Answered step by step

Verified Expert Solution

Question

1 Approved Answer

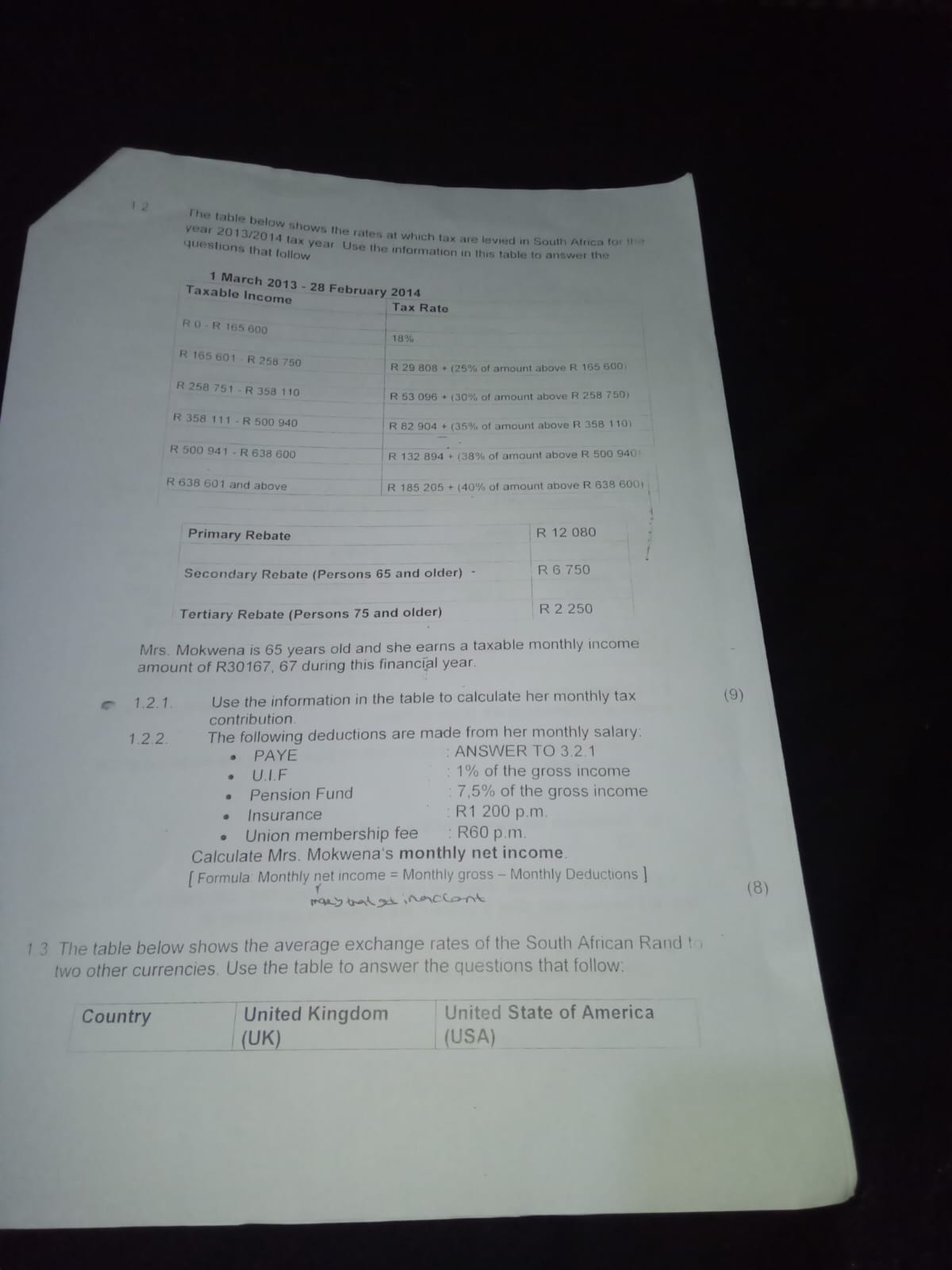

The table below shows the rates at which tax are levind in South Africa for It Vear 2 0 1 3 2 0 1 4

The table below shows the rates at which tax are levind in South Africa for It

Vear tax year Use the mformation in this table to answer the

questions that follow

March February

Mrs Mokwena is years old and she earns a taxable monthly income

amount of R during this financial year.

Use the information in the table to calculate her monthly tax

The following deductions are made from her monthly salary:

PAYE :ANSWER TO

UI.F : of the gross income

Pension Fund : of the gross income

Insurance R pm

Union membership fee : R pm

Calculate Mrs Mokwena's monthly net income.

Formula: Monthly net income Monthly gross Monthly Deductions

ind

maey tral se inerciont

The table below shows the average exchange rates of the South African Rand to

two other currencies. Use the table to answer the questions that follow:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started