Answered step by step

Verified Expert Solution

Question

1 Approved Answer

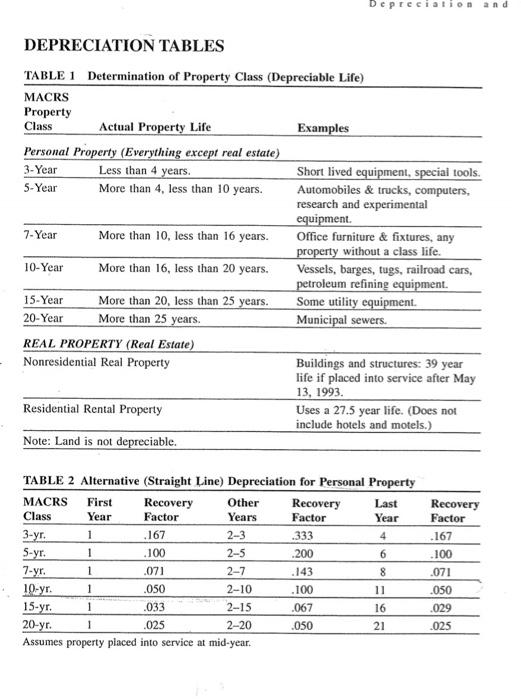

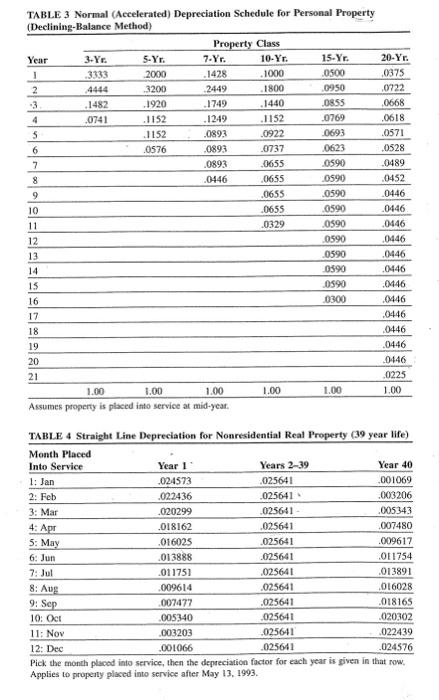

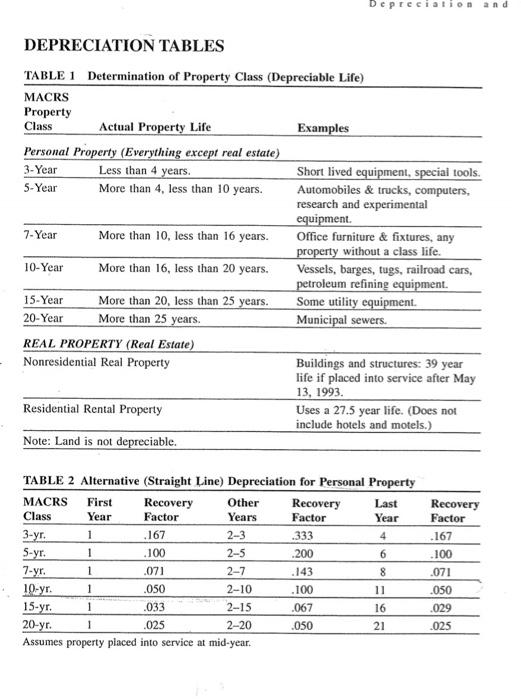

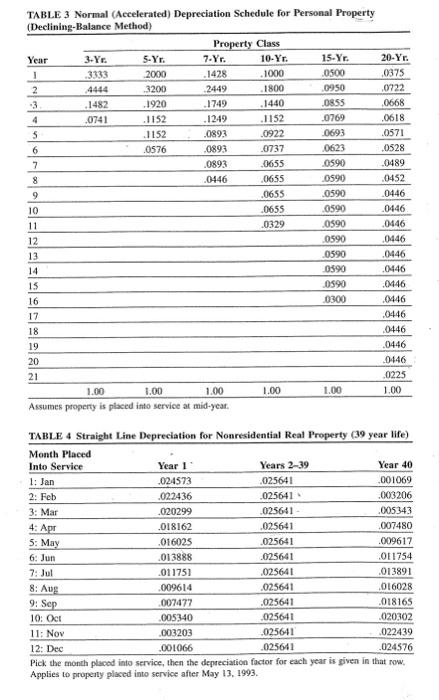

the tables (white pictures) should help with the problem the question is given in the first picture, and the following pictures are just resources that

the tables (white pictures) should help with the problem

the question is given in the first picture, and the following pictures are just resources that might help answer the question

