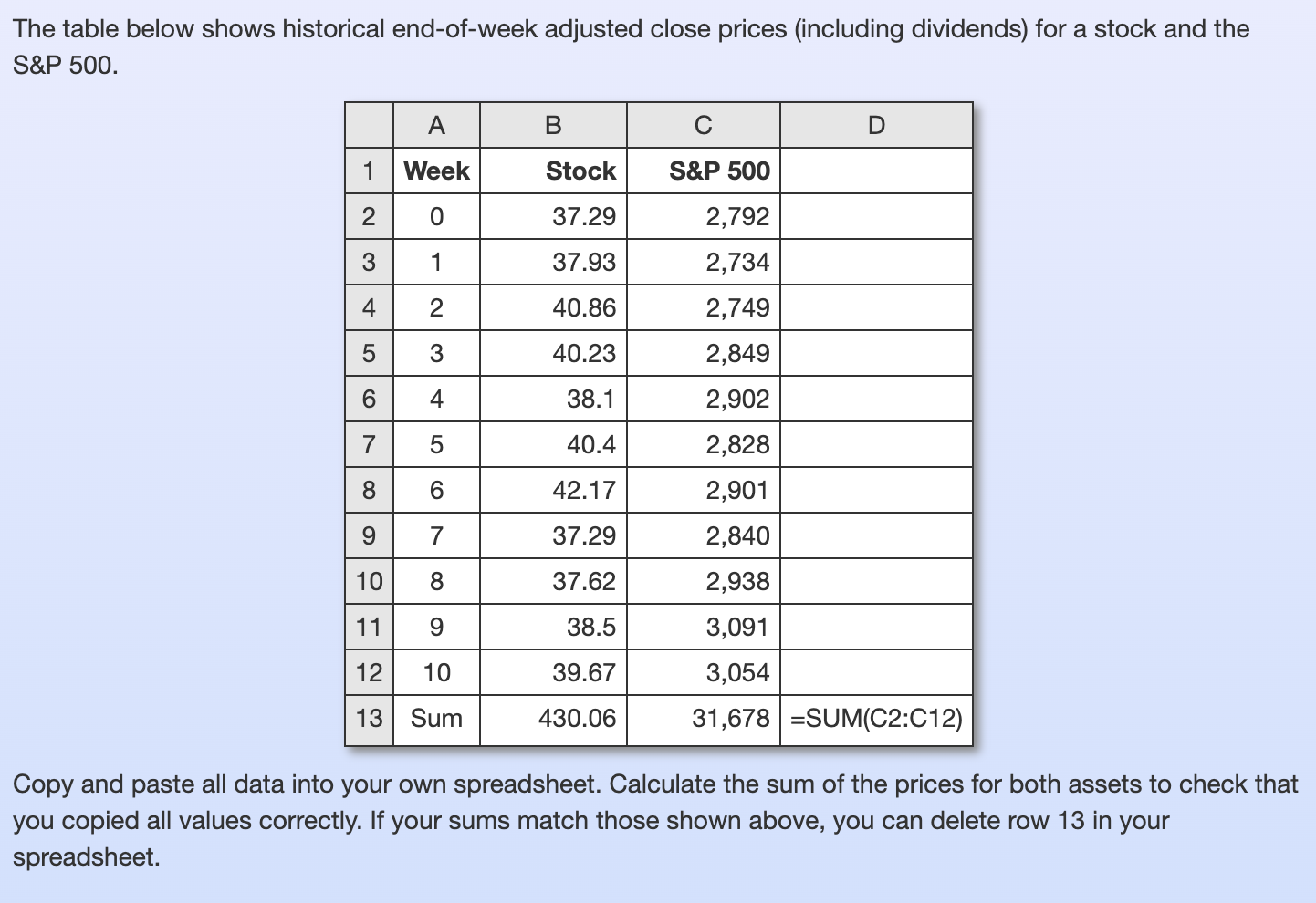

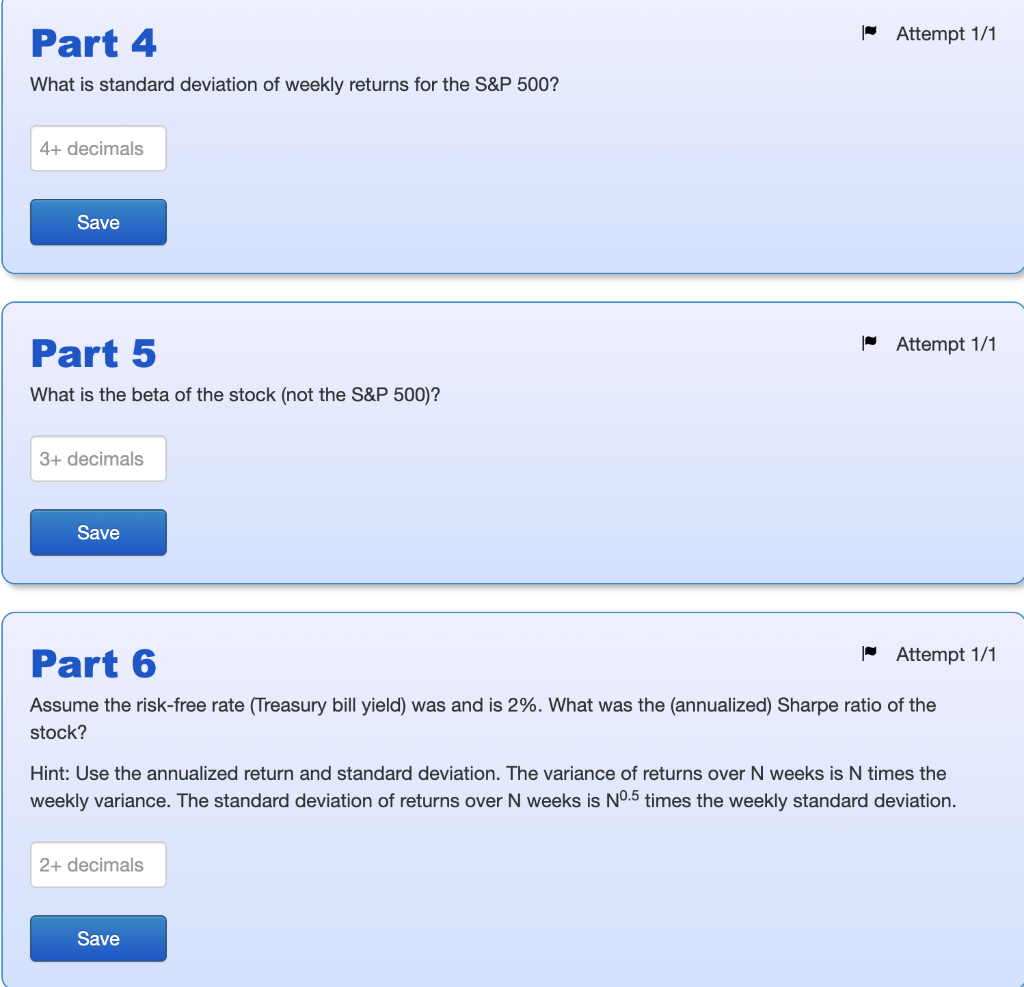

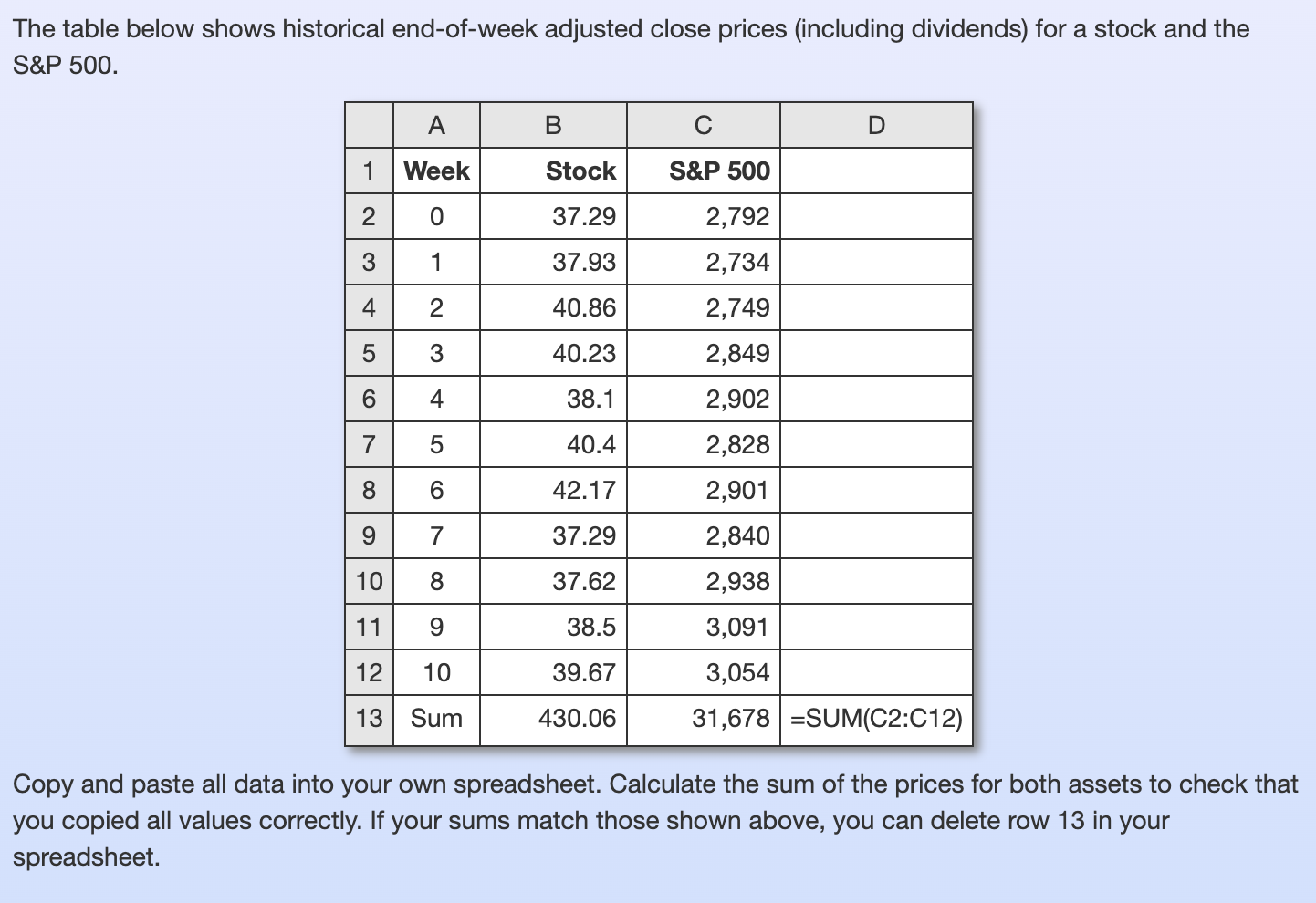

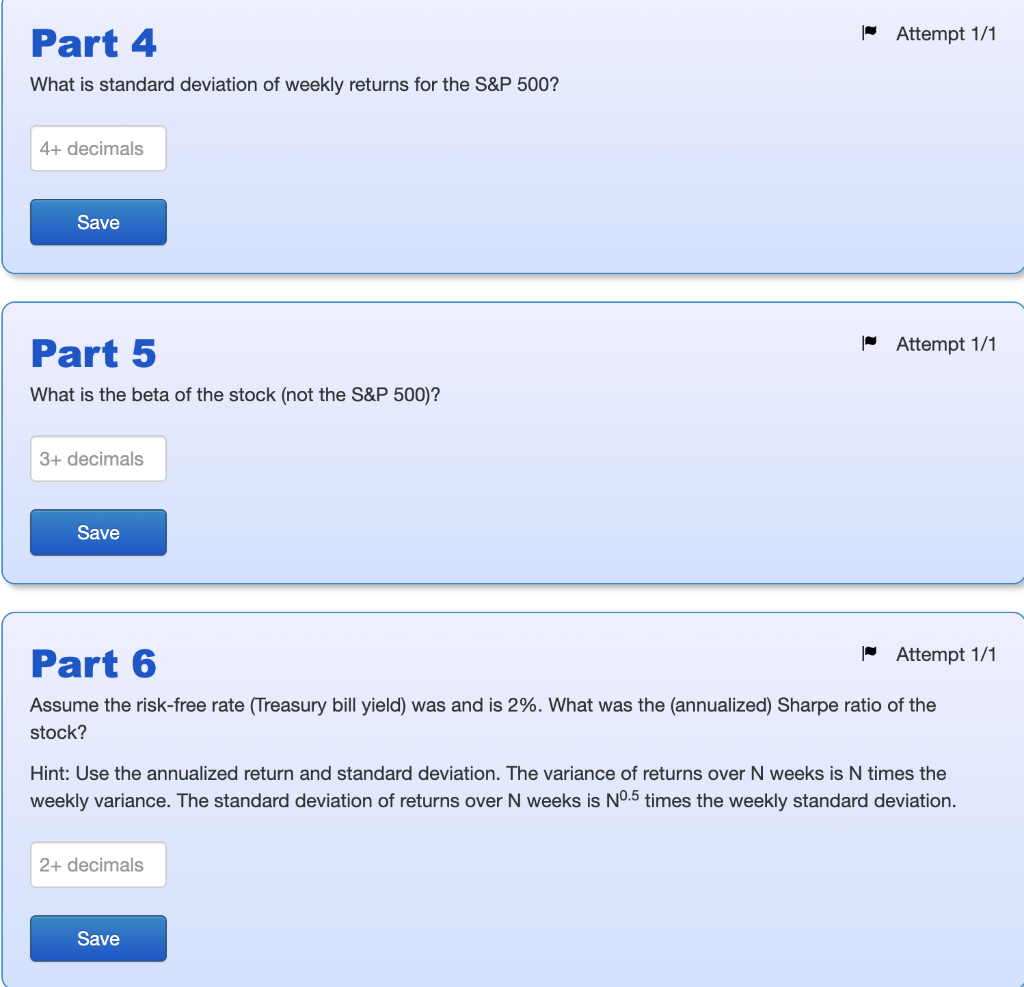

The table below shows historical end-of-week adjusted close prices (including dividends) for a stock and the S&P 500. A B C 1 Week Stock S&P 500 2 37.29 2,792 3 37.93 2,734 4 40.86 2,749 5 40.23 2,849 6 38.1 2,902 7 40.4 2,828 8 42.17 2,901 9 37.29 2,840 10 37.62 2,938 11 9 38.5 3,091 12 10 39.67 3,054 13 Sum 430.06 31,678=SUM(C2:C12) Copy and paste all data into your own spreadsheet. Calculate the sum of the prices for both assets to