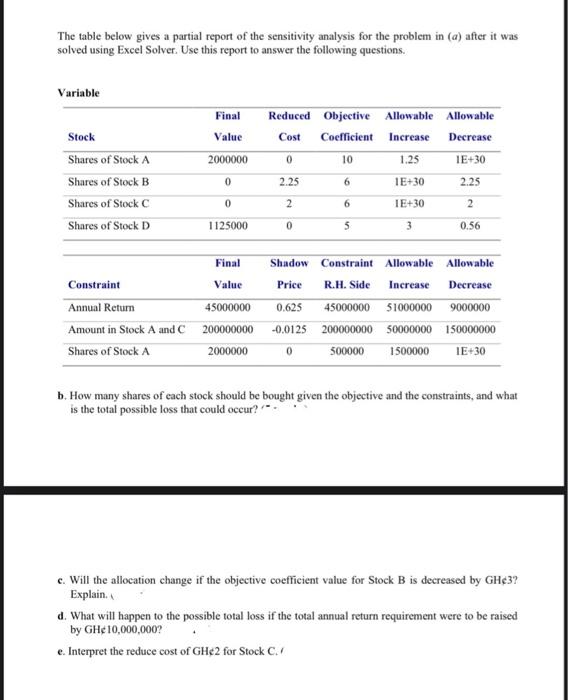

The table below gives a partial report of the sensitivity analysis for the problem in (a) after it was solved using Excel Solver. Use this report to answer the following questions Variable Reduced Objective Allowable Allowable Cost Coefficient Increase Decrease 0 10 1.25 IE+30 Stock Shares of Stock A Shares of Stock B Shares of Stock C Shares of Stock D Final Value 2000000 0 0 1125000 2.25 6 1E+30 2.25 2 6 IE+30 2 0 5 3 0.56 Final Shadow Constraint Allowable Allowable Constraint Value Price R.H. Side Increase Decrease Annual Return 45000000 0.625 45000000 51000000 9000000 Amount in Stock A and C 200000000-0.0125200000000 50000000 150000000 Shares of Stock A 2000000 0 500000 1500000 IE+30 b. How many shares of each stock should be bought given the objective and the constraints, and what is the total possible loss that could occur? c. Will the allocation change if the objective coefficient value for Stock B is decreased by GH3? Explain. d. What will happen to the possible total loss if the total annual return requirement were to be raised by GH10,000,000 e Interpret the reduce cost of GH2 for Stock C. The table below gives a partial report of the sensitivity analysis for the problem in (a) after it was solved using Excel Solver. Use this report to answer the following questions Variable Reduced Objective Allowable Allowable Cost Coefficient Increase Decrease 0 10 1.25 IE+30 Stock Shares of Stock A Shares of Stock B Shares of Stock C Shares of Stock D Final Value 2000000 0 0 1125000 2.25 6 1E+30 2.25 2 6 IE+30 2 0 5 3 0.56 Final Shadow Constraint Allowable Allowable Constraint Value Price R.H. Side Increase Decrease Annual Return 45000000 0.625 45000000 51000000 9000000 Amount in Stock A and C 200000000-0.0125200000000 50000000 150000000 Shares of Stock A 2000000 0 500000 1500000 IE+30 b. How many shares of each stock should be bought given the objective and the constraints, and what is the total possible loss that could occur? c. Will the allocation change if the objective coefficient value for Stock B is decreased by GH3? Explain. d. What will happen to the possible total loss if the total annual return requirement were to be raised by GH10,000,000 e Interpret the reduce cost of GH2 for Stock C