Question

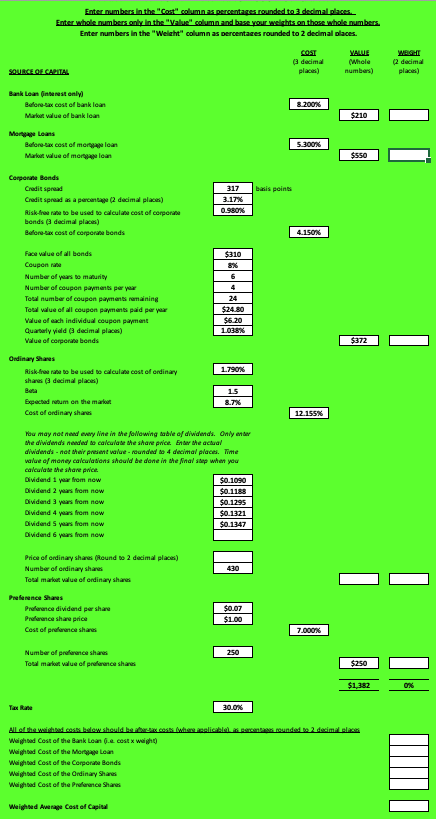

The Tax Rate: 30% The 10-year risk free rate: 1.79% The 6-year risk free rate: .98% USING THE INFORMATION shown and attached above, Please find

The Tax Rate: 30%

The 10-year risk free rate: 1.79%

The 6-year risk free rate: .98%

USING THE INFORMATION shown and attached above,

Please find and show calculations for:

(ROUND ALL ANSWERS TO THE THIRD DECIMAL PLACE)

Bank Loan Weight:

Mortgage Loans Weight:

Corporate Bonds Weight

Price of Ordinary Shares:

Market Value of Ordinary Shares:

Ordinary Shares Weight:

AFTER CALCULATING ABOVE, PLEASE FIND THE ANSWERS BELOW (ROUND TO THIRD DECIMAL PLACE)

All weighted costs after-tax costs (Tax rate 30%)

Weighted Cost of the Bank loan (i.e. cost x weight):

Weighted Cost of the Mortgage Loan

Weighted Cost of the Corporate Bonds

Weighted Cost of the Ordinary Shares

Weighted Cost of the Preference Shares

Weighted Average Cost of Capital:

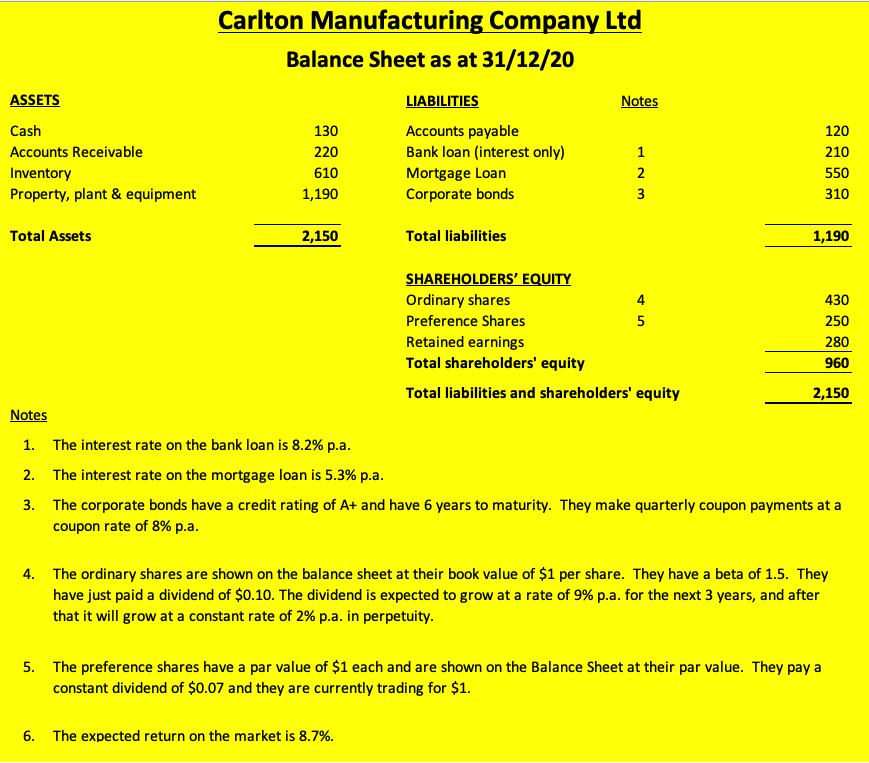

Carlton Manufacturing Company Ltd Balance Sheet as at 31/12/20 LIABILITIES ASSETS Notes Cash 130 Accounts payable 120 Accounts Receivable 220 Bank loan (interest only) 210 Inventory 610 Mortgage Loan Property, plant & equipment 1,190 Corporate bonds 23 2 550 3 310 Total Assets 2,150 Total liabilities 1,190 SHAREHOLDERS' EQUITY Ordinary shares Preference Shares 430 5 250 Retained earnings 280 Total shareholders' equity 960 Total liabilities and shareholders' equity 2,150 45 Notes 1. The interest rate on the bank loan is 8.2% p.a. 2. The interest rate on the mortgage loan is 5.3% p.a. 3. The corporate bonds have a credit rating of A+ and have 6 years to maturity. They make quarterly coupon payments at a coupon rate of 8% p.a. 4. The ordinary shares are shown on the balance sheet at their book value of $1 per share. They have a beta of 1.5. They have just paid a dividend of $0.10. The dividend is expected to grow at a rate of 9% p.a. for the next 3 years, and after that it will grow at a constant rate of 2% p.a. in perpetuity. 5. The preference shares have a par value of $1 each and are shown on the Balance Sheet at their par value. They pay a constant dividend of $0.07 and they are currently trading for $1. 6. The expected return on the market is 8.7%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started