Answered step by step

Verified Expert Solution

Question

1 Approved Answer

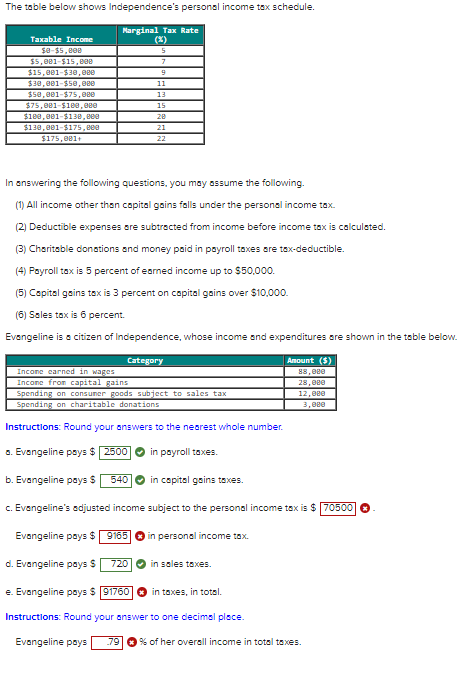

The table below shows Independence's personal income tox schedule. In answering the following questions, you may assume the following. ( 1 ) All income other

The table below shows Independence's personal income tox schedule.

In answering the following questions, you may assume the following.

All income other than capital gains falls under the personal income tox.

Deductible expenses are subtracted from income before income tox is calculated.

Charitable donations and money paid in payroll taxes are taxdeductible.

Payroll tox is percent of earned income up to $

Capitol gains tox is percent on capital gains over $

Soles tox is percent.

Evangeline is a citizen of Independence, whose income and expenditures are shown in the table below.

Instructions: Round your answers to the nearest whole number.

Evangeline pays $

in poyroll toxes.

b Evangeline pays $

in copital gains toxes.

c Evangeline's adjusted income subject to the personal income tox is $

Evangeline pays $

in personal income tox.

d Evangeline pays $

in soles toxes.

e Evangeline pays $

in toxes, in total.

Instructions: Round your answer to one decimal place.

Evangeline pays

of her overall income in total toxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started