Answered step by step

Verified Expert Solution

Question

1 Approved Answer

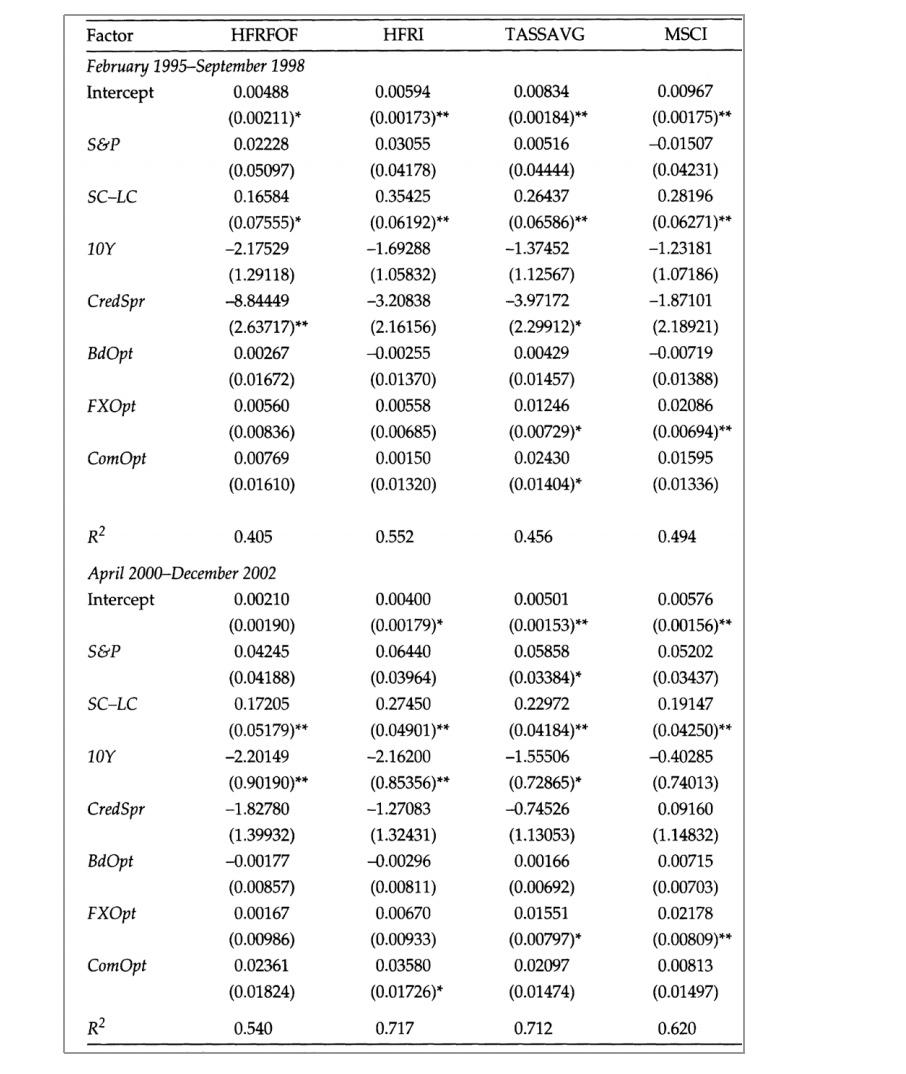

The table below provides the regression outputs of the fund of hedge funds index (HFRFOF) and other various data providers all-hedge fund indices on the

The table below provides the regression outputs of the fund of hedge funds index (HFRFOF) and

other various data providers all-hedge fund indices on the Fung Hsieh 7-factors for two sample

periods. * and ** suggest a significant result for the 5% and 1% level respectively:

1.Describe and compare the performance of the HFRI and TASSAVG indices in both sample periods. Note that the HFRI index does not include CTAs.

2. Compare the alphas between the fund of hedge funds and the rest indices in both periods. Explain possible differences.

