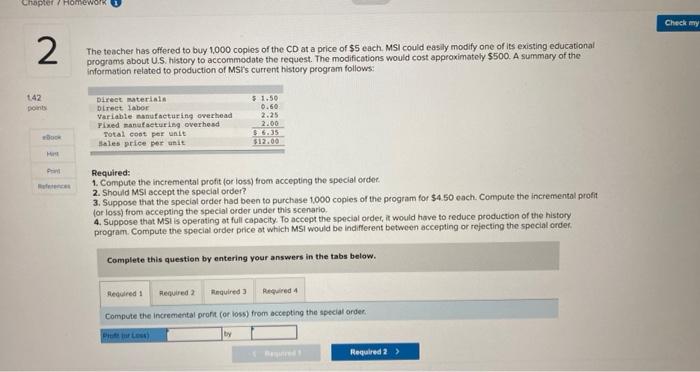

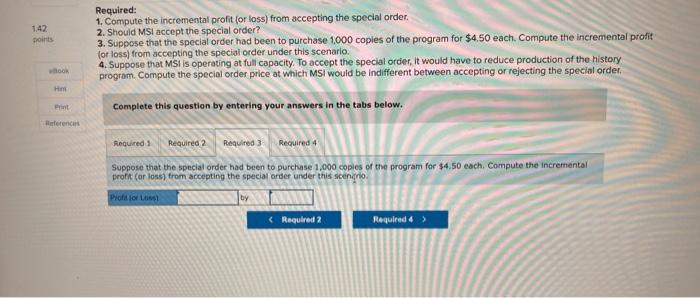

The teacher has offered to buy 1,000 coples of the CD at a price of $5 each. MSil could easily modify one of its existing educational programs about U.S. history to accommodate the request. The modifications would cost approximately $500. A summary of the information related to production of MSi's current history program follows: Required: 1. Compute the incremental profit (or loss) from accepting the special ordet. 2. Should MSi accept the special order? 3. Suppose that the special order had been to purchase 1.000 coples of the program for $4.50 each. Compute the incremental profit. (or loss) from occepting the special order under this scenario. 4. Suppose that MSt is operating at full capacity. To accept the special order, it would have to reduce production of the history program. Compute the special order price of which MSI would be indifferent between accepting or rejecting the special ordef. Complete this question by entering your answers in the tabs below. Compute the incremental profit (or loss) from accepting the special order. Required: 1. Compute the incremental profit (or loss) from accepting the special order. 2. Should MSI accept the special order? 3. Suppose that the special order had been to purchase 1,000 copies of the program for $4,50 each. Compute the incremental profit (or loss) from accepting the special order under this scenario. 4. Suppose that MSt is operating at full capacity. To accept the special order, it would have to reduce production of the history program. Compute the special order price at which MSI would be indifferent between accepting or rejecting the special order. Complete this question by entering your answers in the tabs below. Suppose that the special order had been to purchase 1,000 copies of the program for $4.50 each. Compute the incremental profit (or loss) from accepting the special order under this scencrio. Required: Compute the incremental profit (or loss) from accepting the special order. 2. Should MSI accept the special order? 2. Suppose that the special order had been to purchase 1,000 copies of the program for $4.50 each. Compute the incrementa (or loss) from accepting the special order under this scenario. 4. Suppose that MSl is operating at full capacity. To accept the special order, it would have to reduce production of the history program. Compute the special order price at which MSI would be indifferent between accepting or rejecting the special order. Complete this question by entering your answers in the tabs below. Suppose that MSi is operating at full capacity. To accept the special order, it would have to reduce production of the history program. Compute the special order price at which MSI would be indifferent between accepting or refecting the special order: (Round your answer to 2 decimal places.)