Answered step by step

Verified Expert Solution

Question

1 Approved Answer

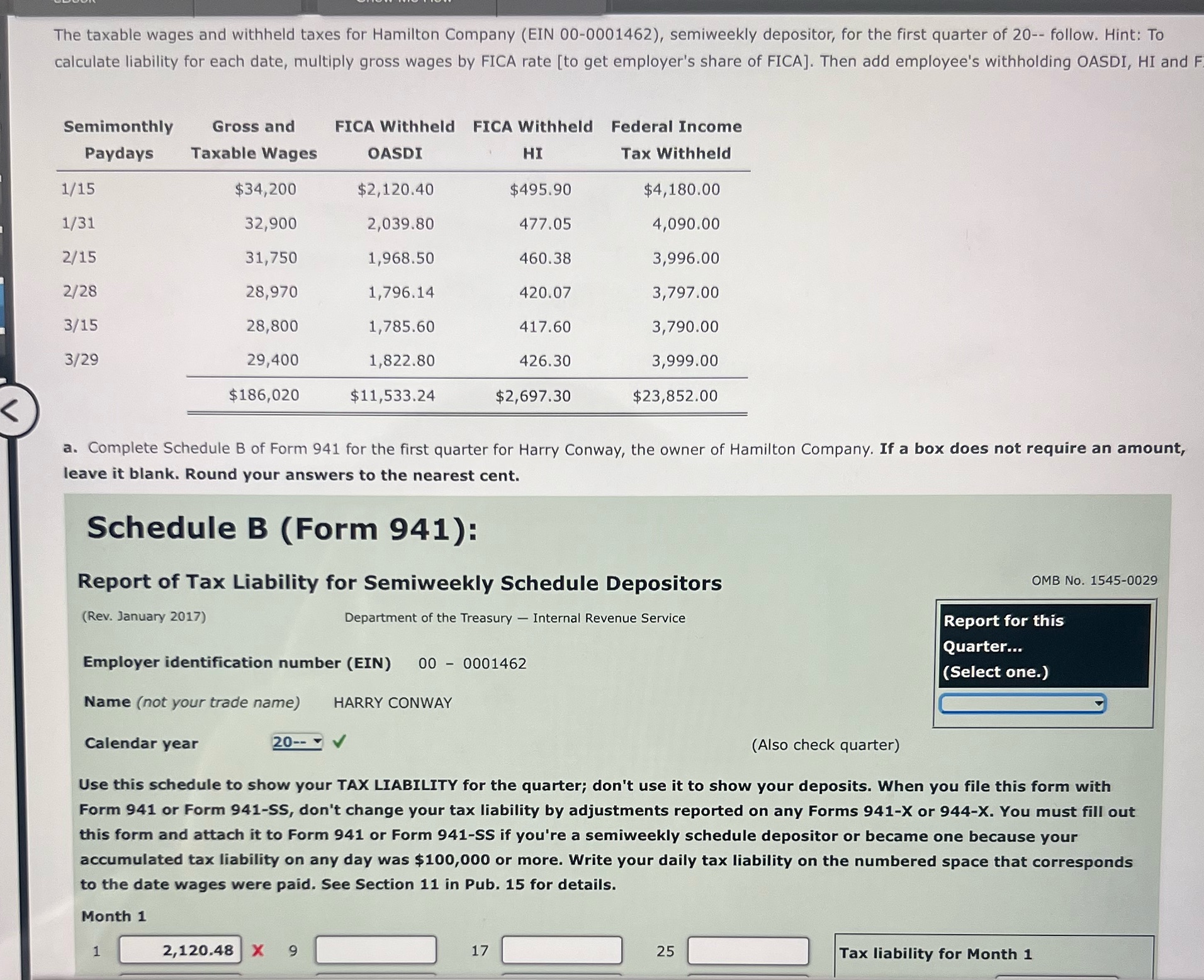

The taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 20-- follow. Hint: To calculate liability

The taxable wages and withheld taxes for Hamilton Company (EIN 00-0001462), semiweekly depositor, for the first quarter of 20-- follow. Hint: To calculate liability for each date, multiply gross wages by FICA rate [to get employer's share of FICA]. Then add employee's withholding OASDI, HI and F Semimonthly Paydays Gross and Taxable Wages FICA Withheld FICA Withheld Federal Income OASDI HI Tax Withheld 1/15 $34,200 $2,120.40 $495.90 $4,180.00 1/31 32,900 2,039.80 477.05 4,090.00 2/15 31,750 1,968.50 460.38 3,996.00 2/28 28,970 1,796.14 420.07 3,797.00 3/15 28,800 1,785.60 417.60 3,790.00 3/29 29,400 $186,020 1,822.80 426.30 $11,533.24 $2,697.30 3,999.00 $23,852.00 a. Complete Schedule B of Form 941 for the first quarter for Harry Conway, the owner of Hamilton Company. If a box does not require an amount, leave it blank. Round your answers to the nearest cent. Schedule B (Form 941): Report of Tax Liability for Semiweekly Schedule Depositors (Rev. January 2017) Department of the Treasury - Internal Revenue Service Employer identification number (EIN) 00 - 0001462 Name (not your trade name) Calendar year HARRY CONWAY 20-- (Also check quarter) OMB No. 1545-0029 Report for this Quarter... (Select one.) Use this schedule to show your TAX LIABILITY for the quarter; don't use it to show your deposits. When you file this form with Form 941 or Form 941-SS, don't change your tax liability by adjustments reported on any Forms 941-X or 944-X. You must fill out this form and attach it to Form 941 or Form 941-SS if you're a semiweekly schedule depositor or became one because your accumulated tax liability on any day was $100,000 or more. Write your daily tax liability on the numbered space that corresponds to the date wages were paid. See Section 11 in Pub. 15 for details. Month 1 1 2,120.48 X 9 17 25 Tax liability for Month 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started