Factor HFRFOF February 1995-September 1998 Intercept 0.00488 (0.00211)* S&P 0.02228 (0.05097) SC-LC 0.16584 (0.07555)* 1 -2.17529 (1.29118) CredSpr -8.84449 (2.63717)** BdOpt 0.00267 (0.01672) FXOpt 0.00560 (0.00836) ComOpt 0.00769 (0.01610) R 0.405 April 2000-December 2002 Intercept 0.00210 (0.00190) S&P 0.04245 (0.04188) SC-LC 0.17205 (0.05179)** 10Y -2.20149 (0.90190)** CredSpr -1.82780 (1.39932) BdOpt -0.00177 (0.00857) FXOpt 0.00167 (0.00986) ComOpt 0.02361 (0.01824) R 0.540 HFRI 0.00594 (0.00173)** 0.03055 (0.04178) 0.35425 (0.06192)** -1.69288 (1.05832) -3.20838 (2.16156) -0.00255 (0.01370) 0.00558 (0.00685) 0.00150 (0.01320) 0.552 0.00400 (0.00179)* 0.06440 (0.03964) 0.27450 (0.04901)** -2.16200 (0.85356)** -1.27083 (1.32431) -0.00296 (0.00811) 0.00670 (0.00933) 0.03580 (0.01726)* 0.717 TASSAVG 0.00834 (0.00184)** 0.00516 (0.04444) 0.26437 (0.06586)** -1.37452 (1.12567) -3.97172 (2.29912)* 0.00429 (0.01457) 0.01246 (0.00729)* 0.02430 (0.01404)* 0.456 0.00501 (0.00153)** 0.05858 (0.03384)* 0.22972 (0.04184)** -1.55506 (0.72865)* -0.74526 (1.13053) 0.00166 (0.00692) 0.01551 (0.00797)* 0.02097 (0.01474) 0.712 MSCI 0.00967 (0.00175)** -0.01507 (0.04231) 0.28196 (0.06271)** -1.23181 (1.07186) -1.87101 (2.18921) -0.00719 (0.01388) 0.02086 (0.00694)** 0.01595 (0.01336) 0.494 0.00576 (0.00156)** 0.05202 (0.03437) 0.19147 (0.04250)** -0.40285 (0.74013) 0.09160 (1.14832) 0.00715 (0.00703) 0.02178 (0.00809)** 0.00813 (0.01497) 0.620 Factor HFRFOF February 1995-September 1998 Intercept 0.00488 (0.00211)* S&P 0.02228 (0.05097) SC-LC 0.16584 (0.07555)* 1 -2.17529 (1.29118) CredSpr -8.84449 (2.63717)** BdOpt 0.00267 (0.01672) FXOpt 0.00560 (0.00836) ComOpt 0.00769 (0.01610) R 0.405 April 2000-December 2002 Intercept 0.00210 (0.00190) S&P 0.04245 (0.04188) SC-LC 0.17205 (0.05179)** 10Y -2.20149 (0.90190)** CredSpr -1.82780 (1.39932) BdOpt -0.00177 (0.00857) FXOpt 0.00167 (0.00986) ComOpt 0.02361 (0.01824) R 0.540 HFRI 0.00594 (0.00173)** 0.03055 (0.04178) 0.35425 (0.06192)** -1.69288 (1.05832) -3.20838 (2.16156) -0.00255 (0.01370) 0.00558 (0.00685) 0.00150 (0.01320) 0.552 0.00400 (0.00179)* 0.06440 (0.03964) 0.27450 (0.04901)** -2.16200 (0.85356)** -1.27083 (1.32431) -0.00296 (0.00811) 0.00670 (0.00933) 0.03580 (0.01726)* 0.717 TASSAVG 0.00834 (0.00184)** 0.00516 (0.04444) 0.26437 (0.06586)** -1.37452 (1.12567) -3.97172 (2.29912)* 0.00429 (0.01457) 0.01246 (0.00729)* 0.02430 (0.01404)* 0.456 0.00501 (0.00153)** 0.05858 (0.03384)* 0.22972 (0.04184)** -1.55506 (0.72865)* -0.74526 (1.13053) 0.00166 (0.00692) 0.01551 (0.00797)* 0.02097 (0.01474) 0.712 MSCI 0.00967 (0.00175)** -0.01507 (0.04231) 0.28196 (0.06271)** -1.23181 (1.07186) -1.87101 (2.18921) -0.00719 (0.01388) 0.02086 (0.00694)** 0.01595 (0.01336) 0.494 0.00576 (0.00156)** 0.05202 (0.03437) 0.19147 (0.04250)** -0.40285 (0.74013) 0.09160 (1.14832) 0.00715 (0.00703) 0.02178 (0.00809)** 0.00813 (0.01497) 0.620Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started