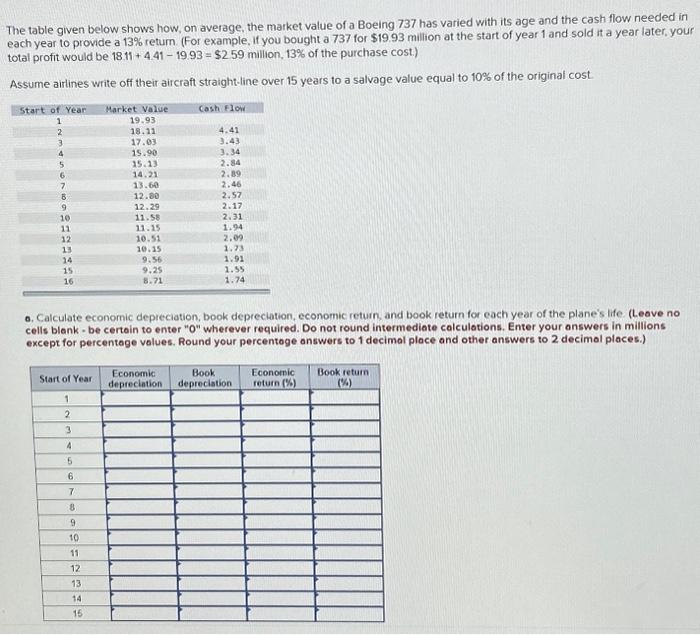

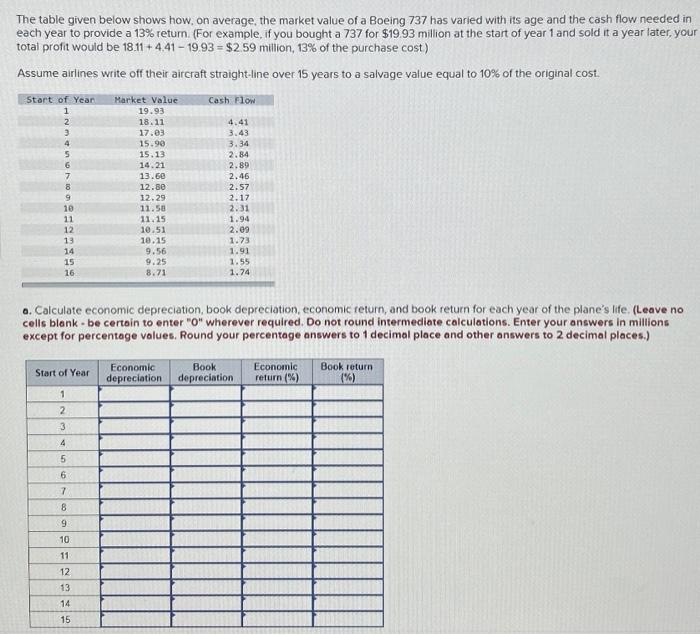

The table given below shows how, on average, the market value of a Boeing 737 has varied with its age and the cash flow needed in each year to provide a 13% retum. (For example. If you bought a 737 for $19.93 milion at the start of year 1 and sold it a year later, your total profit would be 1811+4.4119.93=$2.59 milion, 13% of the purchase cost.) Assume airlines write off their aircraft straight-line over 15 years to a salvage value equal to 10% of the original cost. 0. Calculate economic depreciation, book depreciation, economic return, and book return for cach year of the plane's life. (Leave no cells blank - be certoin to enter " 0 " wherever required. Do not round intermediate calculations. Enter your answers in millions except for percentoge volues. Round your percentoge answers to 1 decimal place and other answers to 2 decimol places.) The table given below shows how, on average, the market value of a Boeing 737 has varled with its age and the cash flow needed in each year to provide a 13% return. (For example, if you bought a 737 for $19.93 million at the start of year 1 and sold it a year later, you total profit would be 18.11+4.4119.93=$2.59 million, 13% of the purchase cost) Assume airlines write off their aircraft straight-line over 15 years to a salvage value equal to 10% of the original cost. a. Calculate economic depreciation, book depreciation, economic return, and book return for each year of the plane's life. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your answers in millions except for percentage volues. Round your percentage answers to 1 decimol place and other answers to 2 decimal places.) The table given below shows how, on average, the market value of a Boeing 737 has varied with its age and the cash flow needed in each year to provide a 13% retum. (For example. If you bought a 737 for $19.93 milion at the start of year 1 and sold it a year later, your total profit would be 1811+4.4119.93=$2.59 milion, 13% of the purchase cost.) Assume airlines write off their aircraft straight-line over 15 years to a salvage value equal to 10% of the original cost. 0. Calculate economic depreciation, book depreciation, economic return, and book return for cach year of the plane's life. (Leave no cells blank - be certoin to enter " 0 " wherever required. Do not round intermediate calculations. Enter your answers in millions except for percentoge volues. Round your percentoge answers to 1 decimal place and other answers to 2 decimol places.) The table given below shows how, on average, the market value of a Boeing 737 has varled with its age and the cash flow needed in each year to provide a 13% return. (For example, if you bought a 737 for $19.93 million at the start of year 1 and sold it a year later, you total profit would be 18.11+4.4119.93=$2.59 million, 13% of the purchase cost) Assume airlines write off their aircraft straight-line over 15 years to a salvage value equal to 10% of the original cost. a. Calculate economic depreciation, book depreciation, economic return, and book return for each year of the plane's life. (Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your answers in millions except for percentage volues. Round your percentage answers to 1 decimol place and other answers to 2 decimal places.)