Answered step by step

Verified Expert Solution

Question

1 Approved Answer

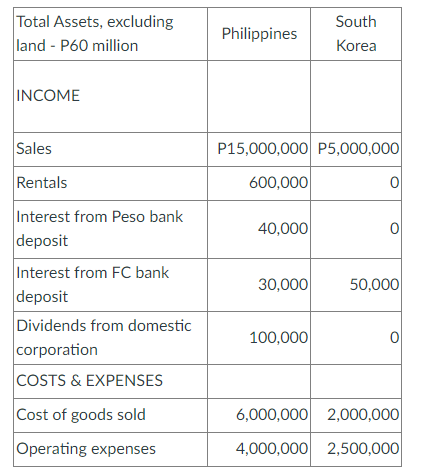

The taxpayer had the following data at the end of the year: Assuming that the taxpayer is a resident foreign corporation claiming itemized deductions, how

The taxpayer had the following data at the end of the year:

Assuming that the taxpayer is a resident foreign corporation claiming itemized deductions, how much is the income tax due for the year?

Group of answer choices

P1,897,500

P1,440,000

P1,120,000

P1,400,000

\begin{tabular}{|l|r|r|} \hline Total Assets, excluding land - P60 million & Philippines & \multicolumn{1}{|c|}{ South Korea } \\ \hline INCOME & & \\ \hline Sales & P15,000,000 & P5,000,000 \\ \hline Rentals & 600,000 & 0 \\ \hline Interest from Peso bank deposit & 40,000 & \\ \hline Interest from FC bank deposit & 30,000 & 50,000 \\ \hline Dividends from domestic corporation & 100,000 & \\ \hline COSTS \& EXPENSES & & 0 \\ \hline Cost of goods sold & 6,000,000 & 2,000,000 \\ \hline Operating expenses & 4,000,000 & 2,500,000 \\ \hline \end{tabular} \begin{tabular}{|l|r|r|} \hline Total Assets, excluding land - P60 million & Philippines & \multicolumn{1}{|c|}{ South Korea } \\ \hline INCOME & & \\ \hline Sales & P15,000,000 & P5,000,000 \\ \hline Rentals & 600,000 & 0 \\ \hline Interest from Peso bank deposit & 40,000 & \\ \hline Interest from FC bank deposit & 30,000 & 50,000 \\ \hline Dividends from domestic corporation & 100,000 & \\ \hline COSTS \& EXPENSES & & 0 \\ \hline Cost of goods sold & 6,000,000 & 2,000,000 \\ \hline Operating expenses & 4,000,000 & 2,500,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started