affect the credit rating if a company decides to issue debt in the market? Please explain it in terms of factors such as probability of default, recovery rate, credit spread or migration.

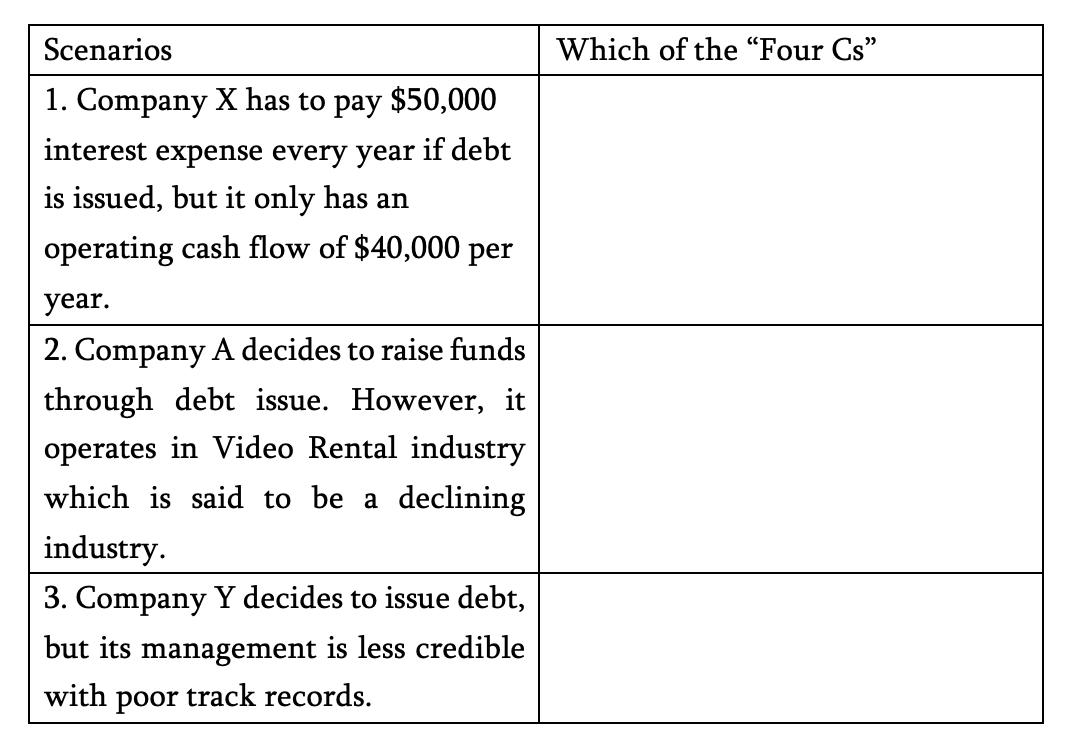

F. "Four Cs of credit analysis" is used by analysts to evaluate creditworthiness. For each of the following scenarios, which of the "Four Cs" should be used for evaluation? Please also explain your answers.

Maturity (T) Spot Rate (%) z(1) -0.48 r(2) r(4) (5) -0.3 -0.15 -0.03 0.08 r(6) (7) 0.18 0.16 r(8) r(9) (10) 0.1 0.04 -0.02

Step by Step Solution

3.49 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Shape of the Spot Yield Curve The shape of the spot yield curve can be described as inverted or downwardsloping This means that shorterterm interest rates are higher than longerterm interest ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started