Answered step by step

Verified Expert Solution

Question

1 Approved Answer

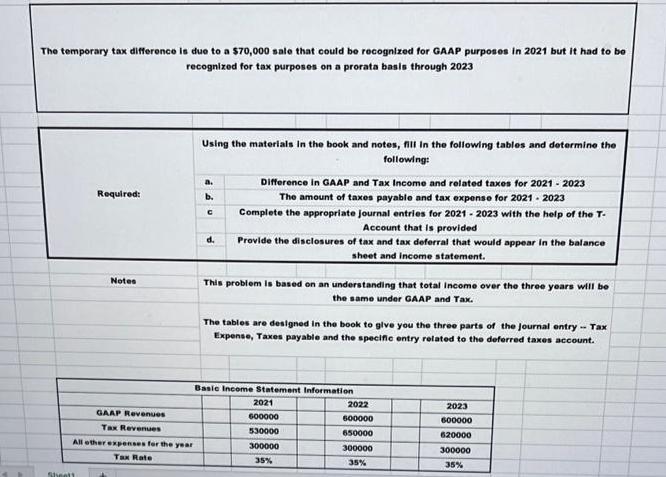

The temporary tax difference is due to a $70,000 sale that could be recognized for GAAP purposes in 2021 but it had to be

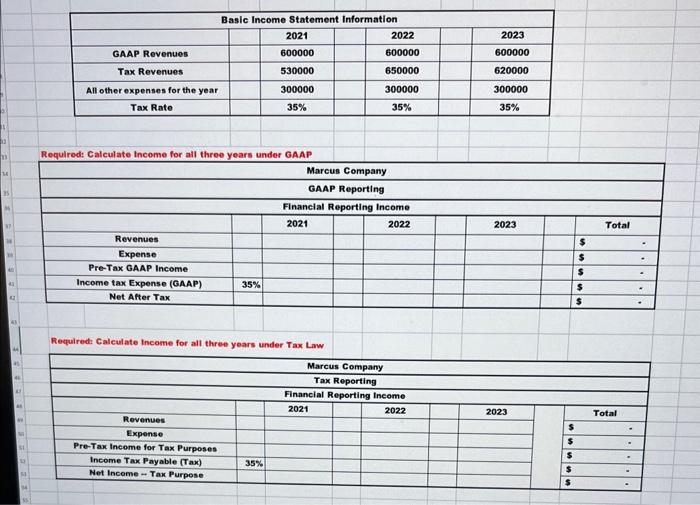

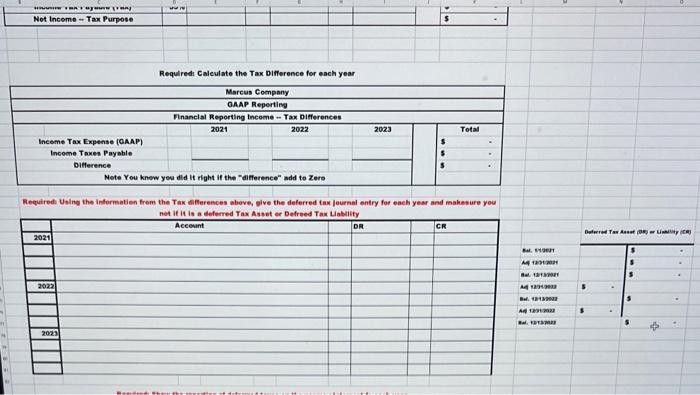

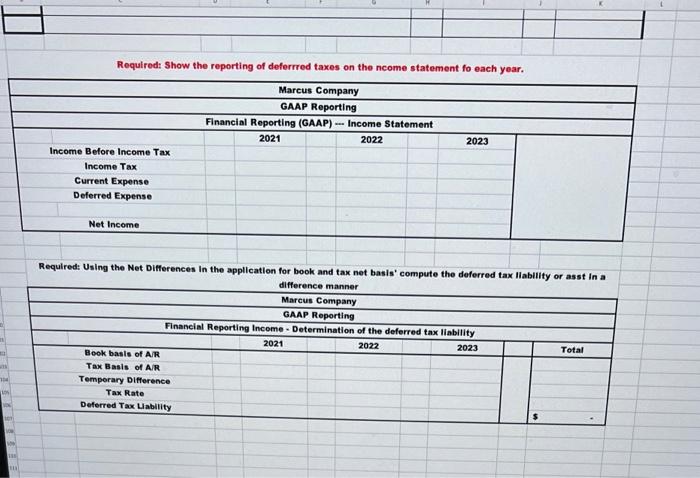

The temporary tax difference is due to a $70,000 sale that could be recognized for GAAP purposes in 2021 but it had to be recognized for tax purposes on a prorata basis through 2023 Sheett a. Required: b. Notes Using the materials in the book and notes, fill in the following tables and determine the d. following: Difference in GAAP and Tax Income and related taxes for 2021-2023 The amount of taxes payable and tax expense for 2021-2023 Complete the appropriate journal entries for 2021-2023 with the help of the T- Account that is provided Provide the disclosures of tax and tax deferral that would appear in the balance sheet and income statement. This problem is based on an understanding that total income over the three years will be the same under GAAP and Tax. The tables are designed in the book to give you the three parts of the Journal entry - Tax Expense, Taxes payable and the specific entry related to the deferred taxes account. Basic Income Statement Information 2021 2022 2023 GAAP Revenues 600000 600000 600000 Tax Revenues 530000 650000 620000 All other expenses for the year 300000 300000 300000 Tax Rate 35% 35% 35% Basic Income Statement Information 2021 2022 2023 GAAP Revenues 600000 600000 600000 Tax Revenues 530000 650000 620000 All other expenses for the year 300000 300000 300000 Tax Rate 35% 35% 35% Required: Calculate Income for all three years under GAAP Marcus Company M GAAP Reporting 35 Financial Reporting Income 2021 2022 2023 Total Revenues $ Expense Pre-Tax GAAP Income Income tax Expense (GAAP) Net After Tax $ . $ 35% $ $ 43 " 31 L3 Required: Calculate Income for all three years under Tax Law Marcus Company Tax Reporting Financial Reporting Income Revenues Expense Pre-Tax Income for Tax Purposes Income Tax Payable (Tax) Net Income Tax Purpose 35% 2021 2022 2023 55555 Total Net Income Tax Purpose Income Tax Expense (GAAP) Income Taxes Payable. Required: Calculate the Tax Difference for each year Marcus Company GAAP Reporting Financial Reporting Income Tax Differences 2021 2022 2023 Total Difference Note You know you did it right if the "difference" add to Zero Required: Using the information from the Tax differences above, give the deferred tax journal entry for each year and makesure you not if it is a deferred Tax Asset or Defreed Tax Liability 2021 2022 2023 Account Bended that th DR CR 13021 12319021 1213201 12913022 $ Bl. 1315302 Required: Show the reporting of deferrred taxes on the ncome statement fo each Marcus Company year. GAAP Reporting Income Before Income Tax Income Tax Current Expense Financial Reporting (GAAP) Income Statement 2021 2022 Deferred Expense Net Income 2023 Required: Using the Net Differences in the application for book and tax net basis' compute the deferred tax liability or asst in a difference manner Book basis of A/R Marcus Company GAAP Reporting Financial Reporting Income- Determination of the deferred tax liability 10 Tax Basis of A/R Temporary Difference Tax Rate Deferred Tax Liability 2021 2022 2023 Total

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Difference in GAAP and Tax Income and related taxes for 20212023 Year GAAP Income Tax Income Diffe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started