Question

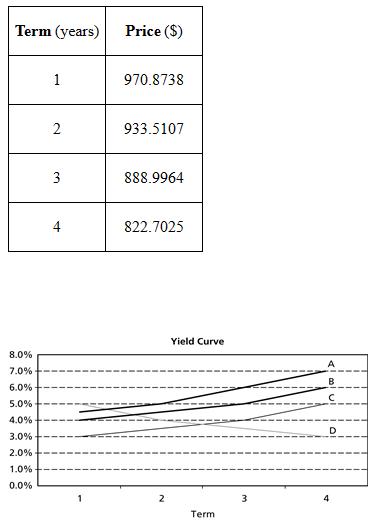

The table below shows market prices for four zero coupon bonds with four different terms: one, two, three, and four years. The bonds all have

The table below shows market prices for four zero coupon bonds with four different terms: one, two, three, and four years. The bonds all have a face value of $1,000. Which line best represents the yield curve derived from the bond prices in the table? Use the letter labels at the end of each line. (hint, compute the yield for each bond)

Zero Coupon Bond Prices

Term (years) 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 1 2 3 4 Price ($) 970.8738 933.5107 888.9964 822.7025 2 Yield Curve Term 3 A B Term (years) 8.0% 7.0% 6.0% 5.0% 4.0% 3.0% 2.0% 1.0% 0.0% 1 2 3 4 Price ($) 970.8738 933.5107 888.9964 822.7025 2 Yield Curve Term 3 A B

Step by Step Solution

3.32 Rating (137 Votes )

There are 3 Steps involved in it

Step: 1

Spot rate Spot rate year 1 Spot rate year 2 Spot rate y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Marketing Research

Authors: V. Kumar, Robert P. Leone, David A. Aaker, George S. Day

13th Edition

1119497639, 978-1119497639

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App