Question

The Taxpayer Relief Act of 1997 created the Roth IRA, which permits qualifying individuals to make after-tax retirement contributions of up to $2,000 annually. Contributions

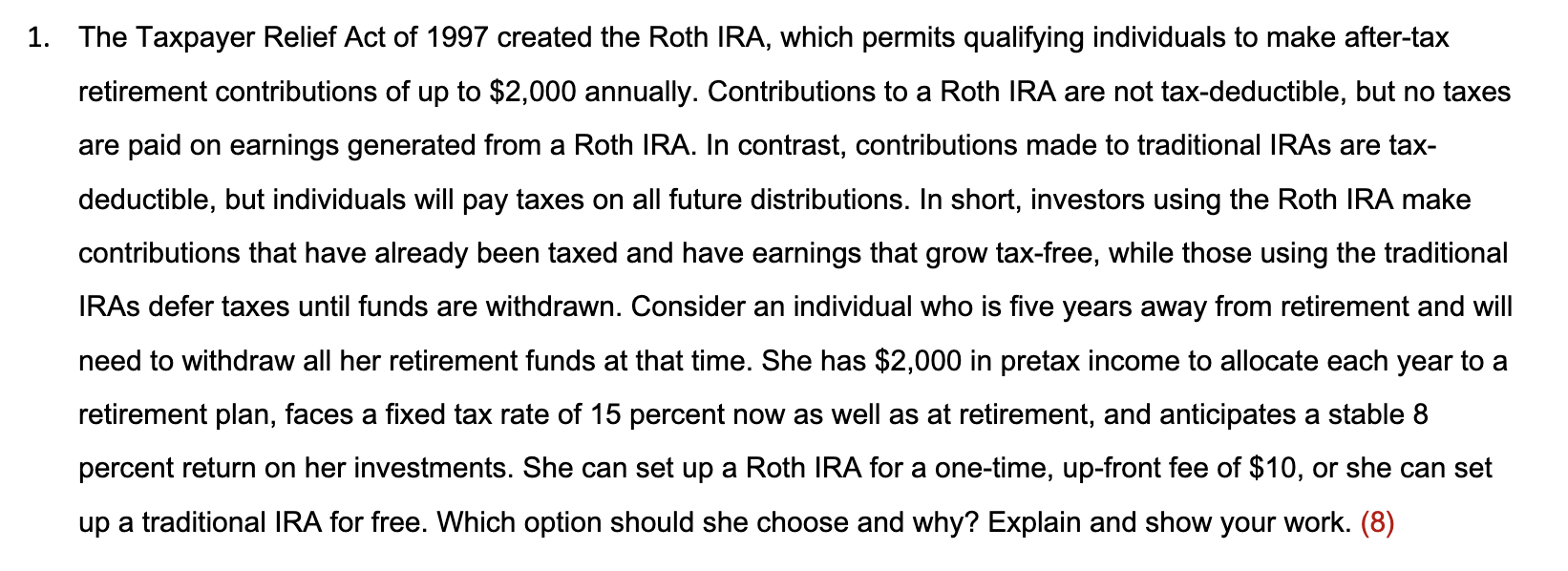

The Taxpayer Relief Act of 1997 created the Roth IRA, which permits qualifying individuals to make after-tax retirement contributions of up to $2,000 annually. Contributions to a Roth IRA are not tax-deductible, but no taxes are paid on earnings generated from a Roth IRA. In contrast, contributions made to traditional IRAs are tax-deductible, but individuals will pay taxes on all future distributions. In short, investors using the Roth IRA make contributions that have already been taxed and have earnings that grow tax-free, while those using the traditional IRAs defer taxes until funds are withdrawn. Consider an individual who is five years away from retirement and will need to withdraw all her retirement funds at that time. She has $2,000 in pretax income to allocate each year to a retirement plan, faces a fixed tax rate of 15 percent now as well as at retirement, and anticipates a stable 8 percent return on her investments. She can set up a Roth IRA for a one-time, up-front fee of $10, or she can set up a traditional IRA for free. Which option should she choose and why? Show calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started