Answered step by step

Verified Expert Solution

Question

1 Approved Answer

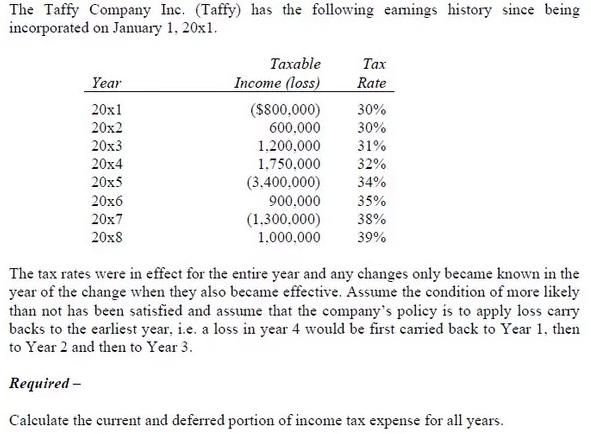

The Taffy Company Inc. (Taffy) has the following eamings history since being incorporated on January 1, 20x1. Year 20x1 20x2 20x3 20x4 20x5 20x6

The Taffy Company Inc. (Taffy) has the following eamings history since being incorporated on January 1, 20x1. Year 20x1 20x2 20x3 20x4 20x5 20x6 20x7 20x8 Taxable Income (loss) ($800.000) 30% 600.000 30% 31% 32% 34% 1.200,000 1,750,000 (3.400,000) 900,000 Tax Rate (1.300.000) 1,000,000 35% 38% 39% The tax rates were in effect for the entire year and any changes only became known in the year of the change when they also became effective. Assume the condition of more likely than not has been satisfied and assume that the company's policy is to apply loss carry backs to the earliest year, i.e. a loss in year 4 would be first carried back to Year 1, then to Year 2 and then to Year 3. Required - Calculate the current and deferred portion of income tax expense for all years.

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the current and deferred portion of income tax expense for each year Year 20x1 Taxable Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started