Answered step by step

Verified Expert Solution

Question

1 Approved Answer

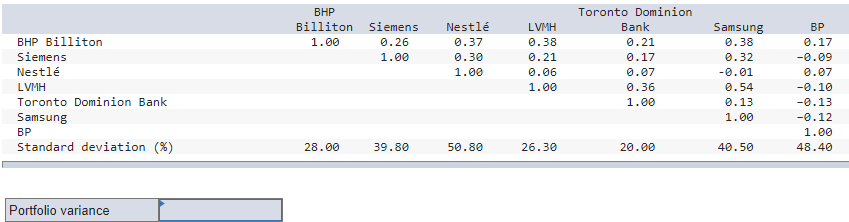

The table below shows standard deviations and correlation coefficients for seven stocks from different countries. Calculate the variance of a portfolio with equal investments in

The table below shows standard deviations and correlation coefficients for seven stocks from different countries. Calculate the variance of a portfolio with equal investments in each stock. (Use decimals, not percents, in your calculations. Do not round intermediate calculations. Round your answer to 4 decimal places.)

Previous answer is incorrect. Please help!

BHP Billiton 1.00 Siemens 0.26 1.00 Nestl 0.37 0.30 1.00 LVMH 0.38 0.21 0.06 1.00 BHP Billiton Siemens Nestl LVMH Toronto Dominion Bank Samsung BP Standard deviation (%) Toronto Dominion Bank 0.21 0.17 0.07 0.36 1.00 Samsung 0.38 0.32 -0.01 0.54 0.13 BP 0.17 -0.09 0.07 -0.10 -0.13 -0.12 1.00 48.40 1.00 28.00 39.80 50.80 26.30 20.00 40.50 Portfolio variance BHP Billiton 1.00 Siemens 0.26 1.00 Nestl 0.37 0.30 1.00 LVMH 0.38 0.21 0.06 1.00 BHP Billiton Siemens Nestl LVMH Toronto Dominion Bank Samsung BP Standard deviation (%) Toronto Dominion Bank 0.21 0.17 0.07 0.36 1.00 Samsung 0.38 0.32 -0.01 0.54 0.13 BP 0.17 -0.09 0.07 -0.10 -0.13 -0.12 1.00 48.40 1.00 28.00 39.80 50.80 26.30 20.00 40.50 Portfolio varianceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started