check that you copied all values correctly. If your sums match those shown above, you can delete row 13 in your spreadsheet. O 1 2 3 4 5 6 7 Attempt 1/1 Part 4 What is standard deviation of weekly returns for the S&P 500? 4+ decimals Save Attempt 1/1 Part 5 What is the beta of the stock (not the S&P 500)? 3+ decimals Save Attempt 1/1 Part 6 Assume the risk-free rate (Treasury bill yield) was and is 2%. What was the (annualized) Sharpe ratio of the stock? Hint: Use the annualized return and standard deviation. The variance of returns over N weeks is N times the weekly variance. The standard deviation of returns over N weeks is N.5 times the weekly standard deviation. 2+ decimals Save The table below shows historical end-of-week adjusted close prices (including dividends) for a stock and the S&P 500. A B C 1 Week Stock S&P 500 2 37.29 2,792 3 37.93 2,734 4 40.86 2,749 5 40.23 2,849 6 38.1 2,902 7 40.4 2,828 8 42.17 2,901 9 37.29 2,840 10 37.62 2,938 11 9 38.5 3,091 12 10 39.67 3,054 13 Sum 430.06 31,678=SUM(C2:C12) Copy and paste all data into your own spreadsheet. Calculate the sum of the prices for both assets to check that you copied all values correctly. If your sums match those shown above, you can delete row 13 in your spreadsheet. O 1 2 3 4 5 6 7 Attempt 1/1 Part 4 What is standard deviation of weekly returns for the S&P 500? 4+ decimals Save Attempt 1/1 Part 5 What is the beta of the stock (not the S&P 500)? 3+ decimals Save Attempt 1/1 Part 6 Assume the risk-free rate (Treasury bill yield) was and is 2%. What was the (annualized) Sharpe ratio of the stock? Hint: Use the annualized return and standard deviation. The variance of returns over N weeks is N times the weekly variance. The standard deviation of returns over N weeks is N.5 times the weekly standard deviation. 2+ decimals Save