Answered step by step

Verified Expert Solution

Question

1 Approved Answer

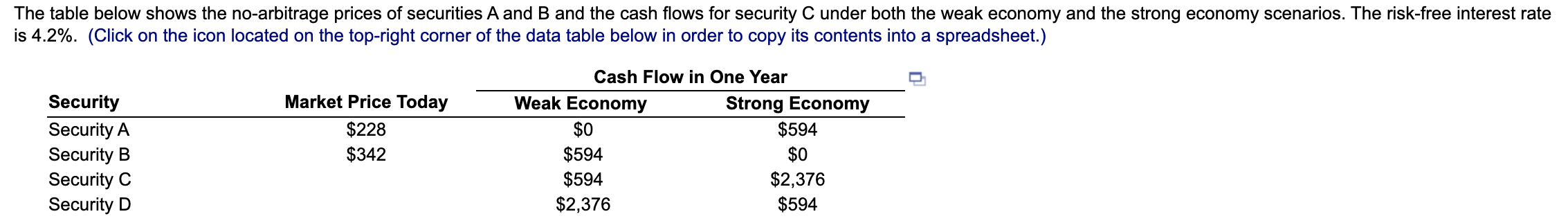

The table below shows the no-arbitrage prices of securities A and B and the cash flows for security C under both the weak economy

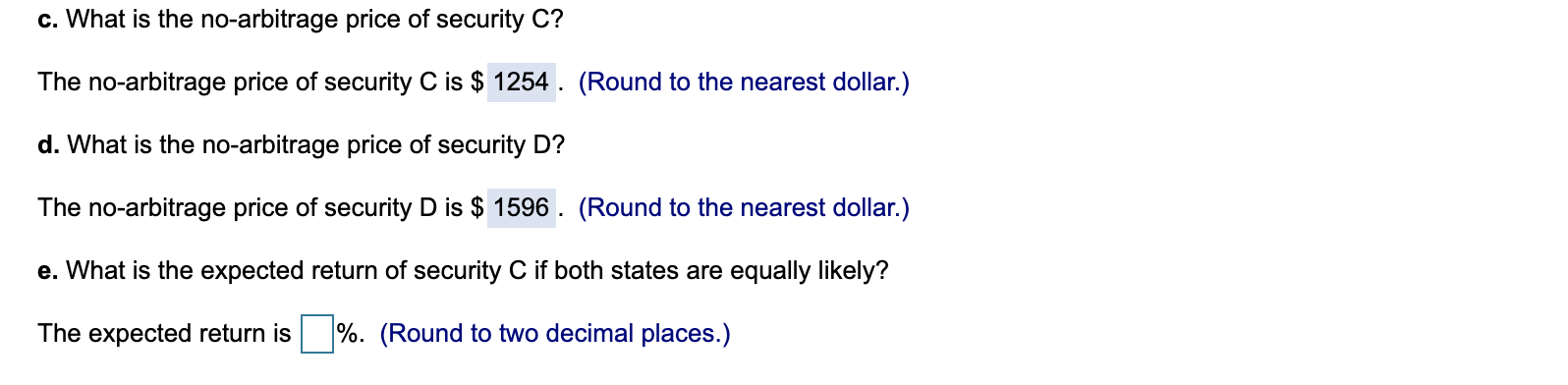

The table below shows the no-arbitrage prices of securities A and B and the cash flows for security C under both the weak economy and the strong economy scenarios. The risk-free interest rate is 4.2%. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Security Security A Security B Security C Security D Market Price Today $228 $342 Cash Flow in One Year Weak Economy $0 $594 $594 $2,376 Strong Economy $594 $0 $2,376 $594 c. What is the no-arbitrage price of security C? The no-arbitrage price of security C is $1254. (Round to the nearest dollar.) d. What is the no-arbitrage price of security D? The no-arbitrage price of security D is $ 1596. (Round to the nearest dollar.) e. What is the expected return of security C if both states are equally likely? The expected return is%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

c Noarbitrage price of security ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started