Question

The board of directors of Jonas Chemical Systems Limited has used payback for many years as an initial selectionrn tool to identify projects for subsequent

The board of directors of Jonas Chemical Systems Limited has used payback for many years as an initial selectionrn tool to identify projects for subsequent and more detailed analysis by its financial investment team. The firm’s capitalrn projects are characterized by relatively long investment periods and even longer recovery phases. Unfortunately, for arn variety of reasons, the cash flows towards the end of each project tend to be very low or indeed sometimes negative. Asrn the company’s new chief financial officer (CFO), you are concerned about the use of payback in this context and wouldrn favor a more thorough pre-evaluation of each capital investment proposal before it is submitted for detailed planningrn and approval. You recognize that many board members like the provision of a payback figure as this, they argue, givesrn them a clear idea as to when the project can be expected to recover its initial capital investment.rn

All capital projects must be submitted to the board for initial approval before the financial investment team begins itsrn detailed review. At the initial stage the board sees the project’s summarized cash flows, a supporting business case andrn an assessment of the project payback and accounting rate of return.rn

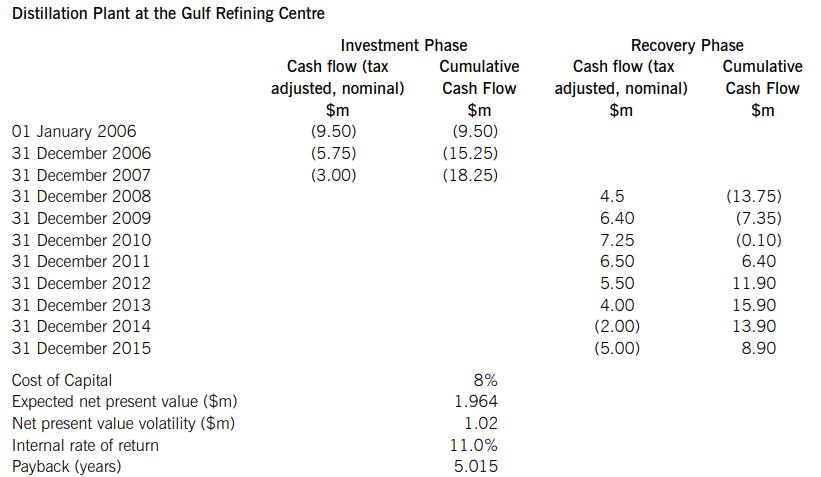

A recent capital investment proposal, which has passed to the implementation stage after much discussion at board level, had summarized cash flows and other information as follows:

The normal financial rules are that a project should only be considered if it has a payback period of less than five years. In this case the project was passed to detail review by the financial investment team who, on your instruction, have undertaken a financial simulation of the project’s net present value to generate the expected value and volatility as shown above. The board minute of the discussion relating to the project’s preliminary approval was as follows:

31 May 2005 Agenda Item 6 New capital projects – preliminary approvals

Outline consideration was given to the construction of a new distillation facility at the Gulf Refining Centre which is regarded as a key strategic component of the company’s manufacturing capability. The cash flow projections had been prepared in accordance with existing guidelines and there was some uncertainty with respect to capital build and future profitability. Mrs Chua (chief financial officer) had given approval for the project to come to the board given its strategic importance and the closeness of the payback estimate to the company’s barrier for long term capital investment of five years. Mr Lazar (non-executive director) suggested that they would need more information about the impact of risk upon the project’s outcome before giving final approval. Mr Bright (operations director) agreed but asked why the board needed to consider capital proposals twice. The board was of the view that what was needed was clearer information about each proposal and the risks to which they were exposed. The chair requested the CFO to provide a review of the company’s capital approval procedures to include better assessment of the firm’s financial exposure. The revised guidelines should include procedures for both the preliminary and final approval stages. Approved (Action CFO to report)

Required:

(a) Prepare a paper for the next board meeting, recommending procedures for the assessment of capital investment projects. Your paper should make proposals about the involvement of the board at a preliminary stage and the information that should be provided to inform their decision. You should also provide an assessment of the alternative appraisal methods.

(b) Using the appraisal methods you have recommended in (a), prepare a paper outlining the case for the acceptance of the project to build a distillation facility at the Gulf plant with an assessment of the company’s likely value at risk. You are not required to undertake an assessment of the impact of the project upon the firm’s financial accounts.

Distillation Plant at the Gulf Refining Centre 01 January 2006 31 December 2006 31 December 2007 31 December 2008 31 December 2009 31 December 2010 31 December 2011 31 December 2012 31 December 2013 31 December 2014 31 December 2015 Cost of Capital Expected net present value ($m) Net present value volatility ($m) Internal rate of return Payback (years) Investment Phase Cash flow (tax adjusted, nominal) $m (9.50) (5.75) (3.00) Cumulative Cash Flow $m (9.50) (15.25) (18.25) 8% 1.964 1.02 11.0% 5.015 Recovery Phase Cash flow (tax adjusted, nominal) $m 4.5 6.40 7.25 6.50 5.50 4.00 (2.00) (5.00) Cumulative Cash Flow $m (13.75) (7.35) (0.10) 6.40 11.90 15.90 13.90 8.90

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Capital investment analysis is a budgeting procedure that companies and government agencies use to assess the potential profitability of a longterm investment Capital investment analysis assesses long...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started