Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The table below represents the beginning-of-day balance sheet of a bank that faces a required reserve ratio of 10% a) Compute the largest deposit outflow

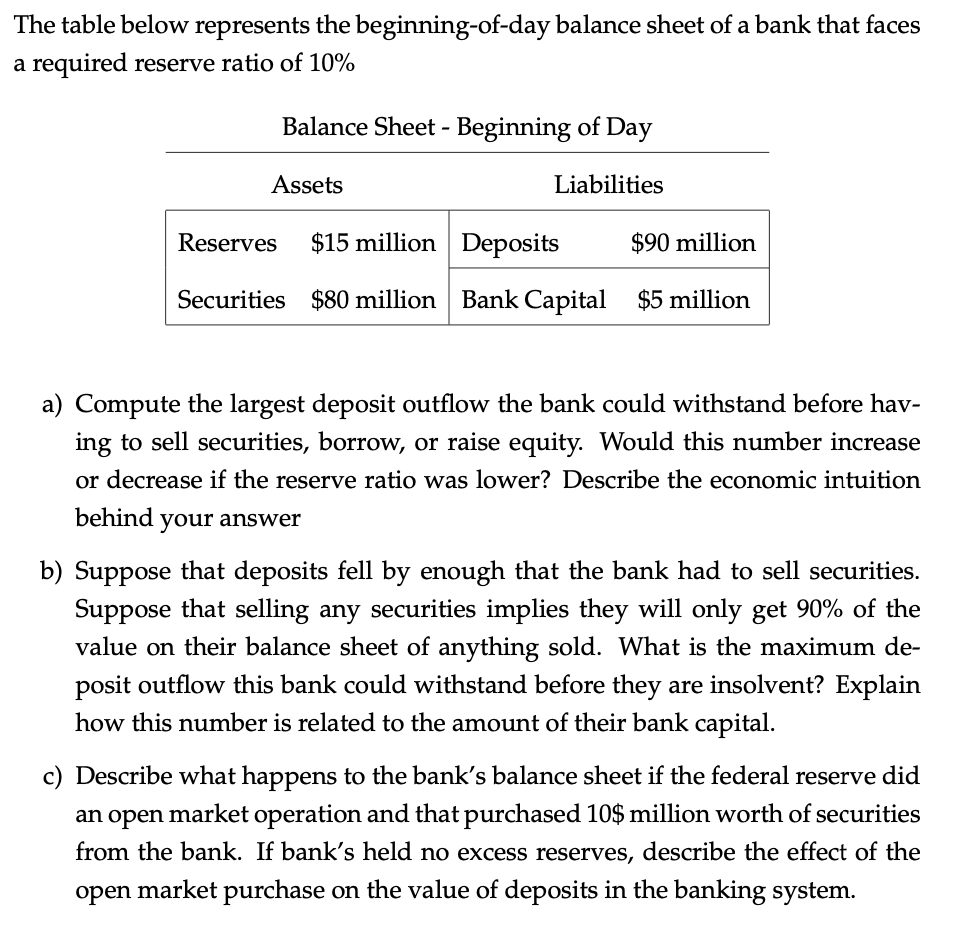

The table below represents the beginning-of-day balance sheet of a bank that faces a required reserve ratio of 10% a) Compute the largest deposit outflow the bank could withstand before having to sell securities, borrow, or raise equity. Would this number increase or decrease if the reserve ratio was lower? Describe the economic intuition behind your answer b) Suppose that deposits fell by enough that the bank had to sell securities. Suppose that selling any securities implies they will only get 90% of the value on their balance sheet of anything sold. What is the maximum deposit outflow this bank could withstand before they are insolvent? Explain how this number is related to the amount of their bank capital. c) Describe what happens to the bank's balance sheet if the federal reserve did an open market operation and that purchased 10$ million worth of securities from the bank. If bank's held no excess reserves, describe the effect of the open market purchase on the value of deposits in the banking system

The table below represents the beginning-of-day balance sheet of a bank that faces a required reserve ratio of 10% a) Compute the largest deposit outflow the bank could withstand before having to sell securities, borrow, or raise equity. Would this number increase or decrease if the reserve ratio was lower? Describe the economic intuition behind your answer b) Suppose that deposits fell by enough that the bank had to sell securities. Suppose that selling any securities implies they will only get 90% of the value on their balance sheet of anything sold. What is the maximum deposit outflow this bank could withstand before they are insolvent? Explain how this number is related to the amount of their bank capital. c) Describe what happens to the bank's balance sheet if the federal reserve did an open market operation and that purchased 10$ million worth of securities from the bank. If bank's held no excess reserves, describe the effect of the open market purchase on the value of deposits in the banking system Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started