Answered step by step

Verified Expert Solution

Question

1 Approved Answer

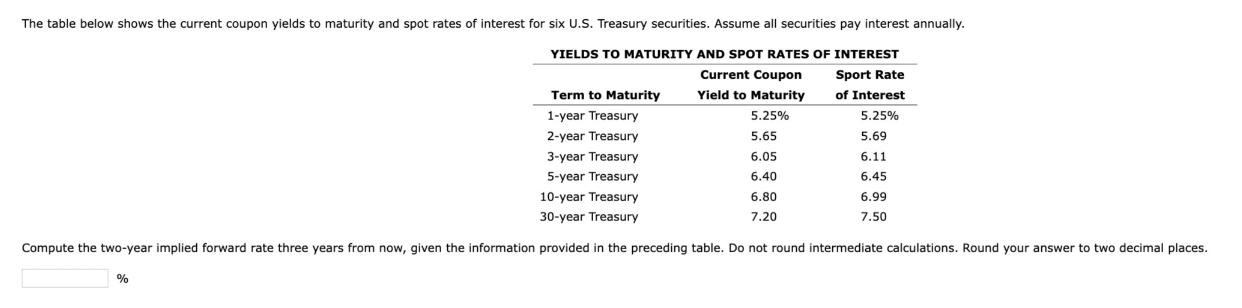

The table below shows the current coupon yields to maturity and spot rates of interest for six U.S. Treasury securities. Assume all securities pay

The table below shows the current coupon yields to maturity and spot rates of interest for six U.S. Treasury securities. Assume all securities pay interest annually. YIELDS TO MATURITY AND SPOT RATES OF INTEREST Sport Rate of Interest Term to Maturity Current Coupon Yield to Maturity 1-year Treasury 5.25% 5.25% 2-year Treasury 5.65 5.69 3-year Treasury 6.05 6.11 5-year Treasury 6.40 6.45 10-year Treasury 30-year Treasury 6.80 6.99 7.20 7.50 Compute the two-year implied forward rate three years from now, given the information provided in the preceding table. Do not round intermediate calculations. Round your answer to two decimal places. %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To compute the twoyear implied forward rate three years from now we first ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started