Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The table below represents the beginning-of-day balance sheet of a bank that faces a required reserve ratio of 15% and a capital requirement that they

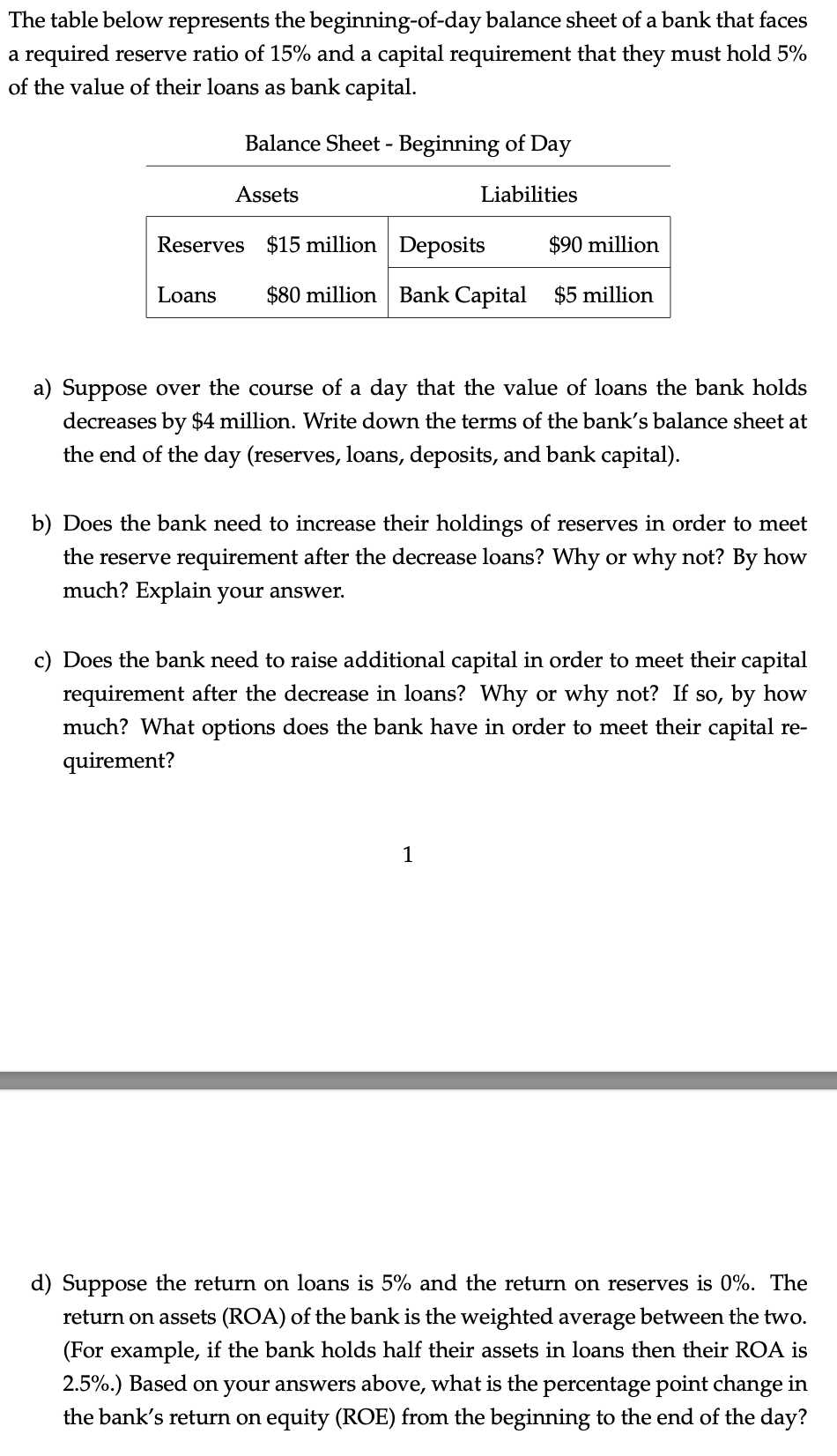

The table below represents the beginning-of-day balance sheet of a bank that faces a required reserve ratio of 15% and a capital requirement that they must hold 5% of the value of their loans as bank capital. a) Suppose over the course of a day that the value of loans the bank holds decreases by $4 million. Write down the terms of the bank's balance sheet at the end of the day (reserves, loans, deposits, and bank capital). b) Does the bank need to increase their holdings of reserves in order to meet the reserve requirement after the decrease loans? Why or why not? By how much? Explain your answer. c) Does the bank need to raise additional capital in order to meet their capital requirement after the decrease in loans? Why or why not? If so, by how much? What options does the bank have in order to meet their capital requirement? 1 d) Suppose the return on loans is 5% and the return on reserves is 0%. The return on assets (ROA) of the bank is the weighted average between the two. (For example, if the bank holds half their assets in loans then their ROA is 2.5%.) Based on your answers above, what is the percentage point change in the bank's return on equity (ROE) from the beginning to the end of the day

The table below represents the beginning-of-day balance sheet of a bank that faces a required reserve ratio of 15% and a capital requirement that they must hold 5% of the value of their loans as bank capital. a) Suppose over the course of a day that the value of loans the bank holds decreases by $4 million. Write down the terms of the bank's balance sheet at the end of the day (reserves, loans, deposits, and bank capital). b) Does the bank need to increase their holdings of reserves in order to meet the reserve requirement after the decrease loans? Why or why not? By how much? Explain your answer. c) Does the bank need to raise additional capital in order to meet their capital requirement after the decrease in loans? Why or why not? If so, by how much? What options does the bank have in order to meet their capital requirement? 1 d) Suppose the return on loans is 5% and the return on reserves is 0%. The return on assets (ROA) of the bank is the weighted average between the two. (For example, if the bank holds half their assets in loans then their ROA is 2.5%.) Based on your answers above, what is the percentage point change in the bank's return on equity (ROE) from the beginning to the end of the day Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started