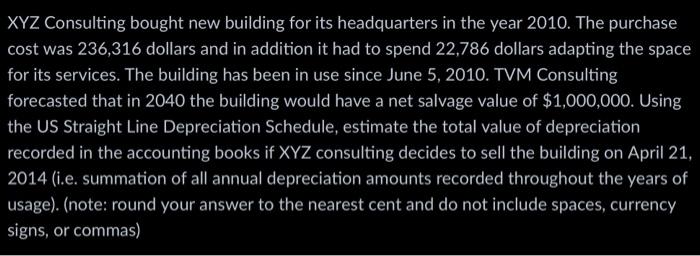

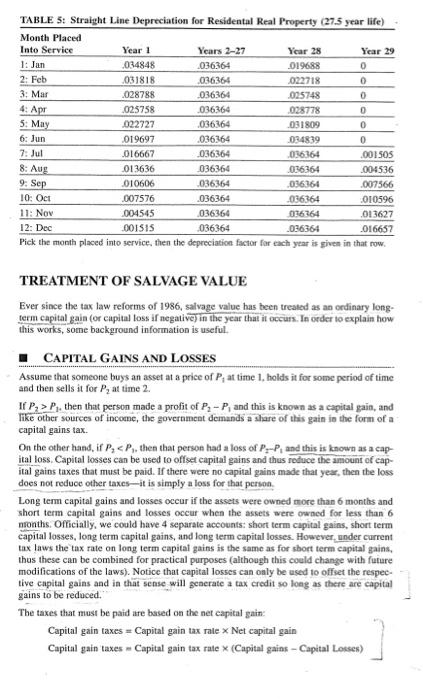

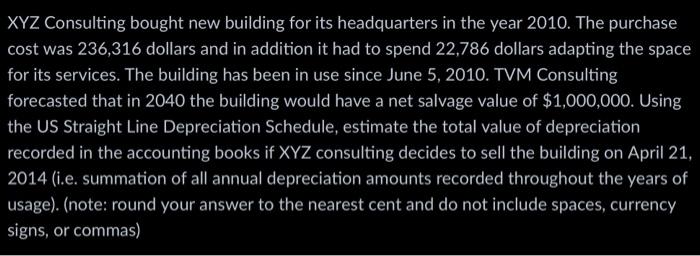

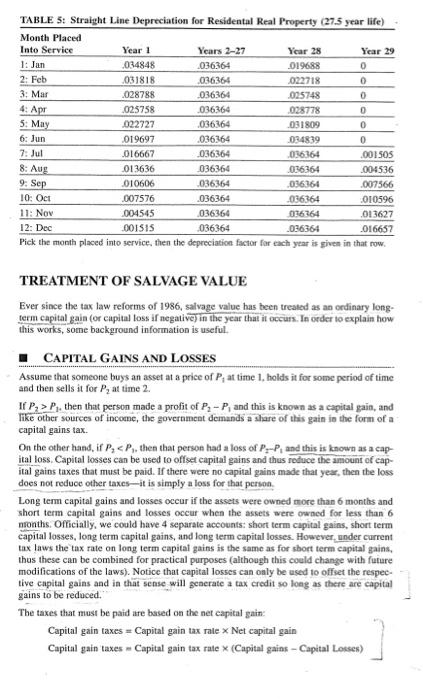

XYZ Consulting bought new building for its headquarters in the year 2010 . The purchase cost was 236,316 dollars and in addition it had to spend 22,786 dollars adapting the space for its services. The building has been in use since June 5, 2010. TVM Consulting forecasted that in 2040 the building would have a net salvage value of $1,000,000. Using the US Straight Line Depreciation Schedule, estimate the total value of depreciation recorded in the accounting books if XYZ consulting decides to sell the building on April 21 , 2014 (i.e. summation of all annual depreciation amounts recorded throughout the years of usage). (note: round your answer to the nearest cent and do not include spaces, currency signs, or commas) DEPRECIATION TABI.FS TABLE 2 Alternative (Straisht I.ine) Denred Assumes property placed into service at mid-year. TABLE 3 Normal (Accelerated) Depreciation Schedule for Personal Property inaelinina.Ralunes Methed TABLE 4 Straieht Line Deoreciation for Nonresidential Real Property (39 year life) Pick the month placed into service, then the depreciatica factor for each year us gven in that row. Applies to propenty placed into service after May 13, 1993. TABLE 5: Straieht Line Denreciation for Residental Real Pronertv i27.5 vear lifel TREATMENT OF SALVAGE VALUE Ever since the tax law reforms of 1986, salvage value has been treated as an ordinary longterm capital gaia (or capital loss if negative) in the year that it occurs. In order to explain how this works, some background information is useful. CAPITAL GaINS AND LOSSES Assume that someone buys an asset at a price of P1 at time 1 , holds it for some period of time and then sells it for P2 at time 2 . If P2>P1, then that person made a profit of P2P1 and this is known as a capital gain, and fike other sources of income, the goverament demands a share of this gain is the form of a capital gains tax. On the other hand, if P2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started