Answered step by step

Verified Expert Solution

Question

1 Approved Answer

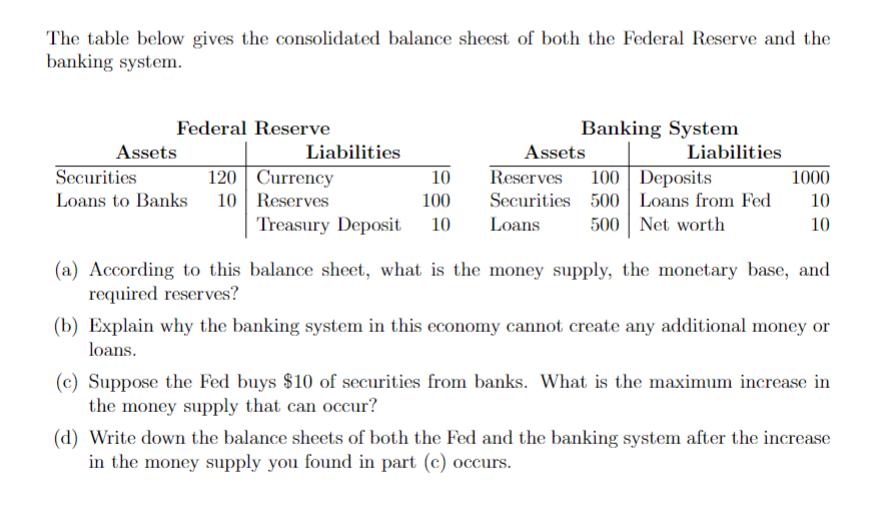

The table below gives the consolidated balance sheest of both the Federal Reserve and the banking system. Federal Reserve Assets Liabilities Securities 120 Currency

The table below gives the consolidated balance sheest of both the Federal Reserve and the banking system. Federal Reserve Assets Liabilities Securities 120 Currency Loans to Banks 10 Reserves Banking System Assets Reserves 100 Deposits Securities 500 Loans from Fed 500 Net worth 10 100 Treasury Deposit 10 Loans Liabilities 1000 10 10 (a) According to this balance sheet, what is the money supply, the monetary base, and required reserves? (b) Explain why the banking system in this economy cannot create any additional money or loans. (c) Suppose the Fed buys $10 of securities from banks. What is the maximum increase in the money supply that can occur? (d) Write down the balance sheets of both the Fed and the banking system after the increase in the money supply you found in part (c) occurs.

Step by Step Solution

★★★★★

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a Money supply Currency Deposits 10 500 510 Monetary base Currency Reserves 10 100 110 Required rese...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started